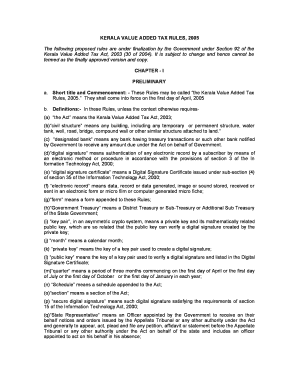

KERALA VALUE ADDED TAX RULES, Form

Understanding the Kerala Value Added Tax Rules

The Kerala Value Added Tax Rules outline the framework for the collection and management of value-added tax in the state of Kerala, India. This tax is levied on the sale of goods and services, ensuring that businesses contribute to state revenue. The rules provide detailed guidance on tax rates, exemptions, and compliance requirements, making it essential for businesses operating in Kerala to familiarize themselves with these regulations.

Key Elements of the Kerala Value Added Tax Rules

Several key elements define the Kerala Value Added Tax Rules, including:

- Tax Rates: The rules specify different tax rates applicable to various categories of goods and services.

- Registration Requirements: Businesses must register for VAT if their turnover exceeds a certain threshold.

- Filing Requirements: Regular filing of returns is mandatory, detailing sales, purchases, and tax collected.

- Exemptions and Deductions: Certain goods and services may be exempt from VAT or eligible for deductions.

Steps to Comply with Kerala Value Added Tax Rules

To ensure compliance with the Kerala Value Added Tax Rules, businesses should follow these steps:

- Register for VAT: Complete the registration process with the state tax department.

- Maintain Accurate Records: Keep detailed records of all transactions, including sales and purchases.

- File Returns Timely: Submit VAT returns within the specified deadlines to avoid penalties.

- Stay Informed: Regularly review any updates to the VAT rules to remain compliant.

Examples of Using the Kerala Value Added Tax Rules

Understanding practical applications of the Kerala Value Added Tax Rules can help businesses navigate compliance effectively. For instance:

- A retailer selling electronic goods must apply the appropriate VAT rate on each sale and ensure proper documentation for tax returns.

- A service provider in the hospitality sector must determine if their services are exempt from VAT and maintain records accordingly.

Legal Use of the Kerala Value Added Tax Rules

The legal framework surrounding the Kerala Value Added Tax Rules ensures that businesses adhere to tax obligations. Non-compliance can lead to penalties, including fines and interest on unpaid taxes. Understanding the legal implications is crucial for business owners to mitigate risks and ensure smooth operations.

Filing Deadlines and Important Dates

Businesses must be aware of critical deadlines related to the Kerala Value Added Tax Rules. Key dates include:

- Quarterly filing deadlines for VAT returns.

- Annual return submission deadlines.

- Dates for any amendments or corrections to previously filed returns.

Required Documents for Compliance

To comply with the Kerala Value Added Tax Rules, businesses need to prepare several documents, including:

- VAT registration certificate.

- Invoices for sales and purchases.

- Records of tax collected and paid.

- Previous VAT returns for reference.

Quick guide on how to complete kerala value added tax rules

Effortlessly Prepare [SKS] on Any Gadget

The use of online document management has surged in popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and store it securely online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without hassles. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications, and streamline your document-related tasks today.

Efficiently Edit and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to initiate the process.

- Make use of the tools provided to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure seamless communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to KERALA VALUE ADDED TAX RULES,

Create this form in 5 minutes!

How to create an eSignature for the kerala value added tax rules

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the KERALA VALUE ADDED TAX RULES?

The KERALA VALUE ADDED TAX RULES govern the collection and payment of VAT in Kerala. These rules outline the procedures for registration, filing returns, and compliance requirements for businesses operating in the state. Understanding these rules is essential for businesses to ensure compliance and avoid penalties.

-

How can airSlate SignNow help with KERALA VALUE ADDED TAX RULES compliance?

airSlate SignNow provides a streamlined solution for businesses to manage their documentation related to KERALA VALUE ADDED TAX RULES. With features like eSigning and document tracking, businesses can ensure that all necessary documents are signed and stored securely, facilitating compliance with tax regulations.

-

What features does airSlate SignNow offer for managing VAT documents?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning to help businesses manage their VAT documents effectively. These features simplify the process of preparing and submitting documents required under the KERALA VALUE ADDED TAX RULES, saving time and reducing errors.

-

Is airSlate SignNow cost-effective for small businesses dealing with KERALA VALUE ADDED TAX RULES?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. By reducing the time spent on document management and ensuring compliance with KERALA VALUE ADDED TAX RULES, businesses can save money and resources while maintaining efficiency.

-

Can airSlate SignNow integrate with accounting software for VAT management?

Absolutely! airSlate SignNow can integrate with various accounting software solutions, making it easier for businesses to manage their VAT-related documents. This integration helps streamline processes related to KERALA VALUE ADDED TAX RULES, ensuring that all financial records are accurate and up-to-date.

-

What are the benefits of using airSlate SignNow for KERALA VALUE ADDED TAX RULES documentation?

Using airSlate SignNow for KERALA VALUE ADDED TAX RULES documentation offers numerous benefits, including enhanced efficiency, improved accuracy, and better compliance. The platform's user-friendly interface allows businesses to quickly prepare, send, and sign documents, reducing the risk of errors and ensuring timely submissions.

-

How secure is airSlate SignNow for handling VAT documents?

airSlate SignNow prioritizes security, employing advanced encryption and secure storage to protect sensitive VAT documents. This ensures that all documents related to KERALA VALUE ADDED TAX RULES are safe from unauthorized access, giving businesses peace of mind when managing their compliance.

Get more for KERALA VALUE ADDED TAX RULES,

Find out other KERALA VALUE ADDED TAX RULES,

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word