Ct W3 2018

What is the Ct W3?

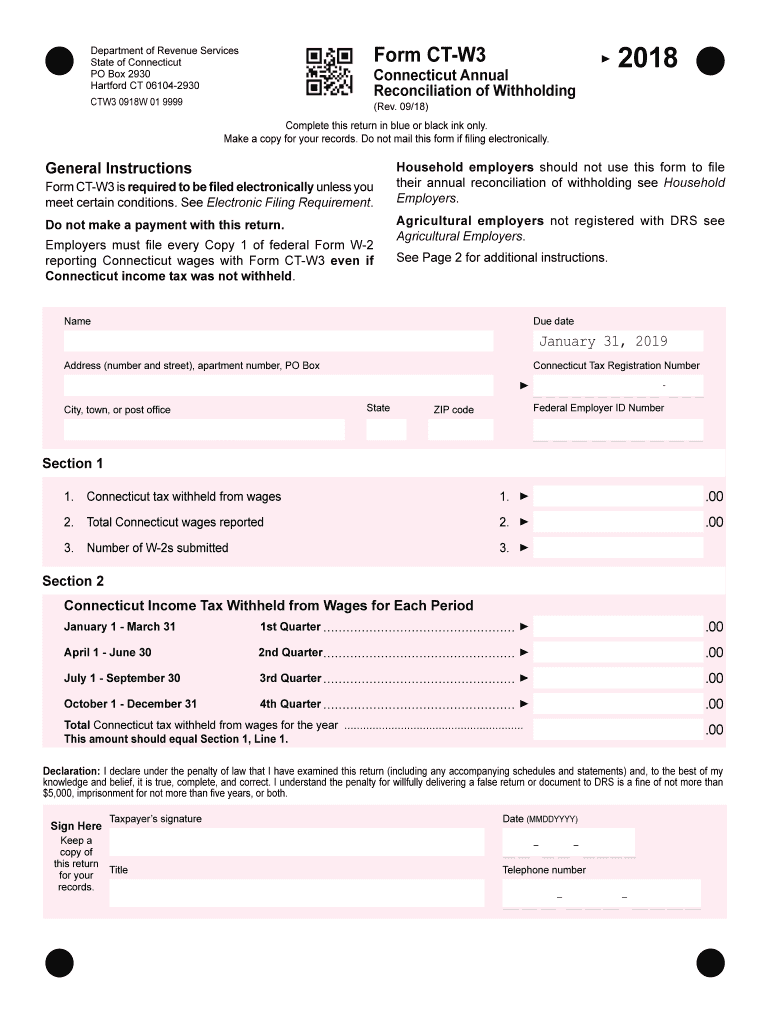

The Ct W3 is a state-specific tax form used in Connecticut for reporting income tax withheld from employees. This form is essential for employers who need to report the total amount of income tax withheld during the tax year. It is typically submitted to the Connecticut Department of Revenue Services and plays a crucial role in ensuring compliance with state tax regulations.

How to use the Ct W3

Using the Ct W3 involves several steps to ensure accurate reporting of withheld taxes. Employers must first gather all relevant payroll information for the year, including total wages paid and the amount of tax withheld for each employee. Once this information is compiled, it can be entered into the Ct W3 form. After completing the form, employers should submit it to the state along with any required payment for taxes owed. It is important to ensure that all information is accurate to avoid penalties.

Steps to complete the Ct W3

Completing the Ct W3 requires careful attention to detail. Follow these steps for successful completion:

- Gather all payroll records for the tax year, including total wages and tax withheld.

- Fill out the Ct W3 form with accurate figures, ensuring all employee information is correct.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the Connecticut Department of Revenue Services by the specified deadline.

