Standard Form 1098, Schedule of Canceled or GSA

What is the Standard Form 1098, Schedule Of Canceled Or GSA

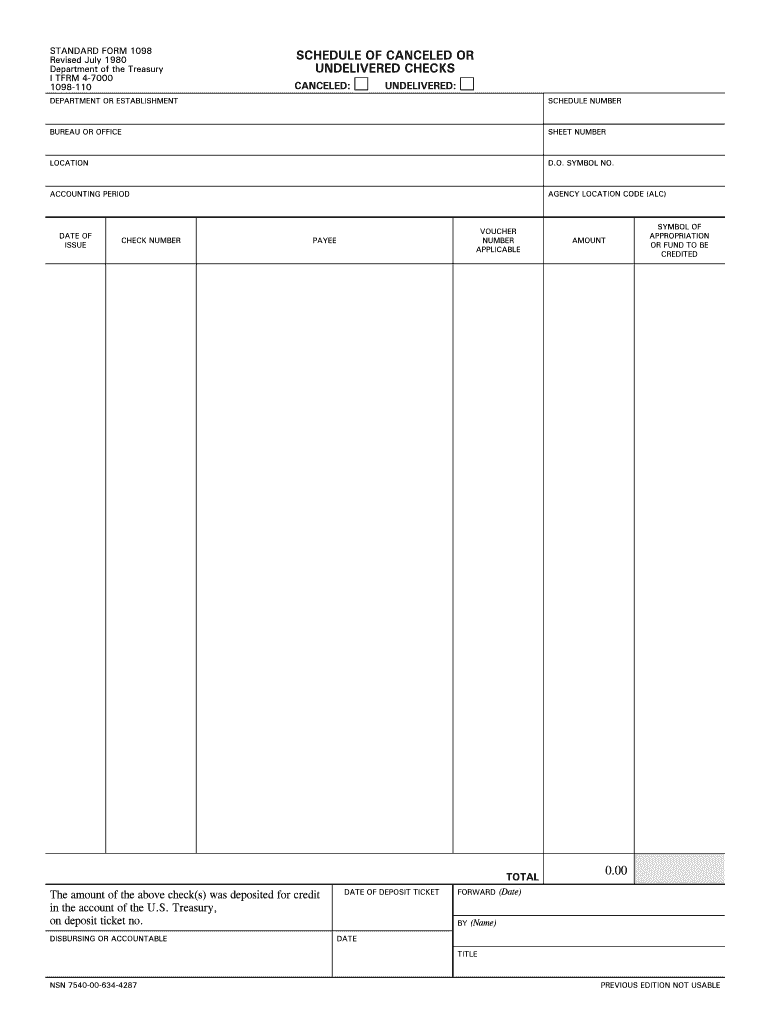

The Standard Form 1098, Schedule Of Canceled Or GSA, is a federal government form used primarily for reporting certain types of financial transactions related to canceled debts. This form is essential for organizations and individuals who need to document the cancellation of debts for tax purposes. It helps ensure compliance with IRS regulations, providing a clear record of canceled obligations that may affect tax liabilities. The form is particularly relevant for businesses and financial institutions that engage in lending or debt forgiveness activities.

How to use the Standard Form 1098, Schedule Of Canceled Or GSA

Using the Standard Form 1098, Schedule Of Canceled Or GSA involves several key steps. First, ensure that you have the correct version of the form, as updates may occur annually. Next, gather all necessary information, including the debtor's details and the specifics of the canceled debt. Fill out the form accurately, providing clear descriptions of the transactions. Once completed, the form must be submitted to the IRS and a copy provided to the debtor. Utilizing electronic means for submission can streamline the process and ensure timely filing.

Steps to complete the Standard Form 1098, Schedule Of Canceled Or GSA

Completing the Standard Form 1098, Schedule Of Canceled Or GSA requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the form from the IRS website or other official sources.

- Input the debtor's name, address, and taxpayer identification number (TIN).

- Detail the amount of the canceled debt and the date it was canceled.

- Provide a description of the debt, including the nature of the transaction.

- Review the form for accuracy before submission.

Legal use of the Standard Form 1098, Schedule Of Canceled Or GSA

The legal use of the Standard Form 1098, Schedule Of Canceled Or GSA is crucial for ensuring compliance with federal tax regulations. This form serves as an official record of canceled debts, which can impact both the lender's and borrower's tax obligations. Properly completing and filing this form helps avoid potential penalties for non-compliance and provides legal protection in case of audits. It is important to retain copies of the submitted form for your records, as they may be required for future reference or verification.

Filing Deadlines / Important Dates

Filing deadlines for the Standard Form 1098, Schedule Of Canceled Or GSA are critical for compliance. Typically, the form must be filed with the IRS by the end of February if submitted on paper, or by the end of March if filed electronically. Additionally, copies must be provided to debtors by the same deadlines. Staying informed about these dates helps prevent late filing penalties and ensures that all parties have the necessary documentation for their tax records.

