Part Year Resident Income Allocation Form

What is the Part Year Resident Income Allocation

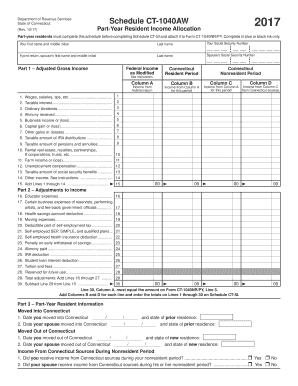

The part year resident income allocation is a crucial document for individuals who have lived in more than one state during the tax year. This worksheet helps determine how much of a taxpayer's income is taxable in each state. It is especially relevant for those who have moved or worked in different locations, as it ensures that individuals report their income accurately according to state-specific tax laws. The allocation process considers various income sources, including wages, dividends, and rental income, to ensure fair taxation based on residency status.

Steps to Complete the Part Year Resident Income Allocation

Completing the part year resident income allocation involves several key steps to ensure accuracy and compliance with tax regulations. Begin by gathering all relevant financial documents, including W-2s, 1099s, and any other income statements. Next, identify the states where you resided during the tax year and determine the duration of your stay in each state.

Once you have this information, calculate the total income earned in each state, taking care to allocate any income that may be shared between states, such as remote work. Fill out the allocation worksheet by entering your income amounts and applying the appropriate state tax rates. Finally, review the completed worksheet for accuracy before submitting it with your tax return.

Legal Use of the Part Year Resident Income Allocation

The part year resident income allocation is legally binding when filled out correctly and submitted to the appropriate tax authorities. To ensure its validity, the form must comply with federal and state regulations regarding income reporting. Electronic signatures, when used, must adhere to the legal standards set by the ESIGN Act and UETA, which recognize eSignatures as valid for tax documents. Maintaining accurate records and documentation is essential, as discrepancies can lead to audits or penalties.

IRS Guidelines

The IRS provides specific guidelines for completing the part year resident income allocation. Taxpayers should refer to IRS publications that outline the requirements for reporting income from multiple states. It is essential to follow these guidelines closely to avoid errors that could result in tax liabilities or delays in processing. Additionally, understanding the IRS’s stance on residency and income allocation can help taxpayers navigate their obligations more effectively.

Filing Deadlines / Important Dates

Filing deadlines for the part year resident income allocation align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April fifteenth of each year. However, if a taxpayer needs additional time, they can file for an extension, which generally provides an additional six months. It is important to be aware of state-specific deadlines as they may differ from federal deadlines, especially for states with unique tax laws.

Required Documents

To complete the part year resident income allocation accurately, several documents are necessary. These include:

- W-2 forms from employers for income earned during the year

- 1099 forms for any freelance or contract work

- Documentation of residency periods in each state

- Records of any other income sources, such as rental income

- Previous year’s tax return for reference

Having these documents on hand will facilitate a smoother completion process and ensure all income is reported correctly.

Quick guide on how to complete income allocation worksheet

Complete income allocation worksheet with ease on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely maintain it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage allocation worksheet for py nr on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to modify and electronically sign part year resident income allocations effortlessly

- Locate part year resident nonresident allocation worksheet and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes only a few seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign income allocation part year resident and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs part year resident

-

How do I fill out an income tax form?

The Indian Income-Tax department has made the process of filing of income tax returns simplified and easy to understand.However, that is applicable only in case where you don’t have incomes under different heads. Let’s say, you are earning salary from a company in India, the company deducts TDS from your salary. In such a scenario, it’s very easy to file the return.Contrary to this is the scenario, where you have income from business and you need to see what all expenses you can claim as deduction while calculating the net taxable income.You can always signNow out to a tax consultant for detailed review of your tax return.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How a Non-US residence company owner (has EIN) should fill the W-7 ITIN form out? Which option is needed to be chosen in the first part?

Depends on the nature of your business and how it is structured.If you own an LLC taxed as a passthrough entity, then you probably will check option b and submit the W7 along with your US non-resident tax return. If your LLC’s income is not subject to US tax, then you will check option a.If the business is a C Corp, then you probably don’t need an ITIN, unless you are receiving taxable compensation from the corporation and then we are back to option b.

-

What forms do I need to fill out as a first-year LLC owner? It's a partnership LLC.

