Business Classification Form 2012

What is the Business Classification Form

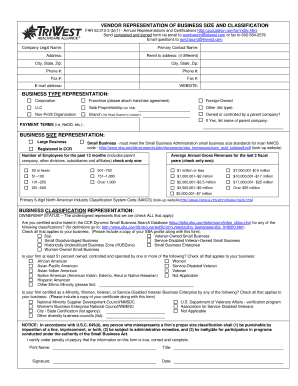

The business classification form is a crucial document used by businesses to categorize their operations for various regulatory and tax purposes. This form typically requires businesses to identify their structure, such as whether they are a sole proprietorship, partnership, corporation, or limited liability company (LLC). Understanding the classification is essential for compliance with federal and state regulations, as it affects taxation, liability, and eligibility for certain programs or incentives.

How to use the Business Classification Form

Using the business classification form involves several straightforward steps. First, gather all necessary information about your business, including its legal name, address, and type of entity. Next, accurately fill out the form by selecting the appropriate classification that reflects your business structure. It’s important to review the completed form for accuracy before submission, as errors can lead to delays or compliance issues. Once completed, the form can be submitted to the relevant authorities, such as the Internal Revenue Service (IRS) or state agencies.

Steps to complete the Business Classification Form

Completing the business classification form requires careful attention to detail. Follow these steps for a smooth process:

- Identify your business type: Determine if your business is a sole proprietorship, partnership, corporation, or LLC.

- Gather required information: Collect details such as your business name, address, and taxpayer identification number.

- Fill out the form: Clearly indicate your business classification and provide any additional requested information.

- Review for accuracy: Double-check all entries to ensure there are no mistakes.

- Submit the form: Send the completed form to the appropriate agency, either online or by mail.

Legal use of the Business Classification Form

The legal use of the business classification form is essential for compliance with state and federal laws. This form helps determine the tax obligations and legal responsibilities of the business entity. Proper classification can also impact liability protection for owners and stakeholders. Failing to accurately complete and submit this form may result in penalties or legal complications, making it vital for businesses to adhere to the guidelines set forth by regulatory agencies.

Required Documents

When preparing to complete the business classification form, certain documents may be required to support your application. These typically include:

- Proof of business registration: This could be a certificate of incorporation or a partnership agreement.

- Tax identification number: Obtain your Employer Identification Number (EIN) from the IRS.

- Operating agreements: If applicable, include any agreements that outline the management structure of your business.

- Personal identification: Owners may need to provide personal identification, such as a driver's license or Social Security number.

Form Submission Methods

The business classification form can be submitted through various methods, depending on the requirements of the governing agency. Common submission methods include:

- Online submission: Many agencies offer an online portal for completing and submitting the form electronically.

- Mail: You can print the completed form and send it via postal service to the appropriate address.

- In-person: Some businesses may choose to deliver the form directly to the agency's office.

Quick guide on how to complete business classification form

Prepare Business Classification Form effortlessly on any device

Online document handling has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without holdups. Manage Business Classification Form on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Business Classification Form effortlessly

- Find Business Classification Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced paperwork, monotonous form searching, or errors that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Business Classification Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct business classification form

Create this form in 5 minutes!

How to create an eSignature for the business classification form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a business classification form?

A business classification form is a document used to categorize a business based on its industry, size, and structure. This form helps organizations streamline their operations and comply with regulatory requirements. By utilizing airSlate SignNow, you can easily create, send, and eSign your business classification form.

-

How can airSlate SignNow help with my business classification form?

airSlate SignNow simplifies the process of managing your business classification form by providing an intuitive platform for document creation and electronic signatures. You can customize your forms, track their status, and ensure secure storage. This efficiency saves time and enhances productivity for your business.

-

Is there a cost associated with using airSlate SignNow for business classification forms?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Each plan includes features that facilitate the creation and management of business classification forms. You can choose a plan that fits your budget while still benefiting from our comprehensive eSigning solutions.

-

What features does airSlate SignNow offer for business classification forms?

airSlate SignNow provides a range of features for business classification forms, including customizable templates, automated workflows, and real-time tracking. Additionally, you can integrate with other applications to streamline your processes further. These features ensure that your business classification forms are handled efficiently.

-

Can I integrate airSlate SignNow with other software for my business classification form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to enhance your workflow when managing business classification forms. Whether you use CRM systems, cloud storage, or project management tools, our platform can connect with them to improve efficiency.

-

What are the benefits of using airSlate SignNow for my business classification form?

Using airSlate SignNow for your business classification form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning and document sharing, which accelerates your business processes. Additionally, you can maintain compliance with industry regulations effortlessly.

-

How secure is my business classification form with airSlate SignNow?

Security is a top priority at airSlate SignNow. Your business classification form is protected with advanced encryption and secure storage solutions. We comply with industry standards to ensure that your sensitive information remains confidential and secure throughout the signing process.

Get more for Business Classification Form

Find out other Business Classification Form

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form