Withholding FAQs Maryland Department of Human Services 2023-2026

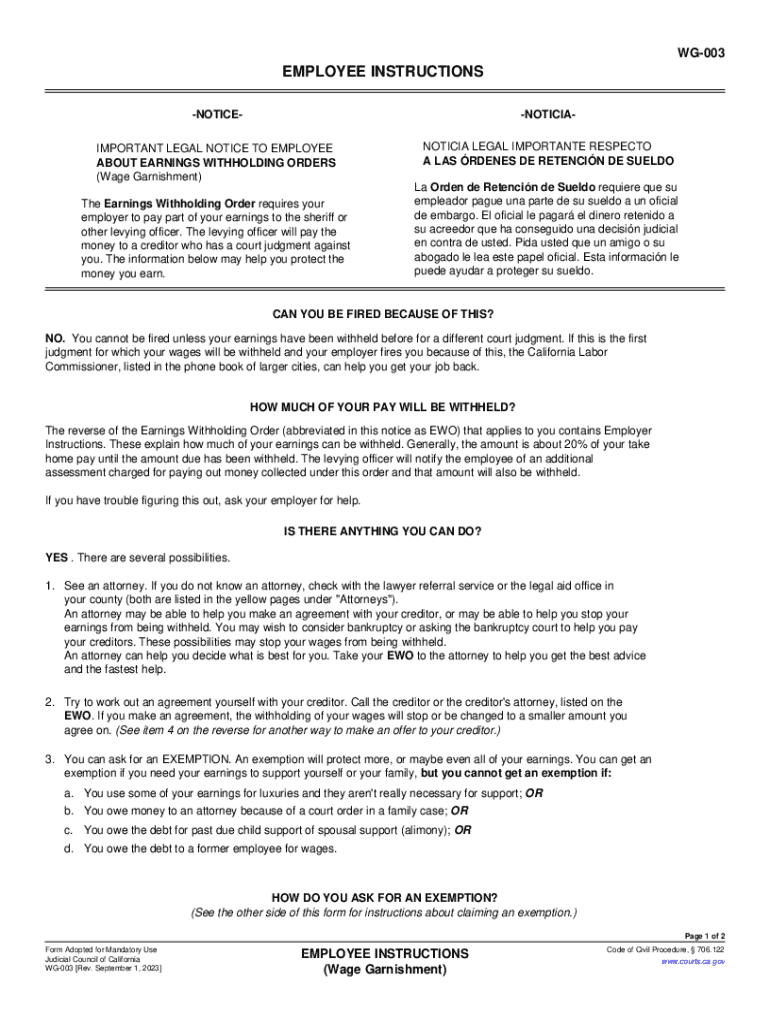

Understanding the WG 003 Form

The WG 003 form is an essential document used in the context of employee wage garnishment. This form is specifically designed to provide clear instructions for employers on how to process wage garnishments in compliance with state laws. It outlines the necessary steps for withholding a portion of an employee's wages to satisfy a debt, ensuring that both employers and employees understand their rights and responsibilities.

Steps to Complete the WG 003 Form

Completing the WG 003 form requires careful attention to detail. Here are the key steps involved:

- Gather necessary employee information, including their full name, social security number, and employment details.

- Review the garnishment order to determine the amount to be withheld from the employee's wages.

- Fill out the form accurately, ensuring that all required fields are completed.

- Submit the completed form to the appropriate state agency or court, following any specific submission guidelines provided in the garnishment order.

Key Elements of the WG 003 Form

The WG 003 form includes several critical elements that must be addressed for proper processing:

- Employee Information: This section captures essential details about the employee whose wages are being garnished.

- Garnishment Amount: Clearly specify the amount to be withheld, based on the garnishment order.

- Employer Information: Provide the employer's details, including name and contact information.

- Signature: The form must be signed by an authorized representative of the employer to validate the submission.

Legal Use of the WG 003 Form

The WG 003 form must be used in accordance with state laws governing wage garnishment. Employers are required to adhere to specific legal guidelines when processing garnishments, including limits on the amount that can be withheld and the types of debts that can lead to garnishment. Understanding these legal parameters helps ensure compliance and protects both the employer and employee from potential disputes.

Filing Deadlines and Important Dates

Timeliness is crucial when dealing with wage garnishments. Employers must be aware of filing deadlines associated with the WG 003 form. Typically, the form should be submitted promptly upon receipt of a garnishment order to avoid penalties. Additionally, employers should keep track of any specific timelines set forth in the garnishment order to ensure compliance with legal requirements.

Examples of Using the WG 003 Form

To better understand the application of the WG 003 form, consider the following scenarios:

- An employee receives a court order for child support payments, requiring the employer to withhold a specific amount from their wages.

- A creditor obtains a judgment against an employee, leading to a wage garnishment for debt repayment.

- Employers may encounter different garnishment types, such as tax levies or student loan defaults, each requiring the appropriate use of the WG 003 form.

Quick guide on how to complete withholding faqs maryland department of human services

Prepare Withholding FAQs Maryland Department Of Human Services seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow offers you all the necessary tools to create, edit, and electronically sign your documents quickly without any holdups. Handle Withholding FAQs Maryland Department Of Human Services on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and electronically sign Withholding FAQs Maryland Department Of Human Services without hassle

- Obtain Withholding FAQs Maryland Department Of Human Services and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your updates.

- Choose how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislocated documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device of your choosing. Modify and electronically sign Withholding FAQs Maryland Department Of Human Services to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct withholding faqs maryland department of human services

Create this form in 5 minutes!

How to create an eSignature for the withholding faqs maryland department of human services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is wg 003 and how does it benefit my business?

wg 003 is a powerful feature of airSlate SignNow that allows businesses to streamline their document signing process. By utilizing wg 003, you can enhance efficiency, reduce turnaround times, and improve overall workflow. This feature is designed to meet the needs of businesses looking for a cost-effective solution to manage their documents.

-

How much does wg 003 cost?

The pricing for wg 003 is competitive and designed to fit various business budgets. airSlate SignNow offers flexible pricing plans that include access to wg 003, ensuring you get the best value for your investment. For detailed pricing information, visit our pricing page or contact our sales team.

-

What features are included with wg 003?

wg 003 includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance your document management experience and ensure that you can eSign documents efficiently. With wg 003, you can also integrate with other tools to further streamline your processes.

-

Can wg 003 integrate with other software?

Yes, wg 003 is designed to integrate seamlessly with various software applications, enhancing your existing workflows. Whether you use CRM systems, project management tools, or other business applications, wg 003 can connect to help you manage documents more effectively. This integration capability makes it a versatile choice for businesses of all sizes.

-

Is wg 003 secure for sensitive documents?

Absolutely! wg 003 prioritizes security, employing advanced encryption and compliance measures to protect your sensitive documents. With airSlate SignNow, you can trust that your data is safe while using wg 003 for eSigning and document management. Our platform adheres to industry standards to ensure your information remains confidential.

-

How can wg 003 improve my team's productivity?

wg 003 can signNowly boost your team's productivity by automating the document signing process. With features like bulk sending and reminders, your team can focus on more important tasks rather than getting bogged down by paperwork. By implementing wg 003, you can streamline operations and enhance collaboration among team members.

-

What types of documents can I manage with wg 003?

wg 003 allows you to manage a wide variety of documents, including contracts, agreements, and forms. Whether you need to send, sign, or store documents, wg 003 provides the tools necessary to handle all your document needs efficiently. This versatility makes it an ideal solution for businesses across different industries.

Get more for Withholding FAQs Maryland Department Of Human Services

Find out other Withholding FAQs Maryland Department Of Human Services

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile