PAYMENT OPTIONS Filing Form

What is the PAYMENT OPTIONS Filing

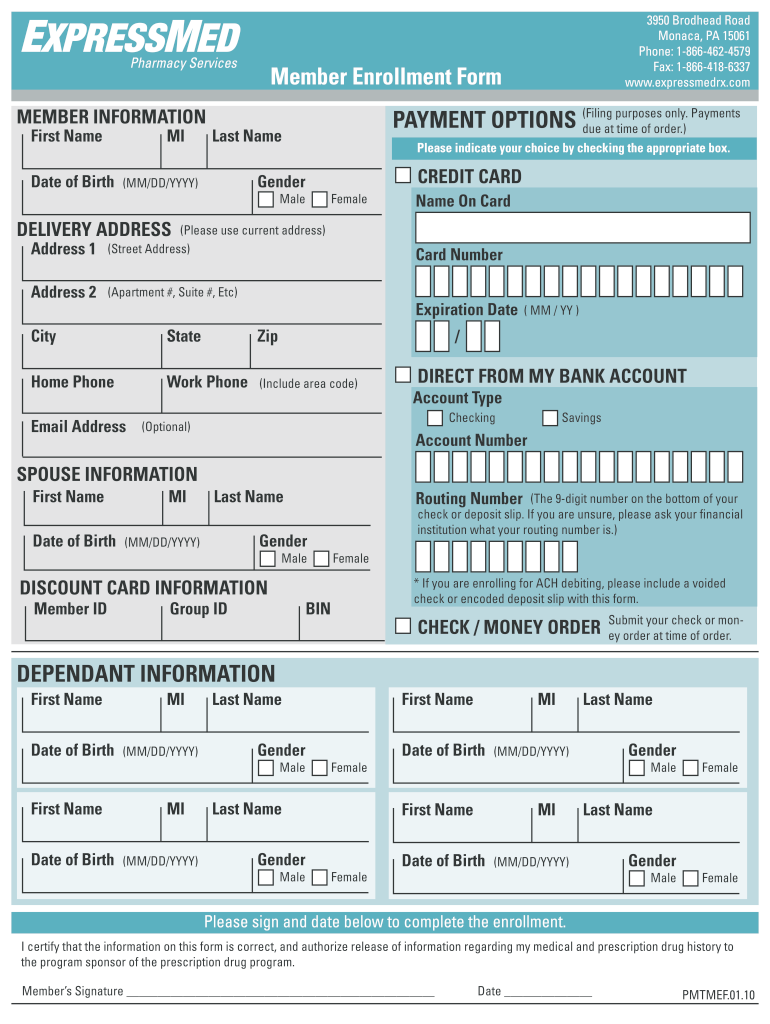

The PAYMENT OPTIONS Filing is a crucial form used by businesses and individuals to report various payment methods and options available for transactions. This form is particularly relevant for tax reporting and compliance purposes, ensuring that all payment options are documented accurately. It helps in maintaining transparency in financial dealings and is often required by regulatory bodies to track income and expenditures effectively.

How to use the PAYMENT OPTIONS Filing

Using the PAYMENT OPTIONS Filing involves several key steps. First, gather all necessary information regarding the payment methods you intend to report. This includes details about credit card transactions, electronic payments, and checks. Next, complete the form by accurately filling in the required fields, ensuring that all information is correct and up to date. Finally, submit the form by the specified deadline to avoid any penalties.

Steps to complete the PAYMENT OPTIONS Filing

Completing the PAYMENT OPTIONS Filing requires careful attention to detail. Follow these steps:

- Collect all relevant financial documents and records of payments.

- Fill out the form, ensuring that each section is completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the PAYMENT OPTIONS Filing

The legal use of the PAYMENT OPTIONS Filing is essential for compliance with federal and state regulations. Businesses must ensure that they are using the form in accordance with IRS guidelines to avoid any legal repercussions. Accurate reporting of payment options helps maintain compliance and can protect businesses from audits or penalties.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the PAYMENT OPTIONS Filing. Typically, these deadlines align with tax reporting periods, and missing them can result in penalties. Businesses should mark these dates on their calendars to ensure timely submission and avoid any disruptions in their financial reporting.

Required Documents

To complete the PAYMENT OPTIONS Filing, certain documents are required. These may include:

- Financial statements

- Records of payment transactions

- Tax identification numbers

- Any relevant correspondence from the IRS or state tax authorities

Form Submission Methods (Online / Mail / In-Person)

The PAYMENT OPTIONS Filing can be submitted through various methods, accommodating different preferences and needs. Options typically include:

- Online submission via the IRS website or designated portals

- Mailing the completed form to the appropriate tax authority

- In-person submission at local tax offices or designated locations

Quick guide on how to complete payment options filing

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as a perfect environment-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and efficiently. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional handwritten signature.

- Review all information thoroughly and click the Done button to save your modifications.

- Select how you wish to deliver your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PAYMENT OPTIONS Filing

Create this form in 5 minutes!

How to create an eSignature for the payment options filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the available PAYMENT OPTIONS Filing for airSlate SignNow?

airSlate SignNow offers various PAYMENT OPTIONS Filing, including monthly and annual subscriptions. You can choose a plan that best fits your business needs, ensuring flexibility and cost-effectiveness. Additionally, we provide a free trial to help you explore our features before committing.

-

How does airSlate SignNow ensure secure PAYMENT OPTIONS Filing?

Security is a top priority for airSlate SignNow. Our PAYMENT OPTIONS Filing are protected with advanced encryption and compliance with industry standards. This ensures that your financial information remains safe while you manage your documents.

-

Can I integrate airSlate SignNow with my existing payment systems?

Yes, airSlate SignNow supports integration with various payment systems, making PAYMENT OPTIONS Filing seamless. You can easily connect with popular platforms to streamline your workflow and enhance your document management process.

-

What features are included in the PAYMENT OPTIONS Filing plans?

Our PAYMENT OPTIONS Filing plans include features such as unlimited eSigning, document templates, and real-time tracking. These tools are designed to enhance your productivity and simplify the signing process for your team and clients.

-

Are there any hidden fees associated with PAYMENT OPTIONS Filing?

No, airSlate SignNow is transparent about its pricing. When you choose a PAYMENT OPTIONS Filing plan, you will know exactly what you are paying for, with no hidden fees. This allows you to budget effectively for your document management needs.

-

How can I upgrade or downgrade my PAYMENT OPTIONS Filing plan?

Upgrading or downgrading your PAYMENT OPTIONS Filing plan is straightforward with airSlate SignNow. You can manage your subscription directly from your account settings, allowing you to adjust your plan based on your business requirements at any time.

-

What benefits does airSlate SignNow offer for businesses using PAYMENT OPTIONS Filing?

Businesses using airSlate SignNow for PAYMENT OPTIONS Filing benefit from increased efficiency and reduced turnaround times. Our platform simplifies the signing process, allowing teams to focus on core activities while ensuring compliance and security.

Get more for PAYMENT OPTIONS Filing

Find out other PAYMENT OPTIONS Filing

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure