Ut Tc 559 2016-2026

What is the Utah TC 559 Form?

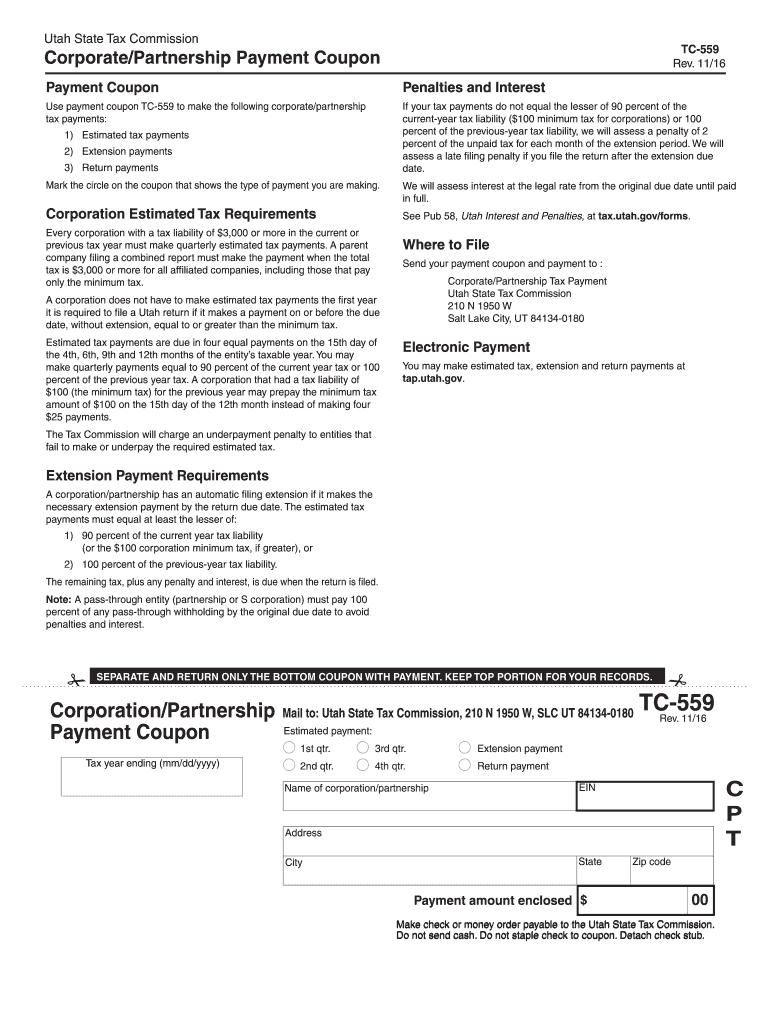

The Utah TC 559 form, also known as the Utah Corporate Payment form, is a crucial document used by businesses operating in Utah for various tax-related purposes. This form is specifically designed for corporations to report and remit their corporate income tax payments to the state. It serves as a formal declaration of the amount owed and is essential for maintaining compliance with Utah tax regulations.

How to Use the Utah TC 559 Form

Using the Utah TC 559 form involves several straightforward steps. First, ensure that you have the correct version of the form, which can be obtained from the Utah State Tax Commission website or through authorized channels. Next, accurately fill out the required fields, including your business information, tax identification number, and the payment amount. Once completed, the form can be submitted online, by mail, or in person, depending on your preference and the specific instructions provided by the state.

Steps to Complete the Utah TC 559 Form

Completing the Utah TC 559 form requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary information, including your business name, address, and tax ID number.

- Determine the correct payment amount based on your taxable income.

- Fill out the form clearly, ensuring all required fields are completed.

- Review the form for accuracy before submission.

- Choose your submission method: online, by mail, or in person.

Legal Use of the Utah TC 559 Form

The Utah TC 559 form has legal standing when filled out correctly and submitted in accordance with state laws. It is essential for businesses to adhere to the guidelines set forth by the Utah State Tax Commission to avoid penalties and ensure compliance. Electronic submissions are legally recognized, provided they meet the requirements of eSignature laws, ensuring that the form is valid and enforceable.

