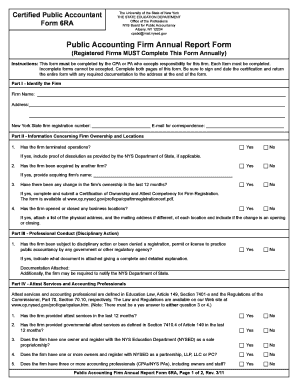

Nys 6ra Form

What is the Nys 6ra Form

The Nys 6ra Form is a crucial document used in the State of New York, primarily for reporting and managing specific tax-related information. This form is typically associated with the New York State Department of Taxation and Finance and is essential for individuals and businesses to ensure compliance with state tax regulations. It plays a significant role in accurately reporting income and deductions, which can affect tax liabilities.

How to use the Nys 6ra Form

Using the Nys 6ra Form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and deduction records. Next, carefully fill out the form, ensuring that each section is completed according to the instructions provided. It is vital to double-check all entries for accuracy before submission to avoid potential penalties or issues with the tax authorities.

Steps to complete the Nys 6ra Form

Completing the Nys 6ra Form requires attention to detail and a systematic approach. Follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts for deductions.

- Review the form instructions carefully to understand the requirements for each section.

- Fill out the personal information section, ensuring that names and addresses are accurate.

- Report all income sources as specified, including wages, self-employment income, and other earnings.

- Detail any applicable deductions and credits that may reduce your taxable income.

- Review your completed form for accuracy and completeness.

- Submit the form via the preferred method, whether online, by mail, or in person.

Legal use of the Nys 6ra Form

The Nys 6ra Form is legally binding when completed and submitted according to New York State regulations. It must be filled out truthfully and accurately, as providing false information can lead to severe penalties, including fines or legal action. The form serves as an official record of your tax obligations and compliance, making it essential for maintaining good standing with the state tax authority.

Who Issues the Form

The Nys 6ra Form is issued by the New York State Department of Taxation and Finance. This department is responsible for overseeing tax collection and ensuring compliance with state tax laws. They provide the necessary forms and guidelines for taxpayers to accurately report their financial information and fulfill their tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Nys 6ra Form are critical to ensure compliance and avoid penalties. Generally, the form must be submitted by the designated tax deadline, which typically aligns with the federal tax filing date. It is essential to stay informed about any changes to deadlines or specific requirements that may arise each tax year to ensure timely submission.

Quick guide on how to complete nys 6ra form

Complete Nys 6ra Form effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, alter, and eSign your documents quickly and without holdups. Handle Nys 6ra Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to modify and eSign Nys 6ra Form with ease

- Locate Nys 6ra Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your method of sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or errors that necessitate printing new document versions. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Nys 6ra Form and guarantee exceptional communication at any stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys 6ra form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nys 6ra Form?

The Nys 6ra Form is a crucial document used by New York State residents for various tax-related purposes. It is often required when filing taxes or applying for specific benefits, ensuring compliance with state regulations. Understanding this form helps streamline your tax filings and avoid potential penalties.

-

How can airSlate SignNow assist with the Nys 6ra Form?

airSlate SignNow simplifies the process of managing the Nys 6ra Form by allowing users to easily prepare, send, and electronically sign the document. Our platform equips businesses with tools to ensure that all required fields are completed correctly, making tax filing more efficient. With SignNow, you can be confident that your Nys 6ra Form is executed flawlessly.

-

What are the pricing options for using airSlate SignNow with the Nys 6ra Form?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, even when dealing with the Nys 6ra Form. You can choose from individual, business, and enterprise plans, ensuring you get the features necessary for your workflow. Our competitive pricing allows you to manage documents like the Nys 6ra Form cost-effectively.

-

Can I integrate airSlate SignNow with other software for processing the Nys 6ra Form?

Yes, airSlate SignNow boasts seamless integrations with popular applications such as Google Drive, Dropbox, and Microsoft Office. This means you can easily access and manage your files, including the Nys 6ra Form, from your preferred tools without hassle. These integrations streamline your workflow and enhance productivity.

-

What features does airSlate SignNow offer for the Nys 6ra Form?

With airSlate SignNow, you can utilize features like templates, secure eSigning, and document tracking for the Nys 6ra Form. Our easy-to-navigate interface allows users to customize documents efficiently, ensuring all necessary information is included. These features collectively improve the overall signing experience and save you time.

-

Are electronic signatures on the Nys 6ra Form legally valid?

Yes, electronic signatures on the Nys 6ra Form are legally valid under U.S. law, including New York State. airSlate SignNow complies with the ESIGN and UETA acts, ensuring that your signed documents hold up in legal and regulatory contexts. This gives users peace of mind when signing critical documents such as the Nys 6ra Form.

-

What are the benefits of using airSlate SignNow for the Nys 6ra Form?

Utilizing airSlate SignNow for the Nys 6ra Form provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced document security. Our platform speeds up the signing process, helping you meet deadlines with ease. Moreover, the user-friendly design makes it accessible for people of all tech levels.

Get more for Nys 6ra Form

- Form 433 b sp rev 2 2019 collection information statement for businesses spanish version

- 2019 instructions for form 4562 instructions for form 4562 depreciation and amortization including information on listed

- Notice 1036 rev december 2018 early release copies of the 2019 percentage method tables for income tax withholding form

- Form 6524 rev 5 2019

- Allianz s2067 form

- Form 886 h eic 2018

- Irs publication 503 form

- Form 433 sp

Find out other Nys 6ra Form

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later