Credit Union Wire Transfer Form

What is the Credit Union Wire Transfer Form

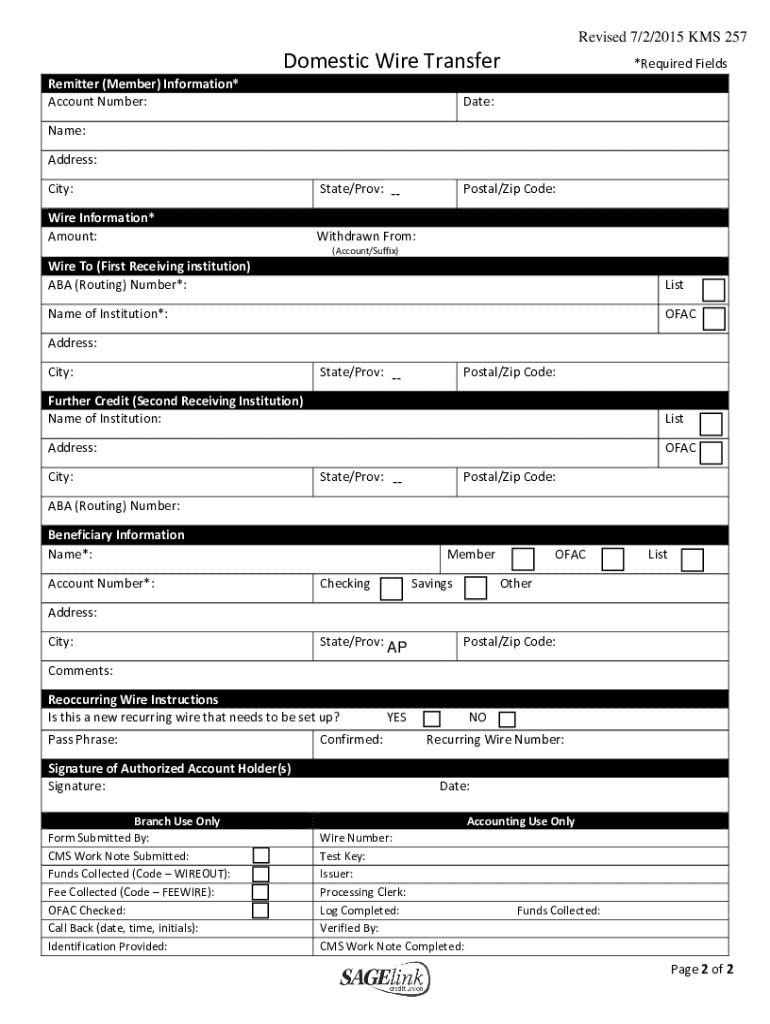

The credit union wire transfer form is a document that allows members of a credit union to initiate a wire transfer of funds from their account to another financial institution. This form typically includes essential details such as the sender's information, recipient's information, and the amount to be transferred. It serves as a formal request to process the transaction and ensures that all necessary information is accurately captured to facilitate a smooth transfer.

How to use the Credit Union Wire Transfer Form

To use the credit union wire transfer form, members should first obtain the form from their credit union, either online or in person. Once the form is in hand, members need to fill it out with accurate details, including their account number, the recipient's bank information, and the transfer amount. After completing the form, members should review it for any errors before submitting it to their credit union for processing. This process helps ensure that funds are transferred correctly and efficiently.

Steps to complete the Credit Union Wire Transfer Form

Completing the credit union wire transfer form involves several key steps:

- Obtain the form from your credit union.

- Fill in your personal information, including your name, account number, and contact details.

- Provide the recipient's information, including their name, bank name, account number, and routing number.

- Indicate the amount you wish to transfer.

- Review the completed form for accuracy.

- Submit the form to your credit union, either in person or through their designated submission method.

Key elements of the Credit Union Wire Transfer Form

The credit union wire transfer form contains several key elements that are crucial for processing the transfer. These include:

- Sender Information: This includes the sender's name, account number, and contact information.

- Recipient Information: Details about the recipient, such as their name, bank name, account number, and routing number.

- Transfer Amount: The specific amount of money being sent.

- Purpose of Transfer: Some forms may require a brief description of the reason for the transfer.

Legal use of the Credit Union Wire Transfer Form

The credit union wire transfer form is legally binding once submitted and processed by the credit union. It is important for members to ensure that all information is accurate and truthful, as any discrepancies can lead to delays or issues with the transfer. Additionally, members should be aware of any fees associated with wire transfers, as these can vary by institution and may affect the total amount sent.

Form Submission Methods

Members can submit the credit union wire transfer form through various methods, depending on their credit union's policies. Common submission methods include:

- In-Person: Delivering the completed form directly to a credit union branch.

- Online: Submitting the form through the credit union's secure online banking platform, if available.

- Mail: Sending the completed form via postal mail to the designated address provided by the credit union.

Quick guide on how to complete credit union wire transfer form

Effortlessly Prepare Credit Union Wire Transfer Form on Any Device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Manage Credit Union Wire Transfer Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Simplest Way to Edit and Electronically Sign Credit Union Wire Transfer Form with Ease

- Find Credit Union Wire Transfer Form and click on Obtain Form to get started.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Finish button to save your changes.

- Choose how you wish to send your form, via email, SMS, invite link, or download it to your computer.

Forget about misplaced or lost documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Credit Union Wire Transfer Form and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit union wire transfer form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a credit union wire transfer form?

A credit union wire transfer form is a document used to initiate a wire transfer between accounts at credit unions. This form typically includes details such as the sender's and recipient's information, account numbers, and the amount to be transferred. Using airSlate SignNow, you can easily create and eSign this form, streamlining the transfer process.

-

How can I create a credit union wire transfer form using airSlate SignNow?

Creating a credit union wire transfer form with airSlate SignNow is simple. You can start by selecting a template or creating a new document from scratch. Our platform allows you to customize the form, add necessary fields, and eSign it securely, making the process efficient and user-friendly.

-

What are the benefits of using airSlate SignNow for credit union wire transfer forms?

Using airSlate SignNow for credit union wire transfer forms offers several benefits, including enhanced security, ease of use, and cost-effectiveness. You can quickly send and receive signed documents, reducing the time spent on paperwork. Additionally, our platform ensures that your sensitive information is protected throughout the process.

-

Are there any costs associated with using airSlate SignNow for credit union wire transfer forms?

airSlate SignNow offers various pricing plans to suit different business needs, including options for creating credit union wire transfer forms. While there may be a subscription fee, the cost is often outweighed by the time and resources saved through our efficient eSigning process. Check our website for detailed pricing information.

-

Can I integrate airSlate SignNow with other applications for credit union wire transfer forms?

Yes, airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow for credit union wire transfer forms. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to manage your documents more effectively. This integration capability enhances productivity and ensures seamless document handling.

-

Is it easy to eSign a credit union wire transfer form with airSlate SignNow?

Absolutely! eSigning a credit union wire transfer form with airSlate SignNow is straightforward. Users can sign documents electronically from any device, making it convenient to complete transactions quickly. The intuitive interface guides you through the signing process, ensuring a hassle-free experience.

-

What security measures does airSlate SignNow implement for credit union wire transfer forms?

airSlate SignNow prioritizes security for all documents, including credit union wire transfer forms. We utilize advanced encryption protocols and secure servers to protect your data. Additionally, our platform complies with industry standards to ensure that your sensitive information remains confidential and secure.

Get more for Credit Union Wire Transfer Form

Find out other Credit Union Wire Transfer Form

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple