Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents Form

Understanding the Schedule CA 540 for California Adjustments

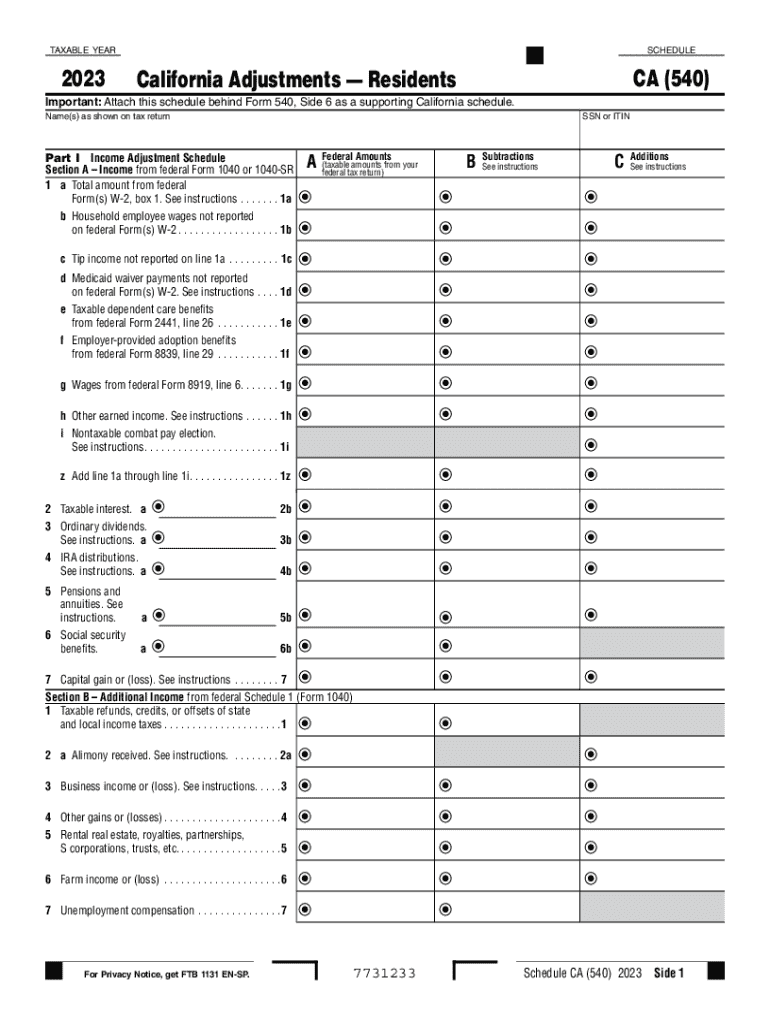

The Schedule CA 540 is a crucial form for California residents, specifically designed to report adjustments to income and deductions for state tax purposes. This form is part of the California Form 540 series, which is used by individuals to file their annual state income tax returns. The adjustments reported on this form can significantly impact the overall tax liability, making it essential for residents to understand its components and requirements.

California residents must complete the Schedule CA 540 to accurately reflect any modifications to their federal adjusted gross income (AGI). These adjustments may include various items such as state tax refunds, contributions to retirement accounts, and other specific deductions that differ from federal guidelines. Understanding these adjustments is vital for ensuring compliance with state tax laws.

Steps to Complete the Schedule CA 540

Completing the Schedule CA 540 involves several key steps that ensure accurate reporting of income adjustments. Start by gathering all necessary financial documents, including W-2s, 1099s, and any records related to deductions.

Next, follow these steps:

- Begin with your federal adjusted gross income (AGI) from your federal tax return.

- Identify and list any California-specific adjustments that apply to your situation.

- Complete the sections of the form that correspond to your income adjustments, ensuring all figures are accurate.

- Review your completed Schedule CA 540 for any errors or omissions before submission.

It is advisable to consult the instructions provided with the form for detailed guidance on each adjustment item.

Key Elements of the Schedule CA 540

The Schedule CA 540 includes several key elements that are essential for California residents. These elements help clarify the adjustments being made and their implications for state tax calculations.

Important components of the form include:

- Income Adjustments: This section allows taxpayers to report any modifications to their federal AGI, such as state tax refunds or other specific income adjustments.

- Deductions: Taxpayers can claim various deductions that are unique to California, which may differ from federal deductions.

- Tax Credits: The form also includes sections for claiming any applicable tax credits that can reduce overall tax liability.

Understanding these elements is critical for accurately completing the form and ensuring compliance with California tax regulations.

Obtaining the Schedule CA 540

California residents can obtain the Schedule CA 540 through various methods. The form is readily available online on the California Franchise Tax Board (FTB) website, where users can download it in PDF format. Additionally, physical copies can be requested through the FTB or found at local tax offices and libraries.

It is important to ensure that you are using the correct version for the tax year, as forms may be updated annually. For 2023, ensure you are accessing the Schedule CA 540 for that specific year to reflect the latest tax regulations and adjustments.

Important Filing Deadlines for the Schedule CA 540

Filing deadlines for the Schedule CA 540 are crucial for California residents to avoid penalties and interest on unpaid taxes. Typically, the deadline for filing the California state income tax return, including the Schedule CA 540, aligns with the federal tax return deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Residents should also be aware of any extensions that may apply, allowing additional time to file without incurring penalties. It is advisable to confirm the specific deadlines for the current tax year, as they may vary based on legislative changes or other factors.

Quick guide on how to complete schedule ca 540 california adjustments residents schedule ca 540 california adjustments residents

Complete Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to modify and eSign Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents effortlessly

- Find Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled paperwork, tedious form hunting, or errors that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device of your choice. Modify and eSign Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule ca 540 california adjustments residents schedule ca 540 california adjustments residents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow for managing california adjustments 2023?

airSlate SignNow offers a range of features tailored for managing california adjustments 2023, including customizable templates, secure eSigning, and real-time tracking. These features streamline the document workflow, ensuring that all adjustments are processed efficiently. Additionally, the platform supports collaboration among team members, making it easier to manage adjustments collectively.

-

How does airSlate SignNow help with compliance regarding california adjustments 2023?

Compliance is crucial when dealing with california adjustments 2023, and airSlate SignNow ensures that all documents are legally binding and secure. The platform adheres to industry standards and regulations, providing users with peace of mind. With features like audit trails and secure storage, businesses can confidently manage their compliance needs.

-

What pricing options are available for airSlate SignNow in relation to california adjustments 2023?

airSlate SignNow offers flexible pricing plans that cater to various business needs, especially for those managing california adjustments 2023. Users can choose from monthly or annual subscriptions, with options that scale according to the number of users and features required. This ensures that businesses can find a cost-effective solution that fits their budget.

-

Can airSlate SignNow integrate with other tools for managing california adjustments 2023?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing its functionality for california adjustments 2023. Popular integrations include CRM systems, cloud storage services, and productivity tools. This allows businesses to streamline their workflows and manage adjustments more effectively across different platforms.

-

What benefits does airSlate SignNow provide for businesses handling california adjustments 2023?

Using airSlate SignNow for california adjustments 2023 offers numerous benefits, including increased efficiency and reduced turnaround times for document processing. The platform's user-friendly interface makes it easy for teams to adopt and utilize. Additionally, the cost-effective nature of the solution helps businesses save on operational costs while ensuring compliance.

-

Is airSlate SignNow suitable for small businesses dealing with california adjustments 2023?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses managing california adjustments 2023. Its intuitive interface and affordable pricing make it accessible for smaller teams. Moreover, the platform's scalability allows small businesses to grow without needing to switch solutions.

-

How secure is airSlate SignNow when handling california adjustments 2023?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents related to california adjustments 2023. The platform employs advanced encryption methods and secure data storage to protect user information. Additionally, features like two-factor authentication further enhance security, ensuring that only authorized users can access documents.

Get more for Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents

- 2000 form 2555 ez foreign earned income exclusion irs

- Form 8109 2000

- Matka calculation formula 2000

- 1998 instructions 1040a instructions for preparing form 1040a and schedules 1 2 and eic

- 1998 2014 form 2555

- Updated l501 1995 form

- 31237 imf general instructionsinternal revenue service form

- Form 9465 installment agreement request 27103271

Find out other Schedule CA 540 California Adjustments Residents , Schedule CA 540, California Adjustments Residents

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later