Get W9 Formulario 2024

What is the Form W-9?

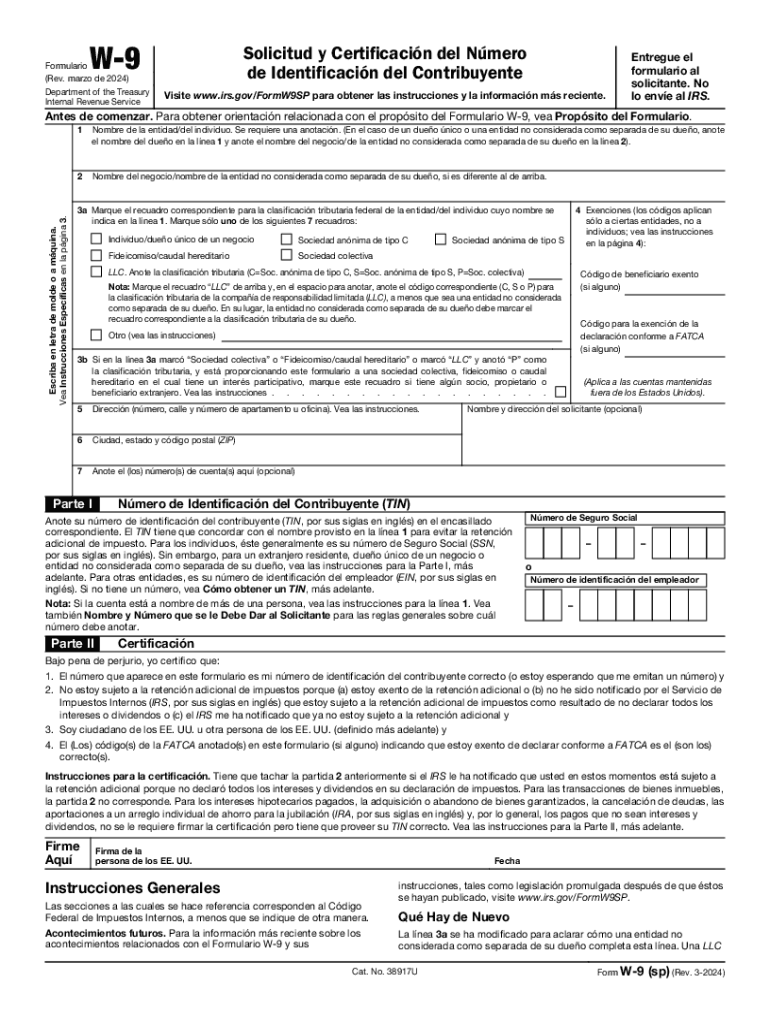

The Form W-9, officially known as the Request for Taxpayer Identification Number and Certification, is a crucial document used in the United States for tax purposes. It is primarily utilized by individuals and businesses to provide their taxpayer identification information to entities that will pay them income. This form is essential for freelancers, contractors, and anyone receiving payments that need to be reported to the IRS. The Spanish version of this form, known as the Form W-9 sp, ensures that Spanish-speaking taxpayers can accurately complete their tax documentation.

How to Obtain the Form W-9

To obtain the Form W-9, you can easily download it from the IRS website or other reliable sources. The form is available in both English and Spanish, allowing users to select the version that best suits their needs. Once downloaded, you can print it for completion. It is important to ensure you have the most recent version of the form, as updates may occur periodically. The form is free to download and does not require any special software.

Steps to Complete the Form W-9

Completing the Form W-9 is straightforward. Here are the steps to follow:

- Provide your name as it appears on your tax return.

- Enter your business name if applicable.

- Fill in your address, including city, state, and ZIP code.

- Indicate your taxpayer identification number, which may be your Social Security Number or Employer Identification Number.

- Certify your information by signing and dating the form.

Ensure all information is accurate to avoid delays in processing and potential penalties.

Legal Use of the Form W-9

The Form W-9 is legally required for certain transactions where income is paid to individuals or entities. It is essential for compliance with IRS regulations, as it helps the payer report payments made to the IRS accurately. Failure to provide a completed W-9 when requested can result in backup withholding, where the payer is required to withhold a percentage of payments for tax purposes. Understanding the legal implications of this form is crucial for both payers and payees.

IRS Guidelines for the Form W-9

The IRS provides specific guidelines regarding the use of the Form W-9. These guidelines include instructions on who should fill out the form, how to complete it correctly, and the importance of providing accurate information. The IRS emphasizes that the form should be requested by the payer and not filled out unsolicited by the payee. Additionally, the IRS advises that the W-9 should be kept on file by the requester for their records, as it may be needed for tax reporting purposes.

Examples of Using the Form W-9

The Form W-9 is commonly used in various scenarios, such as:

- Freelancers providing services to clients who need to report payments to the IRS.

- Contractors working with businesses that require taxpayer information for tax reporting.

- Individuals receiving interest or dividends from banks or financial institutions.

These examples illustrate the form's importance in ensuring compliance with tax regulations and facilitating accurate reporting of income.

Quick guide on how to complete form w 9 sp rev march request for taxpayer identification number and certification spanish version

Simplify Get W9 Formulario 2024 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your files quickly, without any hold-ups. Handle Get W9 Formulario 2024 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign Get W9 Formulario 2024 effortlessly

- Find Get W9 Formulario 2024 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize critical sections of your documents or obscure sensitive data using tools provided by airSlate SignNow specifically for this purpose.

- Generate your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to store your changes.

- Choose your preferred method to share your form via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Get W9 Formulario 2024 while ensuring excellent communication at every step of the document preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 9 sp rev march request for taxpayer identification number and certification spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to descargar w 9 using airSlate SignNow?

To descargar w 9 with airSlate SignNow, simply visit our website and navigate to the W-9 form section. You can easily download the form in a few clicks, fill it out, and send it for eSignature. Our platform ensures a seamless experience for managing your documents.

-

Is there a cost associated with descargar w 9 on airSlate SignNow?

Downloading the W-9 form itself is free, but using airSlate SignNow for eSigning and document management comes with a subscription fee. We offer various pricing plans to suit different business needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing W-9 forms?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking for W-9 forms. These tools help streamline your workflow, making it easier to manage and send documents efficiently. You can also integrate with other applications for enhanced functionality.

-

Can I integrate airSlate SignNow with other software for W-9 management?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to manage your W-9 forms seamlessly. Whether you use CRM systems, cloud storage, or accounting software, our platform can connect to enhance your document management process.

-

What are the benefits of using airSlate SignNow to descargar w 9?

Using airSlate SignNow to descargar w 9 provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform allows you to fill out and send W-9 forms quickly, reducing the risk of errors and ensuring compliance with IRS regulations.

-

Is airSlate SignNow secure for handling sensitive W-9 information?

Absolutely! airSlate SignNow prioritizes security and uses advanced encryption to protect your sensitive W-9 information. Our platform complies with industry standards to ensure that your data remains confidential and secure throughout the signing process.

-

How can I track the status of my W-9 forms after I descargar w 9?

After you descargar w 9 and send it for eSignature, airSlate SignNow allows you to track the status of your documents in real-time. You will receive notifications when the document is viewed, signed, or completed, giving you peace of mind and keeping you informed throughout the process.

Get more for Get W9 Formulario 2024

Find out other Get W9 Formulario 2024

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure