201112 Plan Year Form

What is the 201112 Plan Year

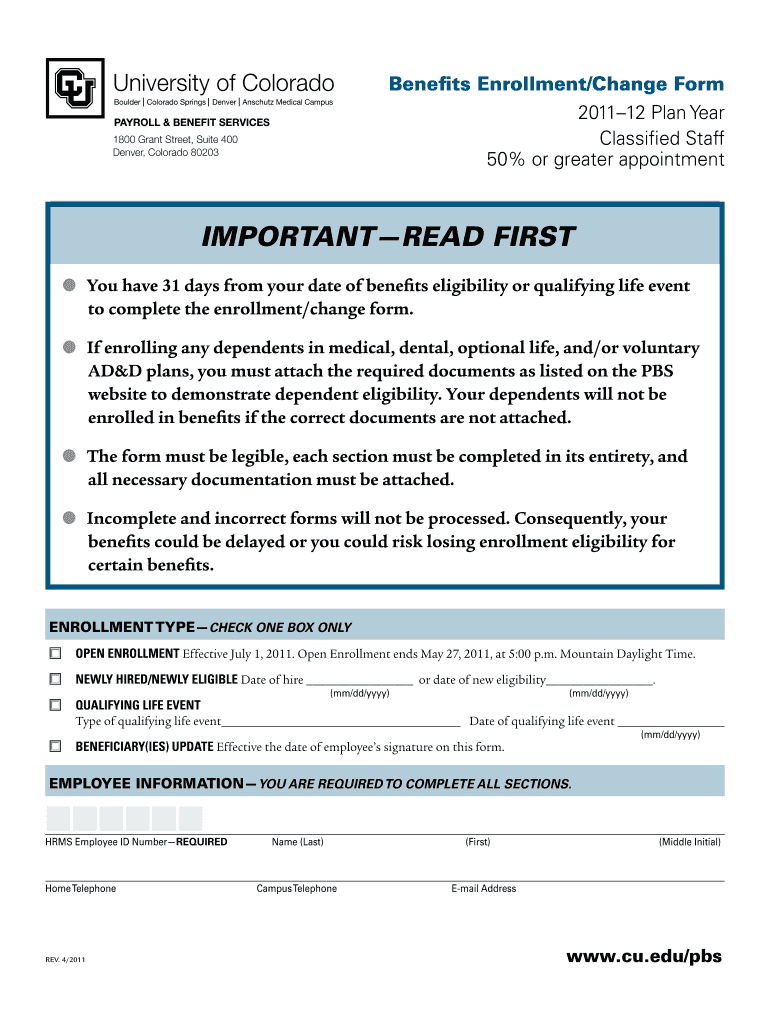

The 201112 Plan Year refers to a specific timeframe used for health insurance and benefits planning, typically covering the period from January 1, 2011, to December 31, 2011. This designation is crucial for employers and employees as it determines the eligibility and coverage options available during that year. Understanding the specifics of the 201112 Plan Year helps individuals navigate their health benefits effectively, ensuring they are aware of their rights and responsibilities under the plan.

How to use the 201112 Plan Year

Utilizing the 201112 Plan Year involves understanding the benefits and options available to you during this timeframe. Employees should review their health insurance plan documents to identify coverage details, including premiums, deductibles, and co-pays. It is also essential to keep track of any changes in employment status or family circumstances that may affect eligibility. Engaging with human resources or benefits administrators can provide clarity on how to maximize benefits during this period.

Steps to complete the 201112 Plan Year

Completing the 201112 Plan Year involves several key steps:

- Review your current health insurance coverage and benefits.

- Document any changes in personal circumstances, such as marriage or the birth of a child.

- Submit any necessary forms or documentation to your employer or benefits provider.

- Monitor your healthcare expenses and claims to ensure they align with your plan's guidelines.

- Evaluate your coverage options for the next plan year during open enrollment.

Legal use of the 201112 Plan Year

The legal use of the 201112 Plan Year is governed by federal and state regulations regarding health insurance and employee benefits. Employers must comply with the Affordable Care Act (ACA) and other relevant laws, ensuring that employees receive the necessary information about their rights and benefits. Understanding these legal frameworks helps both employers and employees navigate potential disputes or issues related to coverage and claims.

Filing Deadlines / Important Dates

Key deadlines associated with the 201112 Plan Year include:

- Open enrollment periods, typically occurring in late fall.

- Deadline for submitting claims for covered services, often within a specific timeframe after the plan year ends.

- Last date to make changes to your benefits, usually before the start of the plan year.

Staying informed about these dates is essential for ensuring compliance and maximizing benefits.

Eligibility Criteria

Eligibility for benefits during the 201112 Plan Year typically depends on several factors, including:

- Employment status (full-time vs. part-time).

- Length of service with the employer.

- Specific health plan requirements set by the employer.

Understanding these criteria helps employees determine their access to benefits and any necessary actions to maintain eligibility.

Quick guide on how to complete 201112 plan year

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and safely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and electronically sign your documents swiftly without any delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The Easiest Way to Edit and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools available to complete your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Eliminate concerns about lost or misplaced documents, burdensome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 201112 Plan Year

Create this form in 5 minutes!

How to create an eSignature for the 201112 plan year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 201112 Plan Year in relation to airSlate SignNow?

The 201112 Plan Year refers to the specific timeframe during which businesses can utilize airSlate SignNow's services for document signing and management. This plan year is crucial for organizations to align their eSigning needs with their fiscal calendar, ensuring compliance and efficiency.

-

How does airSlate SignNow pricing work for the 201112 Plan Year?

For the 201112 Plan Year, airSlate SignNow offers flexible pricing options tailored to different business sizes and needs. Customers can choose from various plans that provide access to essential features, ensuring they get the best value for their investment in eSigning solutions.

-

What features are included in the 201112 Plan Year with airSlate SignNow?

The 201112 Plan Year includes a comprehensive set of features such as document templates, real-time tracking, and secure cloud storage. These features are designed to streamline the signing process, making it easier for businesses to manage their documents efficiently.

-

What are the benefits of using airSlate SignNow during the 201112 Plan Year?

Using airSlate SignNow during the 201112 Plan Year allows businesses to enhance their workflow efficiency and reduce turnaround times for document signing. The platform's user-friendly interface and robust security measures ensure that organizations can operate smoothly while maintaining compliance.

-

Can airSlate SignNow integrate with other software during the 201112 Plan Year?

Yes, airSlate SignNow offers seamless integrations with various software applications during the 201112 Plan Year. This capability allows businesses to connect their existing tools, enhancing productivity and ensuring a cohesive workflow across different platforms.

-

Is airSlate SignNow suitable for small businesses in the 201112 Plan Year?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small businesses during the 201112 Plan Year. Its cost-effective solutions and easy-to-use interface make it an ideal choice for small enterprises looking to streamline their document signing processes.

-

How secure is airSlate SignNow for the 201112 Plan Year?

Security is a top priority for airSlate SignNow during the 201112 Plan Year. The platform employs advanced encryption and compliance with industry standards to protect sensitive information, ensuring that all documents signed through the service are secure and confidential.

Get more for 201112 Plan Year

Find out other 201112 Plan Year

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document