Lender Title Request Form

What is the Lender Title Request Form

The lender title request form is a crucial document used in real estate transactions. It serves as a formal request to obtain the title information of a property from the relevant title company or agency. This form is typically utilized by lenders, real estate agents, and other parties involved in the financing process. By providing essential details about the property and the parties involved, the form facilitates the verification of ownership and any existing liens or encumbrances against the property.

How to use the Lender Title Request Form

Using the lender title request form involves several straightforward steps. First, ensure that all required fields are filled out accurately. This includes information about the property, such as the address and legal description, as well as the contact details of the requesting party. Once completed, the form can be submitted to the title company via mail, email, or through an online submission portal, depending on the title company’s preferred method. It is important to keep a copy of the submitted form for your records.

Steps to complete the Lender Title Request Form

Completing the lender title request form requires attention to detail. Begin by gathering all necessary information regarding the property and the parties involved. Follow these steps:

- Enter the property address, including city, state, and zip code.

- Provide the legal description of the property, which can usually be found on the current deed.

- Include the contact information of the lender or agent requesting the title information.

- Specify the purpose of the request, such as a mortgage application or refinancing.

- Review the form for accuracy and completeness before submission.

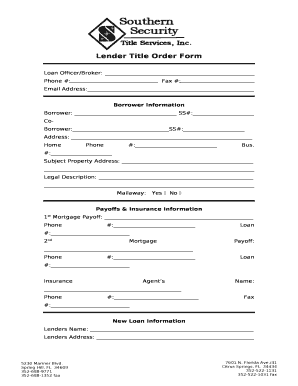

Key elements of the Lender Title Request Form

Several key elements are essential for the lender title request form to be effective. These include:

- Property Information: Accurate details about the property, including its address and legal description.

- Requestor Information: Contact details of the individual or organization submitting the request.

- Purpose of Request: A clear indication of why the title information is needed.

- Signature: The form may require a signature from the requestor to validate the request.

Form Submission Methods

The lender title request form can typically be submitted through various methods, depending on the title company's preferences. Common submission methods include:

- Online Submission: Many title companies offer online portals for submitting requests.

- Email: The completed form can be sent as an attachment via email.

- Mail: A physical copy of the form can be mailed to the title company.

- In-Person: Some requestors may choose to deliver the form directly to the title company.

Legal use of the Lender Title Request Form

The lender title request form is legally significant in real estate transactions. It ensures that lenders and other parties have access to accurate title information, which is essential for assessing property value and ownership rights. Proper use of this form can help prevent disputes over property ownership and ensure compliance with legal requirements during the lending process. It is advisable to consult with legal professionals if there are any uncertainties regarding the form's use.

Quick guide on how to complete lender title request form

Complete Lender Title Request Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Lender Title Request Form across any platform using airSlate SignNow’s Android or iOS applications and simplify your document-centric workflows today.

The easiest way to modify and eSign Lender Title Request Form seamlessly

- Locate Lender Title Request Form and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Select pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow supplies specifically for that reason.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Lender Title Request Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the lender title request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a lender title request form?

A lender title request form is a document used by lenders to request the title information of a property. This form is essential for ensuring that the title is clear and free of any liens or encumbrances before finalizing a loan. Using airSlate SignNow, you can easily create and manage your lender title request forms digitally.

-

How does airSlate SignNow simplify the lender title request form process?

airSlate SignNow streamlines the lender title request form process by allowing users to create, send, and eSign documents quickly and efficiently. Our platform eliminates the need for paper forms and manual signatures, saving time and reducing errors. With our user-friendly interface, you can manage all your title requests in one place.

-

What are the pricing options for using airSlate SignNow for lender title request forms?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can choose from monthly or annual subscriptions, with options that include features specifically designed for managing lender title request forms. Visit our pricing page to find the plan that best fits your needs.

-

Can I integrate airSlate SignNow with other tools for managing lender title request forms?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing your workflow for lender title request forms. You can connect with CRM systems, document management tools, and more to streamline your processes. This integration capability ensures that you can manage all aspects of your title requests efficiently.

-

What are the benefits of using airSlate SignNow for lender title request forms?

Using airSlate SignNow for lender title request forms offers numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. Our platform ensures that your documents are stored securely and can be accessed anytime, anywhere. Additionally, eSigning eliminates the delays associated with traditional paper methods.

-

Is airSlate SignNow compliant with industry regulations for lender title request forms?

Absolutely! airSlate SignNow is designed to comply with industry regulations, ensuring that your lender title request forms meet all necessary legal requirements. Our platform adheres to security standards and provides audit trails for all signed documents, giving you peace of mind regarding compliance.

-

How can I track the status of my lender title request forms in airSlate SignNow?

With airSlate SignNow, you can easily track the status of your lender title request forms in real-time. Our dashboard provides updates on who has viewed, signed, or completed the document, allowing you to stay informed throughout the process. This feature helps you manage your requests more effectively.

Get more for Lender Title Request Form

- Revenuekygovforms62a300062a3000 4 20 original to ky department of revenue

- Revenuekygovforms62a500 wcommonwealth of kentucky tangible personal t property tax

- Pdf 4317 mail in driver license application missouri department of form

- 740ext 2020 form commonwealth of kentucky extension of

- Form 1937 missouri fill online printable fillable

- 2021 amended quarterly withholding form boone county ky

- 2020 kentucky individual income tax forms

- Or security manager must complete form

Find out other Lender Title Request Form

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online