Hawaii Tax Online G45 2018-2026

What is the Hawaii Tax Online G45

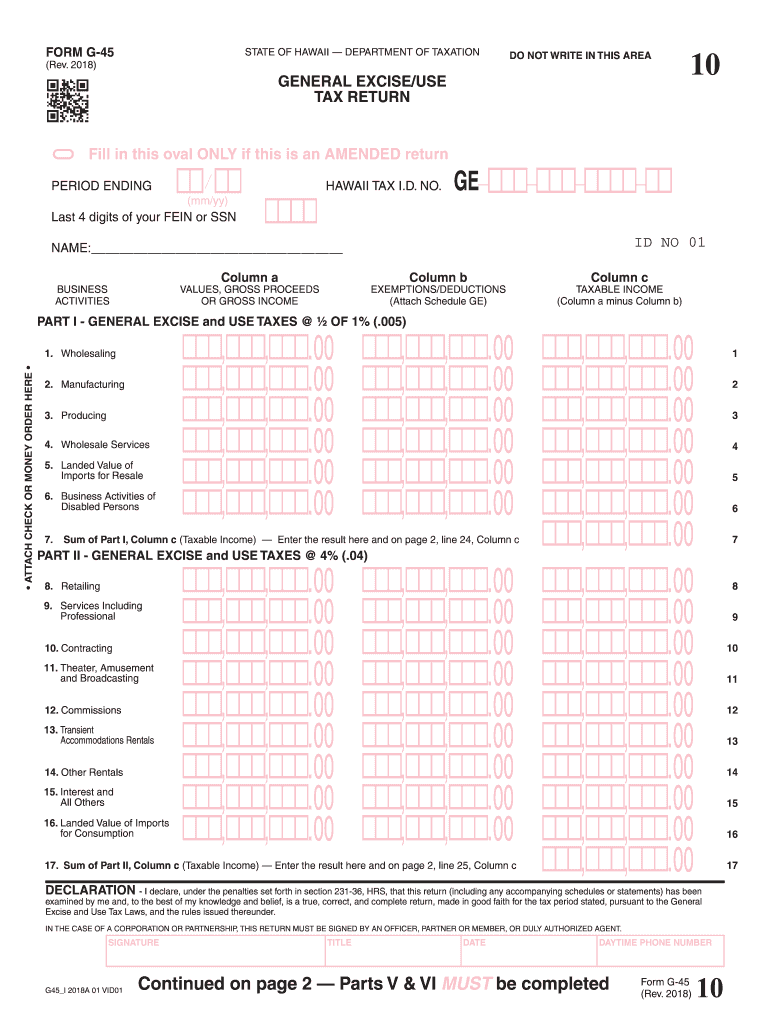

The Hawaii Tax Online G45 is a tax form used by businesses to report and pay the state's general excise tax (GET). This form is essential for entities engaged in business activities within Hawaii, as it helps ensure compliance with state tax regulations. The G45 form is typically filed quarterly, allowing businesses to report their gross income and calculate the appropriate tax owed to the state. Understanding the purpose and requirements of the G45 is crucial for maintaining good standing with the Hawaii Department of Taxation.

Steps to complete the Hawaii Tax Online G45

Completing the Hawaii Tax Online G45 involves several key steps:

- Gather necessary information: Collect your business's financial records, including gross income, deductions, and any applicable exemptions.

- Access the online form: Use the Hawaii Department of Taxation's online portal to access the G45 form.

- Fill out the form: Enter your business details, including your tax identification number and the total gross income for the reporting period.

- Calculate the tax owed: Use the provided tax rates to determine the amount of general excise tax due based on your gross income.

- Review and submit: Double-check all entries for accuracy before submitting the form electronically.

Legal use of the Hawaii Tax Online G45

The Hawaii Tax Online G45 is legally recognized as a valid document for reporting general excise tax. To ensure its legal standing, businesses must adhere to specific guidelines set forth by the Hawaii Department of Taxation. This includes providing accurate information, filing within the designated deadlines, and maintaining compliance with state tax laws. Electronic submissions through authorized platforms are also considered legally binding, provided they meet the necessary requirements for electronic signatures.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii Tax Online G45 are crucial for compliance. Generally, the G45 must be filed quarterly, with specific due dates:

- First Quarter: Due on April 20

- Second Quarter: Due on July 20

- Third Quarter: Due on October 20

- Fourth Quarter: Due on January 20 of the following year

It is essential for businesses to adhere to these deadlines to avoid penalties and interest on late payments.

Required Documents

When preparing to complete the Hawaii Tax Online G45, certain documents are necessary to ensure accurate reporting:

- Financial records: Detailed records of gross income, including sales receipts and invoices.

- Previous tax returns: Copies of prior G45 filings can provide a reference for current reporting.

- Exemption certificates: If applicable, documentation supporting any claimed exemptions from the general excise tax.

Having these documents readily available can streamline the completion process and help ensure compliance with state regulations.

Who Issues the Form

The Hawaii Tax Online G45 is issued by the Hawaii Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among businesses operating within Hawaii. The department provides resources and guidelines to assist businesses in understanding their tax obligations, including the proper completion and submission of the G45 form.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Hawaii Tax Online G45 can result in significant penalties. Businesses may face:

- Late filing penalties: A percentage of the unpaid tax amount for each month the form is late.

- Interest charges: Accrued interest on any unpaid tax balance, calculated from the due date until payment is made.

- Potential audits: Non-compliance may trigger an audit by the Hawaii Department of Taxation, leading to further scrutiny of business practices.

To avoid these consequences, it is important for businesses to stay informed about their filing obligations and deadlines.

Quick guide on how to complete form g 45 periodic general exciseuse tax return rev 2018

Complete Hawaii Tax Online G45 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely keep it online. airSlate SignNow provides all the resources you need to create, edit, and eSign your documents swiftly without delays. Manage Hawaii Tax Online G45 on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to edit and eSign Hawaii Tax Online G45 seamlessly

- Locate Hawaii Tax Online G45 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to submit your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your needs in document management with just a few clicks from any device you choose. Edit and eSign Hawaii Tax Online G45 and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form g 45 periodic general exciseuse tax return rev 2018

How to generate an electronic signature for your Form G 45 Periodic General Exciseuse Tax Return Rev 2018 online

How to generate an eSignature for the Form G 45 Periodic General Exciseuse Tax Return Rev 2018 in Chrome

How to make an electronic signature for putting it on the Form G 45 Periodic General Exciseuse Tax Return Rev 2018 in Gmail

How to create an eSignature for the Form G 45 Periodic General Exciseuse Tax Return Rev 2018 straight from your smartphone

How to create an eSignature for the Form G 45 Periodic General Exciseuse Tax Return Rev 2018 on iOS devices

How to make an electronic signature for the Form G 45 Periodic General Exciseuse Tax Return Rev 2018 on Android OS

People also ask

-

What is the Hawaii Tax Online G45 and how does it work?

The Hawaii Tax Online G45 is an electronic filing solution for businesses required to file their General Excise Tax (GET) returns. It simplifies the process by allowing users to complete and submit their G45 forms online. With airSlate SignNow, you can easily manage your documents and ensure timely submissions while complying with Hawaii state tax regulations.

-

How much does it cost to use airSlate SignNow for Hawaii Tax Online G45?

Pricing for using airSlate SignNow for Hawaii Tax Online G45 varies based on the subscription plan you choose. Our plans are designed to be cost-effective, enabling you to pick a package that fits your business needs. With features tailored for efficient document management, our service offers excellent value for users looking to simplify their tax filing.

-

What features does airSlate SignNow offer for the Hawaii Tax Online G45?

airSlate SignNow provides several features to streamline your Hawaii Tax Online G45 filings. These include customizable templates for G45 forms, integration with your accounting tools, and eSignature capabilities for quick approvals. Together, these features ensure that the process of filing your taxes is efficient and less stressful.

-

Can I integrate airSlate SignNow with other software for my Hawaii tax filings?

Yes, airSlate SignNow seamlessly integrates with various accounting and financial software to enhance your Hawaii Tax Online G45 experience. By linking your existing tools with our platform, you can easily import data and manage documents in one place. This integration saves you time and reduces the chance of errors when filing your taxes.

-

Is it safe to use airSlate SignNow for filing the Hawaii Tax Online G45?

Absolutely! airSlate SignNow prioritizes the security of your documents and sensitive tax information. Our platform employs advanced encryption protocols and secure storage solutions, ensuring your data remains protected during and after the filing of the Hawaii Tax Online G45. You can eSign and manage your tax documents confidently with us.

-

How can airSlate SignNow help reduce time spent on Hawaii Tax Online G45?

Using airSlate SignNow for Hawaii Tax Online G45 can signNowly reduce the time you spend preparing and filing your taxes. With its user-friendly interface, automated workflows, and easy-to-complete templates, you can quickly gather and submit your tax information. This efficiency allows you to focus more on your business operations rather than paperwork.

-

What support options are available for using airSlate SignNow with Hawaii Tax Online G45?

airSlate SignNow provides comprehensive support options for users filing their Hawaii Tax Online G45. Our customer service team is available via chat, email, and phone to assist you with any questions or concerns. Additionally, we provide detailed resources and tutorials to help you navigate the platform and maximize its features.

Get more for Hawaii Tax Online G45

- Banner health medical exemption form influenza

- Proof of loss claim statement loyola university chicago form

- Spine history form

- Here is a helpful list of resources for valid health form

- Trinity lutheran church youth group information and trinitycamphill

- Pdf authorization for use or disclosure of health information providence

- Medical information request form

- Pdf hepatic pathology additional information request form

Find out other Hawaii Tax Online G45

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy