Flexible Benefits Medical Reimbursement Account Cornell College Cornellcollege Form

What is the Flexible Benefits Medical Reimbursement Account

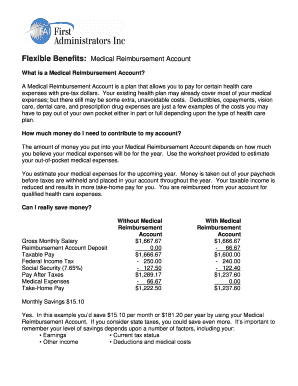

The Flexible Benefits Medical Reimbursement Account at Cornell College is designed to help employees manage their healthcare expenses. This account allows eligible participants to set aside pre-tax dollars to cover qualified medical expenses not reimbursed by insurance. It serves as a valuable tool for employees to reduce their taxable income while effectively budgeting for healthcare costs. Contributions to this account can be used for a variety of medical expenses, including co-pays, deductibles, and certain over-the-counter medications.

How to use the Flexible Benefits Medical Reimbursement Account

Using the Flexible Benefits Medical Reimbursement Account is straightforward. Employees can submit claims for reimbursement by providing documentation of eligible expenses. This documentation typically includes receipts or invoices that detail the services rendered and the amounts paid. Once the claim is submitted, the reimbursement is processed, and funds are disbursed directly to the employee. It is important to keep track of all eligible expenses and submit claims in a timely manner to ensure maximum benefit from the account.

Eligibility Criteria

To participate in the Flexible Benefits Medical Reimbursement Account at Cornell College, employees must meet specific eligibility criteria. Generally, eligibility is extended to full-time employees who are enrolled in the college's benefits program. Participants may also need to complete an enrollment form during the designated open enrollment period. It is essential for employees to review the specific guidelines provided by Cornell College to confirm their eligibility and understand any limitations that may apply.

Required Documents

When submitting claims for reimbursement from the Flexible Benefits Medical Reimbursement Account, employees must provide certain required documents. These typically include:

- Receipts or invoices showing the date of service

- A description of the medical service or product

- The amount paid for the service

- Any insurance explanation of benefits (EOB) if applicable

Having these documents ready will streamline the reimbursement process and help ensure that claims are processed without delays.

Steps to complete the Flexible Benefits Medical Reimbursement Account

Completing the process for the Flexible Benefits Medical Reimbursement Account involves several key steps:

- Determine eligibility for the account based on employment status and enrollment in the benefits program.

- Contribute funds to the account through payroll deductions.

- Keep detailed records of all eligible medical expenses incurred.

- Submit claims for reimbursement with the required documentation.

- Receive reimbursement for approved claims directly to your designated payment method.

Following these steps will help ensure a smooth experience with the account and maximize the benefits available to employees.

IRS Guidelines

The Flexible Benefits Medical Reimbursement Account must comply with IRS guidelines to maintain its tax-advantaged status. This includes adhering to contribution limits and ensuring that all claimed expenses are qualified under IRS regulations. Employees should familiarize themselves with IRS Publication 502, which outlines eligible medical expenses. Being aware of these guidelines helps prevent potential issues during the reimbursement process and ensures compliance with federal tax laws.

Quick guide on how to complete flexible benefits medical reimbursement account cornell college cornellcollege

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The Easiest Way to Modify and Electronically Sign [SKS]

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight key portions of the document or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to confirm your changes.

- Choose your preferred method of sending the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Flexible Benefits Medical Reimbursement Account Cornell College Cornellcollege

Create this form in 5 minutes!

How to create an eSignature for the flexible benefits medical reimbursement account cornell college cornellcollege

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Flexible Benefits Medical Reimbursement Account at Cornell College?

The Flexible Benefits Medical Reimbursement Account at Cornell College allows employees to set aside pre-tax dollars for eligible medical expenses. This account helps reduce taxable income while providing a convenient way to manage healthcare costs. By utilizing this account, employees can maximize their benefits and save money on out-of-pocket expenses.

-

How can I enroll in the Flexible Benefits Medical Reimbursement Account at Cornell College?

Enrollment in the Flexible Benefits Medical Reimbursement Account at Cornell College typically occurs during the open enrollment period. Employees should review the benefits guide provided by the college for specific instructions and deadlines. It's important to complete the enrollment process to take full advantage of the tax savings and reimbursement options available.

-

What types of expenses are covered by the Flexible Benefits Medical Reimbursement Account at Cornell College?

The Flexible Benefits Medical Reimbursement Account at Cornell College covers a wide range of eligible medical expenses, including co-pays, deductibles, and certain over-the-counter medications. Employees can also use the account for dental and vision expenses. It's essential to keep receipts and documentation for all claims submitted for reimbursement.

-

Are there any limits on contributions to the Flexible Benefits Medical Reimbursement Account at Cornell College?

Yes, there are annual contribution limits for the Flexible Benefits Medical Reimbursement Account at Cornell College, which are set by the IRS. Employees should check the latest guidelines to ensure they are aware of the maximum contribution limits. Staying within these limits helps optimize tax savings and ensures compliance with federal regulations.

-

How do I submit a claim for reimbursement from the Flexible Benefits Medical Reimbursement Account at Cornell College?

To submit a claim for reimbursement from the Flexible Benefits Medical Reimbursement Account at Cornell College, employees can typically use an online portal or submit a paper claim form. It's important to include all necessary documentation, such as receipts and proof of payment. Claims are usually processed within a specified timeframe, so employees should keep track of their submissions.

-

What are the benefits of using the Flexible Benefits Medical Reimbursement Account at Cornell College?

The primary benefits of using the Flexible Benefits Medical Reimbursement Account at Cornell College include tax savings and increased financial flexibility for healthcare expenses. Employees can lower their taxable income while having access to funds for necessary medical costs. This account also encourages proactive health management by making it easier to budget for healthcare needs.

-

Can I change my contribution amount for the Flexible Benefits Medical Reimbursement Account at Cornell College?

Changes to contribution amounts for the Flexible Benefits Medical Reimbursement Account at Cornell College are generally allowed during the open enrollment period or if there is a qualifying life event. Employees should consult the benefits coordinator for specific policies regarding mid-year changes. Adjusting contributions can help align the account with changing healthcare needs.

Get more for Flexible Benefits Medical Reimbursement Account Cornell College Cornellcollege

Find out other Flexible Benefits Medical Reimbursement Account Cornell College Cornellcollege

- Sign Minnesota Hold Harmless (Indemnity) Agreement Safe

- Sign Mississippi Hold Harmless (Indemnity) Agreement Now

- Sign Nevada Hold Harmless (Indemnity) Agreement Easy

- Sign South Carolina Letter of Intent Later

- Sign Texas Hold Harmless (Indemnity) Agreement Computer

- Sign Connecticut Quitclaim Deed Free

- Help Me With Sign Delaware Quitclaim Deed

- How To Sign Arkansas Warranty Deed

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template