Examples of using the Standard Form 1098, Schedule Of Canceled Or GSA

Examples of using the Standard Form 1098, Schedule Of Canceled Or GSA include scenarios where a lender forgives a portion of a loan or cancels a debt due to bankruptcy. For instance, if a business loans a client $10,000 and later agrees to forgive $4,000 of that debt, the lender must report the canceled amount using this form. Another example is when a financial institution cancels a credit card debt after a consumer defaults. In both cases, the form serves to document the transaction for tax reporting purposes.

Quick guide on how to complete standard form 1098 schedule of canceled or gsa

Complete Standard Form 1098, Schedule Of Canceled Or GSA effortlessly on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Standard Form 1098, Schedule Of Canceled Or GSA on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest method to modify and eSign Standard Form 1098, Schedule Of Canceled Or GSA effortlessly

- Obtain Standard Form 1098, Schedule Of Canceled Or GSA and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form—via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the issues of lost or misplaced documents, exhausting searches for forms, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you select. Modify and eSign Standard Form 1098, Schedule Of Canceled Or GSA and guarantee exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the standard form 1098 schedule of canceled or gsa

How to create an eSignature for your Standard Form 1098 Schedule Of Canceled Or Gsa in the online mode

How to make an eSignature for your Standard Form 1098 Schedule Of Canceled Or Gsa in Google Chrome

How to make an electronic signature for signing the Standard Form 1098 Schedule Of Canceled Or Gsa in Gmail

How to generate an eSignature for the Standard Form 1098 Schedule Of Canceled Or Gsa straight from your smartphone

How to make an eSignature for the Standard Form 1098 Schedule Of Canceled Or Gsa on iOS devices

How to make an eSignature for the Standard Form 1098 Schedule Of Canceled Or Gsa on Android OS

People also ask

-

What is Standard Form 1098, Schedule Of Canceled Or GSA?

The Standard Form 1098, Schedule Of Canceled Or GSA, is a document utilized for reporting mortgage interest payments. This form is essential for both borrowers and lenders to keep accurate tax records. Understanding this form can help ensure compliance with federal tax regulations.

-

How can airSlate SignNow help with completing the Standard Form 1098, Schedule Of Canceled Or GSA?

airSlate SignNow provides a convenient platform for signing and managing the Standard Form 1098, Schedule Of Canceled Or GSA. Our easy-to-use interface allows users to fill out, send, and eSign documents quickly. This streamlines the process, ensuring that your documents are properly executed and stored.

-

What are the pricing options for using airSlate SignNow for the Standard Form 1098, Schedule Of Canceled Or GSA?

airSlate SignNow offers competitive pricing tailored to different business needs when handling the Standard Form 1098, Schedule Of Canceled Or GSA. We provide various subscription plans that cater to small businesses and larger enterprises alike. You can choose a plan that best fits your budget and features required.

-

What features does airSlate SignNow offer for the Standard Form 1098, Schedule Of Canceled Or GSA?

Our platform includes a range of features to facilitate the use of the Standard Form 1098, Schedule Of Canceled Or GSA, such as customizable templates, electronic signatures, and secure document storage. These features enhance efficiency and ensure that all documents meet legal requirements for eSignatures. You can also track the status of documents easily.

-

Are there any integrations available with airSlate SignNow for handling the Standard Form 1098, Schedule Of Canceled Or GSA?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance the management of the Standard Form 1098, Schedule Of Canceled Or GSA. Popular integrations include platforms like Google Drive, Salesforce, and Microsoft Office. These integrations make it easier to access, send, and store your documents.

-

What are the benefits of using airSlate SignNow for the Standard Form 1098, Schedule Of Canceled Or GSA?

Using airSlate SignNow for the Standard Form 1098, Schedule Of Canceled Or GSA offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that documents are signed quickly and maintained securely, allowing businesses to focus on their core operations rather than administrative tasks.

-

Is airSlate SignNow compliant with legal standards for the Standard Form 1098, Schedule Of Canceled Or GSA?

Absolutely, airSlate SignNow is fully compliant with legal standards for electronic signatures applicable to the Standard Form 1098, Schedule Of Canceled Or GSA. We adhere to regulations such as ESIGN and UETA, ensuring that your eSigned documents are legally recognized. Trust our platform to help you stay compliant with all necessary laws.

Get more for Standard Form 1098, Schedule Of Canceled Or GSA

- Statement of extra provincial registration taber licensing ampamp registry form

- Appointment of an agent form appointment of an agent

- Quotform no 16 see rule 311a part a certificate under section webtel

- Dsw form

- Eligibility certificate form

- Ph071 authority to request or disclose personal information to

- Drivers license forms minnesota department of public safety

- Living skills assessment form

Find out other Standard Form 1098, Schedule Of Canceled Or GSA

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation