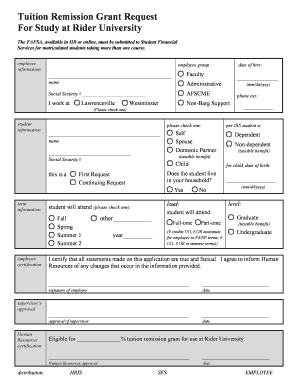

Tuition Remission Grant Request for Study at Rider University Form

What is the Tuition Remission Grant Request For Study At Rider University

The Tuition Remission Grant Request for Study at Rider University is a formal application process designed for eligible students seeking financial assistance to cover tuition costs. This grant is typically available to employees of Rider University and their dependents, allowing them to pursue academic programs while alleviating some of the financial burdens associated with higher education. The grant aims to support educational advancement and foster a culture of learning within the university community.

Eligibility Criteria

To qualify for the Tuition Remission Grant, applicants must meet specific eligibility requirements. Generally, these include being a full-time or part-time employee of Rider University or a dependent of an eligible employee. Additionally, applicants must be enrolled in an approved degree program at Rider University. It is essential for applicants to review the university's guidelines to ensure they meet all criteria before submitting their request.

Steps to Complete the Tuition Remission Grant Request For Study At Rider University

Completing the Tuition Remission Grant Request involves several key steps:

- Gather necessary documentation, including proof of employment and enrollment status.

- Access the official Tuition Remission Grant Request form, which can typically be found on Rider University's website or through the human resources department.

- Fill out the form with accurate information, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form according to the specified submission methods, which may include online submission, mail, or in-person delivery.

Required Documents

When applying for the Tuition Remission Grant, applicants must provide several key documents to support their request. These typically include:

- Proof of employment at Rider University, such as an employment verification letter.

- Evidence of enrollment in an eligible academic program, such as a current class schedule or acceptance letter.

- Any additional documentation requested by the university, which may vary based on individual circumstances.

Form Submission Methods

Applicants can submit the Tuition Remission Grant Request through various methods, depending on the university's guidelines. Common submission methods include:

- Online submission via Rider University's designated portal.

- Mailing the completed form to the appropriate department.

- Delivering the form in person to the human resources office or financial aid office.

Application Process & Approval Time

The application process for the Tuition Remission Grant typically involves several stages. After submission, the university's financial aid or human resources department will review the request. The approval time can vary based on the volume of applications and the completeness of submitted documentation. Generally, applicants can expect to receive a decision within a few weeks. It is advisable to apply early to ensure timely processing and to meet any upcoming tuition payment deadlines.

Quick guide on how to complete tuition remission grant request for study at rider university

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that reason.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tuition remission grant request for study at rider university

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tuition Remission Grant Request For Study At Rider University?

The Tuition Remission Grant Request For Study At Rider University is a financial aid program designed to assist eligible students in covering their tuition costs. This grant allows students to pursue their studies without the burden of excessive financial strain, making higher education more accessible.

-

Who is eligible to apply for the Tuition Remission Grant Request For Study At Rider University?

Eligibility for the Tuition Remission Grant Request For Study At Rider University typically includes current employees, their dependents, and sometimes alumni. Specific criteria may vary, so it's essential to review the university's guidelines to ensure you meet the requirements before applying.

-

How do I submit a Tuition Remission Grant Request For Study At Rider University?

To submit a Tuition Remission Grant Request For Study At Rider University, you will need to complete the designated application form available on the university's website. Ensure that all required documentation is included to facilitate a smooth review process.

-

What are the benefits of the Tuition Remission Grant Request For Study At Rider University?

The primary benefit of the Tuition Remission Grant Request For Study At Rider University is the signNow reduction in tuition costs, allowing students to focus on their education. Additionally, this grant can enhance career advancement opportunities by enabling employees to gain further qualifications.

-

Is there a deadline for the Tuition Remission Grant Request For Study At Rider University?

Yes, there are specific deadlines for submitting the Tuition Remission Grant Request For Study At Rider University, which are typically outlined on the university's financial aid webpage. It is crucial to adhere to these deadlines to ensure your application is considered.

-

Can I apply for the Tuition Remission Grant Request For Study At Rider University for online courses?

Yes, many online courses at Rider University are eligible for the Tuition Remission Grant Request For Study At Rider University. However, it's advisable to check the specific course details and eligibility criteria to confirm that your chosen program qualifies.

-

What documents are required for the Tuition Remission Grant Request For Study At Rider University?

When applying for the Tuition Remission Grant Request For Study At Rider University, you will typically need to provide proof of employment, your academic records, and any other documentation specified in the application guidelines. Ensuring all documents are complete will help expedite the review process.

Get more for Tuition Remission Grant Request For Study At Rider University

- Mobile disco booking form wedding entertainment in gretna green gretna weddings

- Tv licence cancellation form pdf download

- Ease card north tyneside form

- Dairy nz milk smart workbook form

- Acc250 reimbursement of client travel expenses ancillary services client payments form

- Wine bottle forms

- 330 per dozen form

- Countertop order form

Find out other Tuition Remission Grant Request For Study At Rider University

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online