Ford Federal Direct Parent Loan PLUS University of Morris Umn Form

What is the Ford Federal Direct Parent Loan PLUS University Of Morris Umn

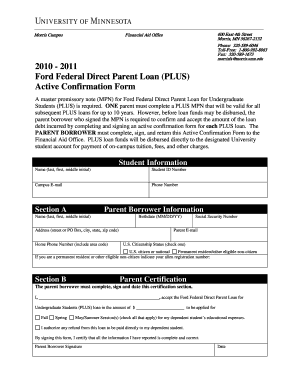

The Ford Federal Direct Parent Loan PLUS for the University of Morris (UMN) is a federal loan program designed to help parents of dependent undergraduate students cover the costs of their child's education. This loan allows parents to borrow funds to pay for tuition, room and board, and other educational expenses. The PLUS loan is a credit-based loan, meaning eligibility is determined by the borrower's credit history. It is important for parents to understand the terms, interest rates, and repayment options associated with this loan to make informed financial decisions.

How to obtain the Ford Federal Direct Parent Loan PLUS University Of Morris Umn

To obtain the Ford Federal Direct Parent Loan PLUS, parents must complete the application process through the Federal Student Aid website. This involves filling out the Free Application for Federal Student Aid (FAFSA) to determine eligibility for federal aid. Once the FAFSA is processed, parents can apply for the PLUS loan directly. They will need to provide personal information, including their Social Security number, and may be required to undergo a credit check. If approved, parents will receive a loan agreement that outlines the terms and conditions of the loan.

Steps to complete the Ford Federal Direct Parent Loan PLUS University Of Morris Umn

Completing the Ford Federal Direct Parent Loan PLUS involves several key steps:

- Complete the FAFSA: Ensure that your child has submitted their FAFSA to the University of Morris.

- Apply for the PLUS loan: Access the application on the Federal Student Aid website.

- Provide required information: Fill in your personal details, including financial information and Social Security number.

- Credit check: Undergo a credit check to determine eligibility.

- Review loan agreement: If approved, carefully review the loan agreement and terms.

- Complete entrance counseling: Parents may need to complete counseling to understand their responsibilities.

- Sign the Master Promissory Note: This legally binds you to the loan's terms.

Key elements of the Ford Federal Direct Parent Loan PLUS University Of Morris Umn

Several key elements define the Ford Federal Direct Parent Loan PLUS:

- Interest Rate: The loan has a fixed interest rate that is set annually by the federal government.

- Loan Limits: Parents can borrow up to the total cost of attendance minus any other financial aid received by the student.

- Repayment Terms: Repayment typically begins within 60 days after the loan is fully disbursed, with various repayment plans available.

- Credit Requirements: A credit check is required, but parents with adverse credit may still be eligible with an endorser.

Eligibility Criteria

To be eligible for the Ford Federal Direct Parent Loan PLUS, parents must meet specific criteria:

- Be the biological or adoptive parent of a dependent undergraduate student.

- The student must be enrolled at least half-time at the University of Morris.

- Complete the FAFSA to determine eligibility for federal student aid.

- Pass a credit check, which assesses the borrower's credit history.

Application Process & Approval Time

The application process for the Ford Federal Direct Parent Loan PLUS is straightforward:

- Complete the FAFSA to establish the student's eligibility for federal aid.

- Access the PLUS loan application online and provide the required information.

- Undergo a credit check, which typically takes a few minutes.

- If approved, review and sign the loan agreement, which may take an additional few days.

Overall, the entire process from application to approval can take anywhere from a few days to several weeks, depending on the completeness of the application and the timeliness of the required documentation.

Quick guide on how to complete ford federal direct parent loan plus university of morris umn

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the necessary forms and securely keep them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] across any device with airSlate SignNow's Android or iOS applications and enhance your document-focused processes today.

The Easiest Way to Alter and Electronically Sign [SKS]

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize essential sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and electronically sign [SKS] to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Ford Federal Direct Parent Loan PLUS University Of Morris Umn

Create this form in 5 minutes!

How to create an eSignature for the ford federal direct parent loan plus university of morris umn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn?

The Ford Federal Direct Parent Loan PLUS for University Of Morris Umn is a federal loan program that allows parents of dependent undergraduate students to borrow funds to help cover educational expenses. This loan can help bridge the gap between financial aid and the total cost of attendance, making it easier for families to manage educational costs.

-

What are the eligibility requirements for the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn?

To be eligible for the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn, parents must be the biological or adoptive parents of a dependent student enrolled at the university. Additionally, they must pass a credit check and meet other federal requirements, ensuring they can responsibly manage the loan.

-

How much can I borrow with the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn?

Parents can borrow up to the total cost of attendance at the University Of Morris Umn, minus any other financial aid received. This means that the loan amount can vary based on the student's specific educational expenses, allowing families to cover tuition, room and board, and other related costs.

-

What are the interest rates for the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn?

The interest rates for the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn are set by the federal government and can change annually. As of the latest updates, the rates are fixed, providing predictability in repayment. It's important to check the current rates before applying to ensure you have the most accurate information.

-

What are the repayment options for the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn?

Repayment options for the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn include standard, graduated, and extended repayment plans. Parents can choose a plan that best fits their financial situation, with the option to defer payments while the student is enrolled at least half-time, providing flexibility during the repayment period.

-

Are there any benefits to using the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn?

Yes, the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn offers several benefits, including fixed interest rates and flexible repayment options. Additionally, parents may qualify for deferment while their child is in school, making it easier to manage finances during this time. This loan can also help build credit history when managed responsibly.

-

How does the Ford Federal Direct Parent Loan PLUS for University Of Morris Umn integrate with other financial aid?

The Ford Federal Direct Parent Loan PLUS for University Of Morris Umn can be used in conjunction with other forms of financial aid, such as grants and scholarships. This integration allows families to cover the full cost of education while minimizing out-of-pocket expenses. It's essential to coordinate with the university's financial aid office to ensure all funding sources are utilized effectively.

Get more for Ford Federal Direct Parent Loan PLUS University Of Morris Umn

Find out other Ford Federal Direct Parent Loan PLUS University Of Morris Umn

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now