A Limited Liability Company (LLC) is business structure that provides the limited liability protection features of a corporation and the tax efficiencies and operational flexibility of a partnership.Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are "passed through" the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.The owners of an LLC have no personal liability for the obligations of the LLC. An LLC is the entity of choice for a businesses seeking to flow through losses to its investors because an LLC offers complete liability protection to all its members. The basic requirement for forming an Limited Liability Company are:Search your business name - before you form an LLC, you should check that your proposed business name is not too similar to another LLC registered with your state's Secretary of StateFile Articles of Organization - the first formal paper you will need file with your state's Secretary of State to form an LLC. This is a necessary document for setting up an LLC in many states. Create an Operating Agreement - an agreement among LLC members governing the LLC's business, and member's financial and managerial rights and duties. Think of this as a contract that governs the rules for the people who own the LLC. Get an Employer Identification Number (EIN) - a number assigned by the IRS and used to identify taxpayers that are required to file various business tax returns. You can easily file for an EIN online if you have a social security number. If you do not have a social security number or if you live outsides of United States, ask a business lawyer to help you get one.File Statement of Information - includes fairly basic information about the LLC that you need to file with your state’s Secretary of State every 2 years. Think of it as a company census you must complete every 2 years.Search and Apply for Business Licenses and Permits - once your business is registered, you should look and apply for necessary licenses and permits you will need from the county and city where you will do business. Every business has their own business licenses and permits so either do a Google search of your business along with the words "permits and licenses" or talk to a business lawyer to guide you with this.If you have any other questions, talk to a business lawyer who will clarify and help you with all 6 above steps or answer any other question you may have about starting your business.I am answering from the perspective of a business lawyer who represents businesspersons and entrepreneurs with their new and existing businesses. Feel free to contact me sam@mollaeilaw.com if you need to form your LLC.In my course, How To Incorporate Your Business on Your Own: Quick & Easy, you will learn how to form your own Limited Liability Company (LLC) or Corporation without a lawyer, choose a business name, file a fictitious business name, file Articles of Organization or Articles of Incorporation, create Operating Agreement or Bylaws, apply for an EIN, file Statement of Information, and how to get business licenses and permits.

Related searches to part year resident tax return

Create this form in 5 minutes!

How to create an eSignature for the allocation worksheet

How to make an eSignature for your Part Year Resident Income Allocation in the online mode

How to generate an electronic signature for the Part Year Resident Income Allocation in Google Chrome

How to generate an electronic signature for signing the Part Year Resident Income Allocation in Gmail

How to generate an electronic signature for the Part Year Resident Income Allocation right from your mobile device

How to create an electronic signature for the Part Year Resident Income Allocation on iOS

How to make an eSignature for the Part Year Resident Income Allocation on Android devices

People also ask part year resident income allocations

-

What is an allocation worksheet for py nr?

An allocation worksheet for py nr is a specialized tool used to allocate resources and track financial data for a specific period. It helps businesses manage their budget effectively by providing a clear overview of allocations and spending, ensuring they meet financial goals.

-

How can I use the allocation worksheet for py nr in airSlate SignNow?

You can easily create and manage your allocation worksheet for py nr using airSlate SignNow by utilizing templates designed for streamlining document workflows. The platform allows for collaborative editing, ensuring all stakeholders can contribute to the document seamlessly.

-

What are the pricing options for airSlate SignNow’s allocation worksheet for py nr?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those requiring an allocation worksheet for py nr. Pricing is competitive, and businesses can choose from monthly or annual subscriptions, allowing for budget-friendly options.

-

What features does airSlate SignNow provide for the allocation worksheet for py nr?

The airSlate SignNow platform includes essential features for your allocation worksheet for py nr, such as eSignature capabilities, document editing, and cloud storage. These features enhance collaboration and make document management easier and more efficient.

-

What are the benefits of using airSlate SignNow for an allocation worksheet for py nr?

Using airSlate SignNow for your allocation worksheet for py nr provides several benefits, including increased efficiency, reduced turnaround times for document signing, and enhanced security. The user-friendly interface makes it accessible for everyone in your organization.

-

Can I integrate airSlate SignNow with other tools for my allocation worksheet for py nr?

Yes, airSlate SignNow supports various integrations that allow you to connect your allocation worksheet for py nr with other tools such as CRMs, project management software, and accounting systems. This ensures a seamless flow of information across your business processes.

-

Is it easy to share the allocation worksheet for py nr with team members?

Absolutely! airSlate SignNow simplifies the process of sharing your allocation worksheet for py nr with team members. You can invite collaborators via email, allowing them to view or edit the document based on the permissions you set.

Get more for part year resident nonresident allocation worksheet

Find out other income allocation part year resident

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed