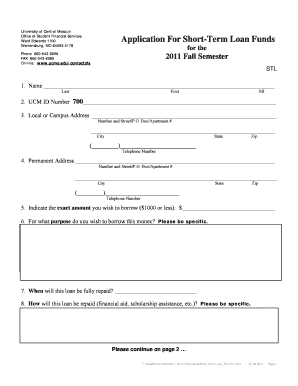

Short Term Loan Program Form

What is the Short Term Loan Program

The Short Term Loan Program is designed to provide individuals and businesses with quick access to funds for temporary financial needs. Typically, these loans are intended to cover unexpected expenses or bridge gaps until more permanent financing is secured. The loans usually have a repayment period of a few weeks to a few months, making them a flexible option for those in need of immediate cash flow.

How to use the Short Term Loan Program

Using the Short Term Loan Program involves a straightforward process. First, applicants need to assess their financial situation to determine the amount required. Next, they should gather necessary documentation, such as proof of income and identification. Once prepared, applicants can fill out the loan application form, ensuring all information is accurate and complete. After submission, the lender will review the application and, if approved, provide the funds within a short timeframe.

Eligibility Criteria

Eligibility for the Short Term Loan Program typically includes several factors. Applicants must be at least eighteen years old and a legal resident of the United States. Lenders often require proof of steady income, which can be from employment or other sources. Additionally, a good credit history may enhance the chances of approval, although some lenders may offer options for those with less-than-perfect credit.

Required Documents

To apply for the Short Term Loan Program, applicants need to provide specific documentation. Commonly required documents include:

- Government-issued identification, such as a driver's license or passport

- Proof of income, like pay stubs or bank statements

- Social Security number

- Proof of residence, such as a utility bill

Having these documents ready can streamline the application process and improve the likelihood of approval.

Steps to complete the Short Term Loan Program

Completing the Short Term Loan Program involves several key steps:

- Assess your financial needs and determine the loan amount.

- Gather required documents, including identification and proof of income.

- Complete the loan application form accurately.

- Submit the application to the lender for review.

- Receive approval and funds, if applicable.

- Repay the loan according to the agreed terms.

Legal use of the Short Term Loan Program

The Short Term Loan Program must be used in accordance with applicable laws and regulations. Borrowers should ensure they understand the terms of the loan, including interest rates and repayment schedules. It is essential to use the funds for legitimate purposes, as misuse can lead to legal consequences. Additionally, borrowers should be aware of their rights under the Fair Lending Act and other consumer protection laws.

Quick guide on how to complete short term loan program

Complete [SKS] effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools you need to create, adjust, and eSign your documents quickly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all details and then click the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or mislaid files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Short Term Loan Program

Create this form in 5 minutes!

How to create an eSignature for the short term loan program

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Short Term Loan Program offered by airSlate SignNow?

The Short Term Loan Program by airSlate SignNow provides businesses with quick access to funds for immediate needs. This program is designed to help companies manage cash flow effectively while ensuring they can meet their short-term financial obligations.

-

How does the Short Term Loan Program work?

The Short Term Loan Program works by allowing businesses to apply for a loan online, with a streamlined approval process. Once approved, funds are typically disbursed quickly, enabling businesses to address urgent financial needs without lengthy delays.

-

What are the eligibility requirements for the Short Term Loan Program?

To qualify for the Short Term Loan Program, businesses generally need to demonstrate a steady revenue stream and a solid credit history. Specific requirements may vary, so it's best to check the details on the airSlate SignNow website for the most accurate information.

-

What are the benefits of using the Short Term Loan Program?

The Short Term Loan Program offers several benefits, including quick access to funds, flexible repayment options, and minimal paperwork. This program is ideal for businesses looking to manage unexpected expenses without disrupting their operations.

-

Are there any fees associated with the Short Term Loan Program?

Yes, the Short Term Loan Program may include fees such as origination fees or interest rates. It's important to review the terms and conditions to understand all potential costs associated with the loan.

-

Can I integrate the Short Term Loan Program with other airSlate SignNow features?

Absolutely! The Short Term Loan Program can be seamlessly integrated with other airSlate SignNow features, allowing businesses to manage their documents and financial transactions in one place. This integration enhances efficiency and simplifies the overall process.

-

How can I apply for the Short Term Loan Program?

Applying for the Short Term Loan Program is simple. You can visit the airSlate SignNow website, fill out the online application form, and submit the required documentation. Our team will review your application and get back to you promptly.

Get more for Short Term Loan Program

- Boc online banking registration form

- Ltfrb online confirmation form

- New patta application form pdf

- United india insurance satisfaction voucher form

- Personal property addendum to real estate contract form

- Same name affidavit format pdf

- Food stamp change of address form

- Ta6 form download 2022 100262180

Find out other Short Term Loan Program

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form