Childcare Expenses off Campus 11 DOC Form

What is the Childcare Expenses Off Campus 11 doc

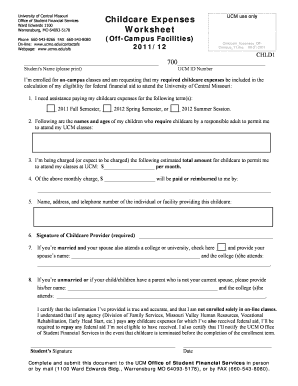

The Childcare Expenses Off Campus 11 doc is a form designed to help families track and report childcare expenses incurred while their children are in off-campus care. This document is essential for parents seeking to claim childcare tax credits or deductions on their federal tax returns. It provides a structured way to organize relevant expenses, ensuring compliance with IRS regulations. This form is particularly useful for families with children in daycare, preschool, or after-school programs, as it assists in documenting the costs associated with these services.

How to use the Childcare Expenses Off Campus 11 doc

Using the Childcare Expenses Off Campus 11 doc involves several straightforward steps. First, gather all receipts and documentation related to childcare expenses. This may include invoices from care providers and payment confirmations. Next, fill out the form by entering the required information, such as the provider’s name, address, and the total amount paid for childcare services. Ensure that all entries are accurate to avoid issues during tax filing. Once completed, this form can be submitted alongside your tax return to claim any eligible credits or deductions.

Steps to complete the Childcare Expenses Off Campus 11 doc

Completing the Childcare Expenses Off Campus 11 doc requires careful attention to detail. Follow these steps:

- Collect all relevant receipts and invoices from childcare providers.

- Enter your personal information, including your name and Social Security number.

- Provide details about the childcare provider, including their name, address, and taxpayer identification number.

- List the total amount spent on childcare during the tax year.

- Review the form for accuracy and completeness.

- Sign and date the document before submission.

Key elements of the Childcare Expenses Off Campus 11 doc

The Childcare Expenses Off Campus 11 doc includes several key elements that are crucial for accurate reporting. These elements typically encompass the following:

- Provider Information: Name, address, and taxpayer identification number of the childcare provider.

- Expense Details: A breakdown of the total childcare expenses, including dates and services provided.

- Parent Information: The parent or guardian's name and Social Security number for identification purposes.

- Signature: A signature line for the parent to affirm the accuracy of the information provided.

Eligibility Criteria

To utilize the Childcare Expenses Off Campus 11 doc effectively, certain eligibility criteria must be met. Generally, the following conditions apply:

- The taxpayer must have incurred expenses for the care of a qualifying child under the age of thirteen.

- The care must enable the taxpayer to work or look for work.

- Expenses must be for care provided by a licensed childcare provider.

- The taxpayer must meet income limits set by the IRS to qualify for specific tax credits.

IRS Guidelines

IRS guidelines dictate how childcare expenses can be reported and what qualifies for deductions or credits. According to these guidelines:

- Only expenses paid for qualifying children can be claimed.

- Taxpayers must retain receipts and documentation for at least three years.

- Expenses must be reasonable and necessary for the care of the child.

- Taxpayers should consult IRS publications for detailed information on eligible expenses and filing requirements.

Quick guide on how to complete childcare expenses off campus 11 doc

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers a robust environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the features required to create, modify, and eSign your documents rapidly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The simplest way to edit and eSign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure outstanding communication at any point during the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Childcare Expenses Off Campus 11 doc

Create this form in 5 minutes!

How to create an eSignature for the childcare expenses off campus 11 doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Childcare Expenses Off Campus 11 doc?

Childcare Expenses Off Campus 11 doc refers to documentation required for claiming childcare expenses incurred while studying off-campus. This document helps students and parents manage and report these expenses effectively, ensuring they maximize their benefits.

-

How can airSlate SignNow help with Childcare Expenses Off Campus 11 doc?

airSlate SignNow simplifies the process of managing Childcare Expenses Off Campus 11 doc by allowing users to easily create, send, and eSign necessary documents. This streamlines the documentation process, making it more efficient and less time-consuming.

-

What features does airSlate SignNow offer for managing Childcare Expenses Off Campus 11 doc?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Childcare Expenses Off Campus 11 doc. These features ensure that users can manage their documents with ease and confidence.

-

Is airSlate SignNow cost-effective for handling Childcare Expenses Off Campus 11 doc?

Yes, airSlate SignNow provides a cost-effective solution for handling Childcare Expenses Off Campus 11 doc. With various pricing plans, users can choose an option that fits their budget while still accessing essential features for document management.

-

Can I integrate airSlate SignNow with other tools for Childcare Expenses Off Campus 11 doc?

Absolutely! airSlate SignNow offers integrations with various tools and platforms, making it easy to manage Childcare Expenses Off Campus 11 doc alongside your existing workflows. This flexibility enhances productivity and ensures seamless document handling.

-

What are the benefits of using airSlate SignNow for Childcare Expenses Off Campus 11 doc?

Using airSlate SignNow for Childcare Expenses Off Campus 11 doc provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Users can focus on their studies or work while airSlate SignNow takes care of the documentation process.

-

How secure is airSlate SignNow for handling Childcare Expenses Off Campus 11 doc?

airSlate SignNow prioritizes security, ensuring that all documents, including Childcare Expenses Off Campus 11 doc, are protected with advanced encryption and secure storage. Users can trust that their sensitive information is safe and confidential.

Get more for Childcare Expenses Off Campus 11 doc

Find out other Childcare Expenses Off Campus 11 doc

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online