Oregon Form 20 V Oregon Corporation Tax Payment 2023-2026

What is the Oregon Form OR-20-V Corporation Tax Payment?

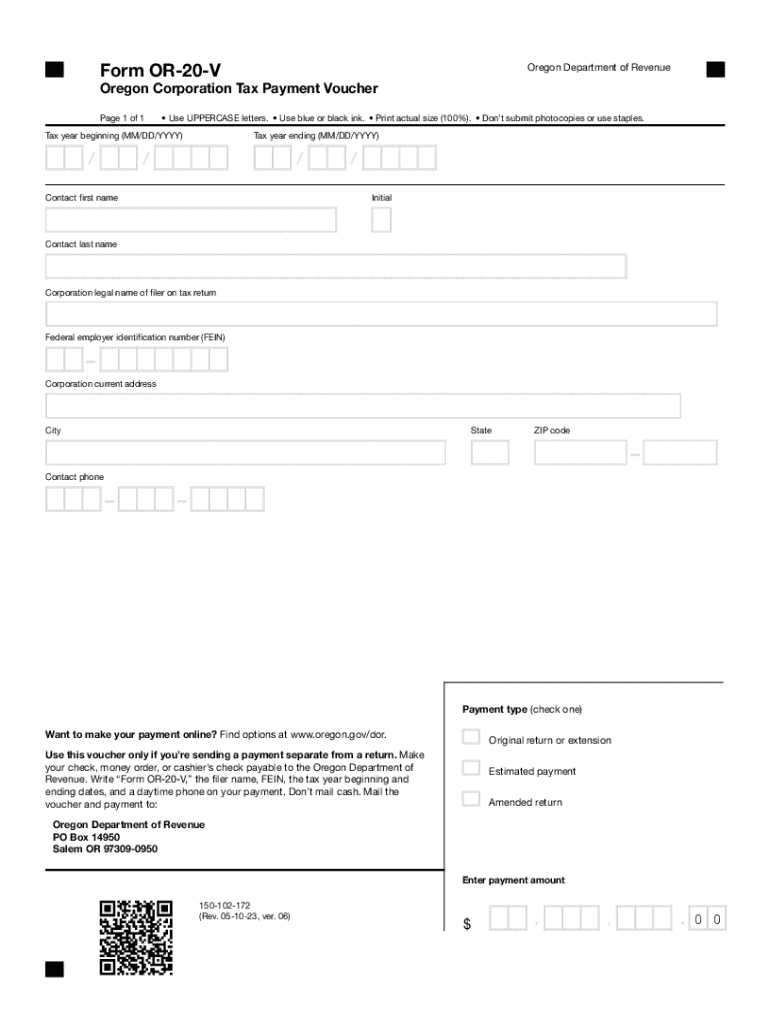

The Oregon Form OR-20-V is a tax payment voucher specifically designed for corporations operating in Oregon. This form is utilized to remit estimated tax payments to the Oregon Department of Revenue. Corporations are required to use this form when making payments related to their corporate income tax obligations. The OR-20-V ensures that businesses comply with state tax regulations while facilitating the payment process.

How to Use the Oregon Form OR-20-V Corporation Tax Payment

To effectively use the Oregon Form OR-20-V, corporations must first determine their estimated tax liability for the year. Once the amount is calculated, the corporation can complete the form by providing necessary details such as the business name, address, and the payment amount. It is important to ensure that all information is accurate to avoid delays or penalties. After completing the form, the corporation should submit it along with the payment to the Oregon Department of Revenue.

Steps to Complete the Oregon Form OR-20-V Corporation Tax Payment

Completing the Oregon Form OR-20-V involves several key steps:

- Gather necessary financial information to estimate your corporation's tax liability.

- Fill out the form, including your corporation's name, address, and the payment amount.

- Double-check all entries for accuracy to prevent issues with the Oregon Department of Revenue.

- Prepare the payment, ensuring it matches the amount listed on the form.

- Submit the completed form and payment either online, by mail, or in person at designated locations.

Key Elements of the Oregon Form OR-20-V Corporation Tax Payment

Several key elements must be included when filling out the Oregon Form OR-20-V:

- Corporation Information: This includes the legal name and address of the corporation.

- Payment Amount: The total estimated tax payment being submitted.

- Tax Year: Indicate the tax year for which the payment is being made.

- Signature: A representative of the corporation must sign the form to validate the submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when submitting the Oregon Form OR-20-V. Typically, estimated tax payments are due quarterly, with deadlines falling on the 15th of April, June, September, and December. It is essential for corporations to stay informed about these dates to avoid penalties and interest charges on late payments.

Form Submission Methods

The Oregon Form OR-20-V can be submitted through various methods:

- Online: Corporations can submit the form and payment electronically through the Oregon Department of Revenue's online portal.

- By Mail: Complete the form and send it along with the payment to the designated address provided by the Oregon Department of Revenue.

- In-Person: Corporations may also deliver the form and payment directly to a local Oregon Department of Revenue office.

Quick guide on how to complete oregon form 20 v oregon corporation tax payment

Effortlessly prepare Oregon Form 20 V Oregon Corporation Tax Payment on any device

The management of documents online has gained traction among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily access the right document and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and digitally sign your documents quickly without any holdups. Manage Oregon Form 20 V Oregon Corporation Tax Payment on any platform with the airSlate SignNow applications for Android or iOS, and enhance any document-related process today.

Steps to modify and eSign Oregon Form 20 V Oregon Corporation Tax Payment effortlessly

- Find Oregon Form 20 V Oregon Corporation Tax Payment and click on Get Form to begin.

- Use the available tools to fill in your document.

- Emphasize important sections of the documents or redact sensitive information with the specialized tools that airSlate SignNow provides for this purpose.

- Create your signature using the Sign feature, which only takes a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you would like to share your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Oregon Form 20 V Oregon Corporation Tax Payment and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oregon form 20 v oregon corporation tax payment

Create this form in 5 minutes!

How to create an eSignature for the oregon form 20 v oregon corporation tax payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is or20v and how does it relate to airSlate SignNow?

Or20v is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send and sign documents securely. By utilizing or20v, businesses can improve efficiency and reduce turnaround times.

-

How much does airSlate SignNow cost with the or20v feature?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains cost-effective even with the or20v feature included. Plans typically start at a competitive rate, providing excellent value for businesses looking to enhance their document signing processes. You can find detailed pricing information on our website.

-

What are the main features of airSlate SignNow's or20v?

The or20v feature includes advanced eSigning capabilities, customizable templates, and real-time tracking of document status. Additionally, it supports multiple file formats and integrates seamlessly with other applications. These features make it a powerful tool for businesses of all sizes.

-

How can or20v benefit my business?

By implementing or20v through airSlate SignNow, your business can signNowly reduce the time spent on document management. It enhances collaboration among team members and clients, ensuring that documents are signed quickly and efficiently. This leads to improved productivity and customer satisfaction.

-

Does airSlate SignNow with or20v integrate with other software?

Yes, airSlate SignNow with or20v offers integrations with various software applications, including CRM systems, cloud storage services, and productivity tools. This allows for a seamless workflow, enabling users to manage documents across different platforms effortlessly. Check our integration page for a full list of compatible applications.

-

Is it easy to use airSlate SignNow with the or20v feature?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, and the or20v feature is no exception. The intuitive interface allows users to navigate the platform easily, making it simple to send and sign documents without extensive training or technical knowledge.

-

What security measures does airSlate SignNow implement with or20v?

Security is a top priority for airSlate SignNow, especially with the or20v feature. We implement industry-standard encryption, secure data storage, and compliance with regulations such as GDPR and HIPAA. This ensures that your documents and sensitive information remain protected throughout the signing process.

Get more for Oregon Form 20 V Oregon Corporation Tax Payment

- 2018 instructions for schedule f 2018 instructions for schedule f profit or loss from farming form

- Youre financially unable to pay the liability in full when form

- 2017 3 form 2018 2019

- 2018 instructions for schedule m 3 form 1065 instructions for schedule m 3 form 1065 net income loss reconciliation for certain

- About attorneys connecticut judicial branch ctgov form

- Attorney revocable retirementwritten notice connecticut judicial form

- Gv 115 request to continue court hearing for firearms restraining order judicial council forms

- Plea form and waiver of rights florida 2015 2019

Find out other Oregon Form 20 V Oregon Corporation Tax Payment

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free