Student Untaxed Income and Benefits Worksheet Form

What is the Student Untaxed Income And Benefits Worksheet

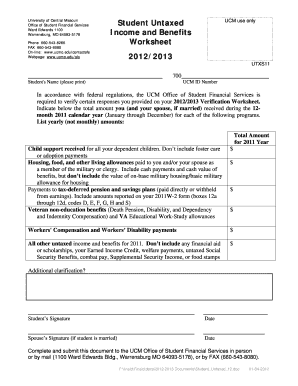

The Student Untaxed Income And Benefits Worksheet is a crucial document used by students applying for federal financial aid. This form helps to gather information about untaxed income and benefits that may not be reported on the FAFSA (Free Application for Federal Student Aid). It is designed to ensure that students accurately report their financial situation, which is essential for determining eligibility for various forms of financial assistance, including grants, loans, and work-study programs.

How to use the Student Untaxed Income And Benefits Worksheet

To effectively use the Student Untaxed Income And Benefits Worksheet, students should first gather all necessary financial documents. This includes records of any untaxed income such as child support, worker’s compensation, and veterans benefits. Once the information is collected, students should complete the worksheet by entering the relevant amounts in the designated sections. It is important to ensure that all information is accurate and complete, as this will directly impact the financial aid process.

Steps to complete the Student Untaxed Income And Benefits Worksheet

Completing the Student Untaxed Income And Benefits Worksheet involves several key steps:

- Gather all relevant financial documents, including income statements and benefit records.

- Carefully read the instructions provided with the worksheet to understand each section.

- Fill in the worksheet, ensuring that all untaxed income sources are reported accurately.

- Review the completed worksheet for any errors or omissions before submission.

- Keep a copy of the worksheet for your records once it is submitted.

Key elements of the Student Untaxed Income And Benefits Worksheet

The Student Untaxed Income And Benefits Worksheet includes several key elements that students must complete. These elements typically encompass:

- Identification of the student and their financial situation.

- Details of untaxed income sources, such as child support and disability payments.

- Any additional benefits received that are not reported on the FAFSA.

- Certification that the information provided is accurate to the best of the student's knowledge.

Legal use of the Student Untaxed Income And Benefits Worksheet

The Student Untaxed Income And Benefits Worksheet must be used in accordance with federal regulations governing financial aid applications. It is essential for students to provide truthful and accurate information, as any discrepancies can lead to legal consequences, including potential penalties or loss of financial aid eligibility. Understanding the legal implications of this worksheet is important for maintaining compliance with financial aid requirements.

Examples of using the Student Untaxed Income And Benefits Worksheet

Examples of situations where the Student Untaxed Income And Benefits Worksheet may be utilized include:

- A student receiving child support payments that are not reported on their FAFSA.

- A student who has received unemployment benefits during the year.

- A student who is a veteran and receives military benefits that are not included in taxable income.

In each case, accurately reporting this information can significantly affect the financial aid package offered to the student.

Quick guide on how to complete student untaxed income and benefits worksheet

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely maintain it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] across any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to Alter and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark pertinent sections of the documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or mislaid files, tedious form retrieval, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Edit and electronically sign [SKS] to ensure clear communication throughout every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Student Untaxed Income And Benefits Worksheet

Create this form in 5 minutes!

How to create an eSignature for the student untaxed income and benefits worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Student Untaxed Income And Benefits Worksheet?

The Student Untaxed Income And Benefits Worksheet is a crucial document used in the financial aid process. It helps students report untaxed income and benefits accurately, ensuring they receive the appropriate financial assistance. By using this worksheet, students can clarify their financial situation to aid offices.

-

How can airSlate SignNow assist with the Student Untaxed Income And Benefits Worksheet?

airSlate SignNow provides a seamless platform for students to complete and eSign the Student Untaxed Income And Benefits Worksheet. Our user-friendly interface simplifies the process, allowing students to fill out and submit their worksheets quickly and securely. This ensures that students can focus on their education rather than paperwork.

-

Is there a cost associated with using airSlate SignNow for the Student Untaxed Income And Benefits Worksheet?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for students. Our cost-effective solutions ensure that you can manage your Student Untaxed Income And Benefits Worksheet without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for the Student Untaxed Income And Benefits Worksheet?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the Student Untaxed Income And Benefits Worksheet. These features streamline the completion and submission process, making it easier for students to manage their financial aid documents efficiently.

-

Can I integrate airSlate SignNow with other tools for the Student Untaxed Income And Benefits Worksheet?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to connect your workflow seamlessly. This means you can easily incorporate the Student Untaxed Income And Benefits Worksheet into your existing systems, enhancing productivity and efficiency.

-

How secure is the information submitted through the Student Untaxed Income And Benefits Worksheet on airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect all information submitted through the Student Untaxed Income And Benefits Worksheet. You can trust that your sensitive data is safe and secure with us.

-

What are the benefits of using airSlate SignNow for the Student Untaxed Income And Benefits Worksheet?

Using airSlate SignNow for the Student Untaxed Income And Benefits Worksheet offers numerous benefits, including time savings, ease of use, and enhanced accuracy. Our platform helps students avoid common mistakes and ensures that their financial aid applications are submitted correctly and on time.

Get more for Student Untaxed Income And Benefits Worksheet

Find out other Student Untaxed Income And Benefits Worksheet

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement