ANNUAL TREASURER'S REPORT ATTORNEY GENERAL of Form

What is the Annual Treasurer's Report Attorney General of …

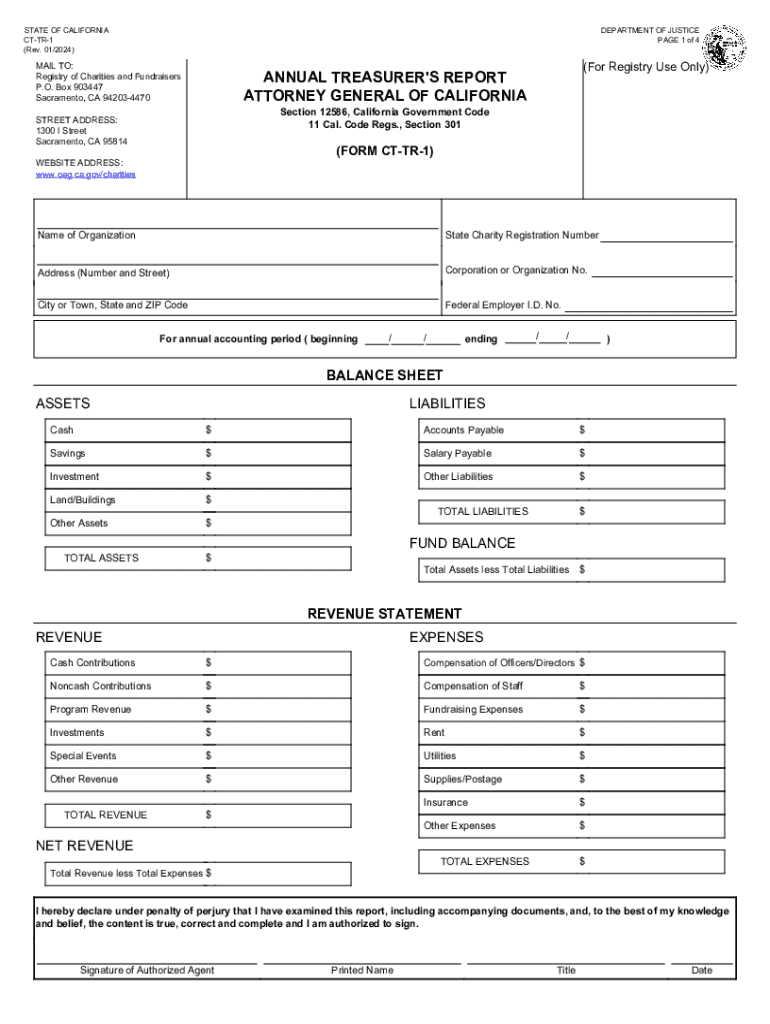

The Annual Treasurer's Report Attorney General of … is a formal document that provides a comprehensive overview of the financial activities and status of a specific organization or entity for a given year. This report is typically required by state law and serves to ensure transparency and accountability in financial reporting. It includes details such as income, expenditures, assets, and liabilities, allowing stakeholders to assess the financial health of the organization. The report is often submitted to the Attorney General's office, which oversees compliance with financial regulations.

Steps to Complete the Annual Treasurer's Report Attorney General of …

Completing the Annual Treasurer's Report involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary financial records, including bank statements, receipts, and invoices. Next, categorize the financial data into income and expenses. Then, fill out the report form accurately, ensuring all figures are correctly calculated and supported by documentation. After completing the form, review it for any errors or omissions. Finally, submit the report to the appropriate authority by the specified deadline, ensuring that all required signatures are included.

Required Documents for the Annual Treasurer's Report Attorney General of …

To complete the Annual Treasurer's Report, several documents are typically required. These include:

- Financial statements from the previous year

- Bank statements and reconciliations

- Receipts for all income and expenditures

- Documentation of any grants or funding received

- Minutes from meetings where financial decisions were made

Having these documents organized and readily available can streamline the reporting process and help ensure compliance with state regulations.

Legal Use of the Annual Treasurer's Report Attorney General of …

The Annual Treasurer's Report serves a crucial legal function by providing a transparent account of an organization's financial activities. It is often used by regulatory bodies to verify compliance with financial laws and regulations. Additionally, the report can be referenced in legal proceedings or audits to demonstrate financial integrity and accountability. Organizations must ensure that the report is filed accurately and on time to avoid potential legal repercussions, such as fines or penalties.

Filing Deadlines for the Annual Treasurer's Report Attorney General of …

Filing deadlines for the Annual Treasurer's Report vary by state and organization type. Generally, organizations are required to submit their reports within a specific timeframe following the end of their fiscal year. It is essential to check the specific regulations applicable to your state to ensure timely submission. Missing the deadline can result in penalties or legal issues, making it crucial to adhere to these timelines.

Form Submission Methods for the Annual Treasurer's Report Attorney General of …

The Annual Treasurer's Report can typically be submitted through various methods, depending on state regulations. Common submission methods include:

- Online submission through the Attorney General's office website

- Mailing a hard copy of the report to the designated office

- In-person submission at local government offices

Each method may have specific requirements, such as additional documentation or signatures, so it is important to review the guidelines provided by the state Attorney General's office before submitting the report.

State-Specific Rules for the Annual Treasurer's Report Attorney General of …

Each state has its own regulations regarding the Annual Treasurer's Report, including specific requirements for content, format, and submission procedures. It is important for organizations to familiarize themselves with their state's rules to ensure compliance. This may include understanding the necessary financial disclosures, deadlines for submission, and any unique reporting formats required by the Attorney General's office. Consulting with a legal expert or financial advisor can also help navigate these state-specific regulations effectively.

Quick guide on how to complete annual treasurers report attorney general of

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device with the airSlate SignNow apps for Android or iOS and enhance any document-centric process today.

The simplest way to edit and electronically sign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF

Create this form in 5 minutes!

How to create an eSignature for the annual treasurers report attorney general of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF …. and why is it important?

The ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF …. is a crucial document that provides transparency regarding the financial activities of the state. It ensures accountability and helps maintain public trust in government operations. Understanding this report is essential for stakeholders and citizens alike.

-

How can airSlate SignNow assist with the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF ….?

airSlate SignNow streamlines the process of preparing and signing the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF …. by providing an easy-to-use platform for document management. Our eSigning features ensure that all necessary signatures are obtained quickly and securely, enhancing efficiency.

-

What are the pricing options for using airSlate SignNow for the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF ….?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of various organizations. Whether you are a small business or a large enterprise, our cost-effective solutions ensure that you can manage the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF …. without breaking the bank.

-

What features does airSlate SignNow provide for managing the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF ….?

Our platform includes features such as customizable templates, secure eSigning, and real-time tracking, all designed to simplify the management of the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF …. These tools help ensure that your documents are processed efficiently and securely.

-

Can airSlate SignNow integrate with other software for the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF ….?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your workflow for the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF …. This integration allows for better data management and ensures that all your documents are in sync across platforms.

-

What are the benefits of using airSlate SignNow for the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF ….?

Using airSlate SignNow for the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF …. offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform helps you focus on what matters most while ensuring compliance with legal requirements.

-

Is airSlate SignNow secure for handling the ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF ….?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF …. is protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF

- Symmetry tests in nuclear beta decay annual reviews form

- Membership application and renewal form names 1 2

- A survey of public attitudes towards climate change and form

- It 09 4 quotstatute of limitations applicationquot illinois department of tax illinois form

- Application for nursing home administrator license state of new state nj form

- J767republic of south africaform 2 bringing matter

- Sale distribution agreement template form

- Sale marketing agreement template form

Find out other ANNUAL TREASURER'S REPORT ATTORNEY GENERAL OF

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors