Completing a Basic Tax ReturnLearn About Your Taxes Form

Understanding the T1213 Request to Reduce Tax Deductions at Source

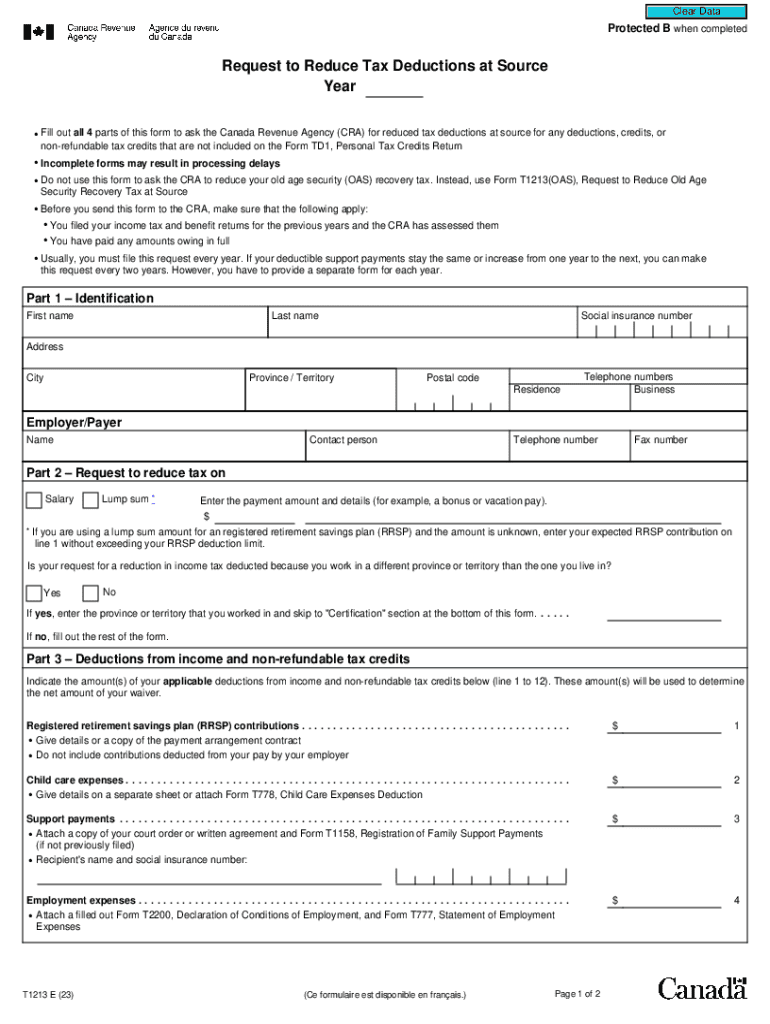

The T1213 form is a request made to the Canada Revenue Agency (CRA) to reduce the amount of tax deductions at source from your income. This form is particularly useful for individuals who may have higher deductions than necessary due to various tax credits or deductions they are eligible for. By submitting the T1213, taxpayers can ensure that they receive more of their income throughout the year rather than waiting for a refund after filing their tax return.

Eligibility Criteria for Submitting the T1213

To qualify for a reduction in tax deductions using the T1213 form, certain criteria must be met. Individuals typically eligible include those who:

- Expect to claim significant deductions or credits that will reduce their taxable income.

- Have a consistent income level that allows for predictable tax calculations.

- Are not currently in a situation where they owe back taxes or have outstanding tax liabilities.

Steps to Complete the T1213 Form

Filling out the T1213 form involves several key steps:

- Gather necessary documents, including proof of deductions or credits you plan to claim.

- Complete the form accurately, ensuring all personal information is correct.

- Attach any supporting documentation that may help substantiate your request.

- Submit the form to the CRA either by mail or through their online services, if applicable.

Required Documents for Submission

When submitting the T1213 form, it's essential to include specific documents to support your request. These may include:

- Proof of eligibility for deductions, such as receipts or statements.

- Any previous tax returns that demonstrate your income and deduction history.

- Documentation related to any changes in your financial situation that justify the request.

Form Submission Methods

The T1213 form can be submitted to the CRA through various methods:

- By mail, using the address specified on the form.

- Electronically, if you are registered for CRA’s online services.

Ensure that you keep a copy of the submitted form and any supporting documents for your records.

IRS Guidelines for Tax Deductions

While the T1213 form is specific to Canada, understanding IRS guidelines can be beneficial for U.S. taxpayers. The IRS provides regulations on tax deductions that may influence how you manage your tax withholdings. Familiarizing yourself with these guidelines can help you make informed decisions regarding your tax situation.

Common Scenarios for T1213 Usage

The T1213 form is often used in various taxpayer scenarios, including:

- Self-employed individuals who have significant business expenses.

- Employees with substantial deductions for things like childcare or medical expenses.

- Individuals nearing retirement who may have changes in income or expenses.

Understanding these scenarios can help you determine if submitting a T1213 is appropriate for your financial situation.

Quick guide on how to complete completing a basic tax returnlearn about your taxes

Effortlessly Prepare Completing A Basic Tax ReturnLearn About Your Taxes on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents quickly without delays. Manage Completing A Basic Tax ReturnLearn About Your Taxes on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centered procedure today.

How to Alter and Electronically Sign Completing A Basic Tax ReturnLearn About Your Taxes with Ease

- Find Completing A Basic Tax ReturnLearn About Your Taxes and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight necessary sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to distribute your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Completing A Basic Tax ReturnLearn About Your Taxes and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the completing a basic tax returnlearn about your taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a t1213 request to reduce tax deductions at source?

A t1213 request to reduce tax deductions at source is a form submitted to the Canada Revenue Agency (CRA) to request a reduction in the amount of tax withheld from your income. This request is typically made by individuals who expect to have a lower tax liability for the year. By submitting this form, you can keep more of your earnings throughout the year instead of waiting for a tax refund.

-

How can airSlate SignNow help with my t1213 request to reduce tax deductions at source?

airSlate SignNow provides a seamless platform for electronically signing and sending your t1213 request to reduce tax deductions at source. Our user-friendly interface ensures that you can complete and submit your documents quickly and securely, making the process hassle-free.

-

What features does airSlate SignNow offer for managing tax-related documents?

With airSlate SignNow, you can easily create, edit, and eSign your tax-related documents, including the t1213 request to reduce tax deductions at source. Our platform offers templates, document tracking, and secure storage, ensuring that your sensitive information is protected while being easily accessible.

-

Is there a cost associated with using airSlate SignNow for my t1213 request?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective, allowing you to manage your t1213 request to reduce tax deductions at source without breaking the bank. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for my tax documents?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow for managing tax documents. Whether you use accounting software or customer relationship management tools, our integrations can help streamline the process of submitting your t1213 request to reduce tax deductions at source.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for your tax document management, including the t1213 request to reduce tax deductions at source, offers numerous benefits. You gain efficiency through electronic signatures, reduce paper waste, and ensure compliance with legal standards. Additionally, our platform provides real-time updates and notifications, keeping you informed throughout the process.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive tax documents, including the t1213 request to reduce tax deductions at source. Our platform is compliant with industry standards, ensuring that your information remains confidential and secure.

Get more for Completing A Basic Tax ReturnLearn About Your Taxes

- Al rajhi bank application form

- Allen university transcript request form

- I wonder poem worksheet form

- Ferpa acknowledgement form the university of west georgia westga

- Piaa pole vault verification form

- Alaska assistance gen50 c form

- Assistance with your application ny state of health form

- Construction partnership agreement template form

Find out other Completing A Basic Tax ReturnLearn About Your Taxes

- Sign Tennessee Joint Venture Agreement Template Free

- How Can I Sign South Dakota Budget Proposal Template

- Can I Sign West Virginia Budget Proposal Template

- Sign Alaska Debt Settlement Agreement Template Free

- Help Me With Sign Alaska Debt Settlement Agreement Template

- How Do I Sign Colorado Debt Settlement Agreement Template

- Can I Sign Connecticut Stock Purchase Agreement Template

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template