Legal use of the Ct W3

The Ct W3 must be used in accordance with Connecticut state laws regarding tax reporting. Employers are legally obligated to report the correct amount of income tax withheld from employees to avoid penalties. Failure to submit the Ct W3 or submitting inaccurate information can lead to fines and legal repercussions. It is important for employers to stay informed about any changes to tax laws that may affect their reporting obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Ct W3 are crucial for compliance. Typically, the form must be submitted annually by January 31 of the following year. Employers should also be aware of any quarterly deadlines for submitting estimated tax payments. Staying on top of these dates helps avoid late fees and ensures that all tax obligations are met in a timely manner.

Who Issues the Form

The Ct W3 form is issued by the Connecticut Department of Revenue Services. This state agency oversees tax collection and compliance, providing necessary forms and guidance for employers. It is important for employers to refer to the official state website or contact the agency directly for the most current information regarding the Ct W3 and other tax-related forms.

Quick guide on how to complete connecticut annual

Effortlessly prepare Ct W3 on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents quickly and without delays. Manage Ct W3 across all platforms with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

Effortlessly modify and electronically sign Ct W3

- Find Ct W3 and click on Get Form to begin.

- Employ the tools available to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your method of sending the form: by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate reprinting documents. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Ct W3 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct connecticut annual

Create this form in 5 minutes!

How to create an eSignature for the connecticut annual

How to make an eSignature for your Connecticut Annual online

How to make an electronic signature for your Connecticut Annual in Chrome

How to create an electronic signature for signing the Connecticut Annual in Gmail

How to generate an eSignature for the Connecticut Annual right from your smart phone

How to create an eSignature for the Connecticut Annual on iOS

How to create an electronic signature for the Connecticut Annual on Android

People also ask

-

What is ct w3 corrected and how does it relate to eSignatures?

The ct w3 corrected refers to the updated version of tax-related documents ensuring accurate reporting. With airSlate SignNow, you can easily eSign these corrected documents, streamlining your compliance process and enhancing accuracy.

-

Can I use airSlate SignNow for signing ct w3 corrected forms?

Yes, airSlate SignNow allows you to electronically sign ct w3 corrected forms quickly and efficiently. Our platform simplifies the signing process, ensuring that your documents are legally binding and securely stored.

-

What are the benefits of using airSlate SignNow for ct w3 corrected documents?

Using airSlate SignNow for ct w3 corrected documents offers several benefits, including faster processing times and reduced paperwork. Our platform is designed for ease of use, enabling users to manage their eSignatures from any device.

-

How does pricing work for airSlate SignNow when dealing with ct w3 corrected?

airSlate SignNow offers flexible pricing plans that accommodate various business needs, including those needing ct w3 corrected signings. You can choose from multiple tiers depending on the features you require, ensuring a cost-effective solution for document signing.

-

What features does airSlate SignNow provide for handling ct w3 corrected documents?

airSlate SignNow provides a variety of features for managing ct w3 corrected documents, such as customizable templates, audit trails, and integration with other software. These features work together to enhance your document workflow and ensure compliance.

-

Is it easy to integrate airSlate SignNow with other software for ct w3 corrected?

Absolutely! airSlate SignNow integrates seamlessly with various software systems to facilitate the management of ct w3 corrected documents. This enables you to streamline operations and maintain productivity across different platforms.

-

What security measures does airSlate SignNow employ for ct w3 corrected eSignatures?

airSlate SignNow takes security seriously, using encryption and secure cloud storage for all ct w3 corrected eSignatures. Your documents are protected with advanced security features, ensuring that your sensitive information remains confidential.

Get more for Ct W3

- Vehicle registration renewreplacetransfer form

- Ilovepdf rest api pdf tools for developers form

- Form 749 personalized license plate application not for motorcycles

- Form 11 a prescribed by the ohio secretary of stat

- Application for registration of a motor vehicle with restricted form

- Other special state provisionsgeorgia department of form

- Ohio bmv applicationfill out printable pdf forms online

- Dmv alaska motor vehicle crash form 12209one cho

Find out other Ct W3

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later