Key Elements of the Utah TC 559 Form

Understanding the key elements of the Utah TC 559 form is vital for accurate completion. The form typically includes:

- Business identification details, including name and tax ID number.

- Payment amount due based on corporate income.

- Signature line for the authorized representative of the business.

- Instructions for submission and payment methods.

Form Submission Methods

The Utah TC 559 form can be submitted through various methods to accommodate different preferences. Options include:

- Online: Submit the form electronically via the Utah State Tax Commission's online portal.

- Mail: Send the completed form to the designated address provided on the form.

- In-Person: Deliver the form directly to a local tax office for immediate processing.

Quick guide on how to complete tc 559 tax payment coupon for utah corporationpartnership forms ampamp publications

Effortlessly prepare Ut Tc 559 on any device

The management of online documents has gained traction among both organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Ut Tc 559 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and electronically sign Ut Tc 559 with ease

- Locate Ut Tc 559 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this task.

- Create your electronic signature with the Sign tool, which takes only a few seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Ut Tc 559 to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tc 559 tax payment coupon for utah corporationpartnership forms ampamp publications

How to make an electronic signature for your Tc 559 Tax Payment Coupon For Utah Corporationpartnership Forms Ampamp Publications in the online mode

How to make an electronic signature for the Tc 559 Tax Payment Coupon For Utah Corporationpartnership Forms Ampamp Publications in Chrome

How to make an eSignature for putting it on the Tc 559 Tax Payment Coupon For Utah Corporationpartnership Forms Ampamp Publications in Gmail

How to make an electronic signature for the Tc 559 Tax Payment Coupon For Utah Corporationpartnership Forms Ampamp Publications from your smartphone

How to generate an electronic signature for the Tc 559 Tax Payment Coupon For Utah Corporationpartnership Forms Ampamp Publications on iOS

How to create an eSignature for the Tc 559 Tax Payment Coupon For Utah Corporationpartnership Forms Ampamp Publications on Android devices

People also ask

-

What is the Utah TC 559 form used for?

The Utah TC 559 form is primarily used for reporting and documenting the taxable value of personal property in Utah. Businesses must accurately complete this form to comply with state tax regulations and ensure correct assessment of property taxes.

-

How can airSlate SignNow help with the Utah TC 559 form?

airSlate SignNow simplifies the process of completing and signing the Utah TC 559 form. With its user-friendly interface, you can easily fill out, eSign, and share the form with the necessary stakeholders, making it efficient for compliance and submission.

-

Is there a cost associated with using airSlate SignNow for the Utah TC 559 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, providing a great value for businesses that need to manage forms like the Utah TC 559 efficiently.

-

What features does airSlate SignNow offer for the Utah TC 559 form?

AirSlate SignNow provides several features that are beneficial for completing the Utah TC 559 form, including eSigning, document sharing, and cloud storage. These features streamline the process of document management and ensure security and compliance.

-

Can I integrate airSlate SignNow with other software for my Utah TC 559 form needs?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow when dealing with the Utah TC 559 form. This allows you to connect your existing tools and utilize a seamless approach to managing your documentation.

-

What are the benefits of using airSlate SignNow for the Utah TC 559 form?

Using airSlate SignNow for the Utah TC 559 form provides numerous benefits, including time savings, improved accuracy, and enhanced security. Its intuitive platform helps eliminate tedious paperwork, allowing you to focus on more critical business tasks.

-

How do I get started with airSlate SignNow for the Utah TC 559 form?

Getting started with airSlate SignNow for the Utah TC 559 form is easy. Simply sign up for an account, select a pricing plan, and begin creating or uploading your form to start eSigning and sharing seamlessly.

Get more for Ut Tc 559

- 20222023financial aid officeidentity and statement form

- Apply for or renew a blue badge online form

- Get the esrs employer enrollment form pdffiller

- Mn gov doc assetsall forms of communication are subject to monitoring mn gov

- Please enter your name exactly as it appears on your drivers licensestate issued id form

- State of ohio legal immunization exemption per ohio form

- Omb control number 2120 0021 form

- Board of mandatory continuing legal education form

Find out other Ut Tc 559

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF