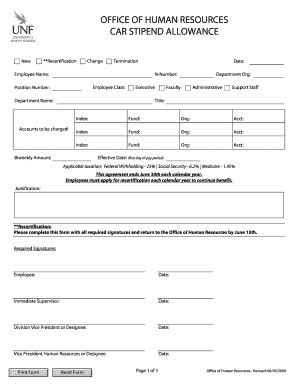

OFFICE of HUMAN RESOURCES CAR STIPEND ALLOWANCE Form

Understanding the Office of Human Resources Car Stipend Allowance

The Office of Human Resources Car Stipend Allowance is a financial benefit provided to employees to assist with vehicle-related expenses incurred while performing job duties. This stipend is designed to cover costs such as fuel, maintenance, and insurance, making it easier for employees to manage transportation needs. It is important for employees to understand the specifics of this allowance, including eligibility criteria and how it fits within their compensation package.

Eligibility Criteria for the Car Stipend Allowance

To qualify for the Office of Human Resources Car Stipend Allowance, employees typically need to meet certain criteria. These may include:

- Full-time employment status

- Job responsibilities that require regular travel or use of a personal vehicle

- Compliance with company policies regarding vehicle use

It is advisable for employees to consult their HR department for specific eligibility requirements, as these can vary by organization.

Steps to Obtain the Car Stipend Allowance

Obtaining the Office of Human Resources Car Stipend Allowance generally involves a straightforward process. Employees should follow these steps:

- Review the eligibility criteria to ensure qualification.

- Complete the required application form, which may include details about job responsibilities and vehicle usage.

- Submit the application to the HR department for review and approval.

- Once approved, the stipend will be included in the employee's compensation package.

Timely submission of the application is crucial to avoid delays in receiving the stipend.

Legal Use of the Car Stipend Allowance

Employees must adhere to legal guidelines when using the Office of Human Resources Car Stipend Allowance. This includes using the stipend solely for work-related vehicle expenses. Misuse of the allowance can lead to penalties, including repayment of the stipend or disciplinary action. Employees should keep accurate records of expenses to ensure compliance with company policies and IRS regulations.

Examples of Using the Car Stipend Allowance

Understanding how to effectively utilize the Office of Human Resources Car Stipend Allowance can enhance its benefits. Common examples include:

- Using the stipend to cover fuel costs for business travel.

- Applying the allowance towards regular vehicle maintenance, such as oil changes and tire rotations.

- Utilizing funds for insurance premiums related to the vehicle used for work purposes.

These examples illustrate how the stipend can alleviate financial burdens associated with vehicle use in a professional context.

Required Documents for the Car Stipend Allowance

When applying for the Office of Human Resources Car Stipend Allowance, employees may need to provide specific documentation. Required documents often include:

- Proof of vehicle ownership or lease agreement

- Documentation of insurance coverage

- Records of vehicle-related expenses, such as receipts for fuel and maintenance

Having these documents ready can streamline the application process and facilitate approval.

Quick guide on how to complete average vehicle stipend

Complete average vehicle stipend effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Manage average vehicle stipend on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign average vehicle stipend with ease

- Locate average vehicle stipend and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure private information with tools specifically designed for that purpose by airSlate SignNow.

- Form your eSignature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign average vehicle stipend and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to average vehicle stipend

Create this form in 5 minutes!

How to create an eSignature for the average vehicle stipend

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask average vehicle stipend

-

What is the average vehicle stipend offered by companies?

The average vehicle stipend varies by company and location, but it typically ranges from $300 to $800 per month. This stipend is designed to cover expenses related to vehicle maintenance, fuel, and insurance. Understanding the average vehicle stipend can help employees negotiate better compensation packages.

-

How can airSlate SignNow help manage vehicle stipend documentation?

airSlate SignNow simplifies the process of managing vehicle stipend documentation by allowing businesses to create, send, and eSign necessary forms quickly. This ensures that all vehicle stipend agreements are securely stored and easily accessible. With our platform, you can streamline the approval process for vehicle stipends.

-

What features does airSlate SignNow offer for vehicle stipend agreements?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning for vehicle stipend agreements. These features help businesses save time and reduce errors in the documentation process. By utilizing these tools, companies can efficiently manage their average vehicle stipend agreements.

-

Are there any integrations available for managing vehicle stipends?

Yes, airSlate SignNow integrates with various HR and payroll systems to help manage vehicle stipends seamlessly. These integrations allow for automatic updates and tracking of stipend payments. By connecting your existing systems, you can ensure that your average vehicle stipend processes are efficient and accurate.

-

What are the benefits of using airSlate SignNow for vehicle stipends?

Using airSlate SignNow for vehicle stipends offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and easy document management, which can save businesses time and resources. This ultimately leads to a smoother process for handling the average vehicle stipend.

-

How does airSlate SignNow ensure the security of vehicle stipend documents?

airSlate SignNow prioritizes the security of all documents, including vehicle stipend agreements, by employing advanced encryption and secure storage solutions. This ensures that sensitive information remains protected throughout the signing process. Businesses can trust that their average vehicle stipend documentation is safe with us.

-

Can I customize vehicle stipend agreements using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize vehicle stipend agreements to fit their specific needs. You can modify templates, add company branding, and include specific terms related to the average vehicle stipend. This flexibility ensures that your agreements align with your business policies.

Get more for average vehicle stipend

Find out other average vehicle stipend

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form