Ct W3 2019-2026

What is the CT W-3?

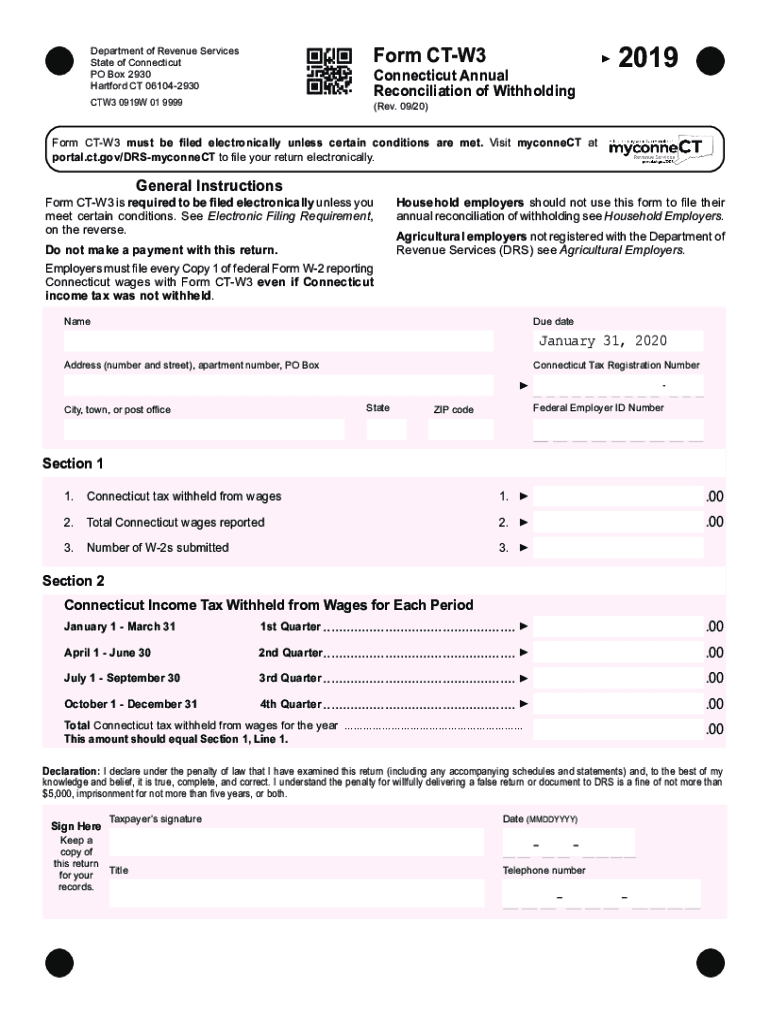

The CT W-3 is a summary form used by employers in Connecticut to report annual wage and tax information for their employees. This form consolidates data from individual W-2 forms and is submitted to the Connecticut Department of Revenue Services. It is essential for employers to accurately complete the CT W-3 to ensure compliance with state tax regulations and to facilitate the correct processing of employee tax information.

How to Use the CT W-3

To use the CT W-3, employers must first gather all W-2 forms issued to employees for the tax year. The CT W-3 requires the total wages paid, total Connecticut income tax withheld, and the number of employees for whom W-2 forms were issued. Employers should ensure that all information is accurate and matches the data reported on the W-2 forms. Once completed, the CT W-3 can be submitted electronically or via mail to the appropriate state agency.

Steps to Complete the CT W-3

Completing the CT W-3 involves several key steps:

- Collect all W-2 forms issued to employees for the tax year.

- Enter the total wages paid to employees as reported on the W-2 forms.

- Calculate the total Connecticut income tax withheld from employee wages.

- Count the number of employees for whom W-2 forms were issued.

- Review all entries for accuracy before submission.

Legal Use of the CT W-3

The CT W-3 serves a legal purpose by ensuring that employers comply with state tax laws. Submitting this form is a requirement for all employers who have withheld Connecticut income tax from their employees. Failure to submit the CT W-3 or providing inaccurate information can lead to penalties and interest charges, making it crucial for employers to adhere to the guidelines set forth by the Connecticut Department of Revenue Services.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines for the CT W-3 to avoid penalties. The form is typically due by the end of January following the tax year. For example, the CT W-3 for the 2024 tax year must be filed by January 31, 2025. It is important for employers to mark their calendars and ensure timely submission to maintain compliance with state regulations.

Required Documents

To complete the CT W-3, employers need the following documents:

- All W-2 forms issued to employees for the reporting year.

- Records of wages paid and taxes withheld for each employee.

- Any additional documentation required by the Connecticut Department of Revenue Services for verification purposes.

Form Submission Methods

The CT W-3 can be submitted through various methods, including:

- Electronically via the Connecticut Department of Revenue Services online portal.

- By mail, using the address specified on the form.

- In-person submission at designated state offices, if applicable.

Quick guide on how to complete internal revenue service locations ampamp hours near hartford ct

Complete Ct W3 effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Ct W3 on any device using airSlate SignNow Android or iOS applications and streamline any document-oriented task today.

How to modify and eSign Ct W3 effortlessly

- Obtain Ct W3 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of the documents or obscure confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign Ct W3 while ensuring clear communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct internal revenue service locations ampamp hours near hartford ct

Create this form in 5 minutes!

How to create an eSignature for the internal revenue service locations ampamp hours near hartford ct

How to create an eSignature for the Internal Revenue Service Locations Ampamp Hours Near Hartford Ct in the online mode

How to make an eSignature for the Internal Revenue Service Locations Ampamp Hours Near Hartford Ct in Chrome

How to make an eSignature for signing the Internal Revenue Service Locations Ampamp Hours Near Hartford Ct in Gmail

How to create an eSignature for the Internal Revenue Service Locations Ampamp Hours Near Hartford Ct right from your smartphone

How to create an electronic signature for the Internal Revenue Service Locations Ampamp Hours Near Hartford Ct on iOS

How to create an electronic signature for the Internal Revenue Service Locations Ampamp Hours Near Hartford Ct on Android OS

People also ask

-

What is ctw4p and how does it relate to airSlate SignNow?

ctw4p refers to a specific solution offered by airSlate SignNow, designed to streamline document signing processes. It provides businesses with a secure and efficient way to send and eSign documents, enhancing overall productivity.

-

How much does airSlate SignNow cost with the ctw4p feature?

Pricing for airSlate SignNow with the ctw4p feature is competitive and varies based on the subscription plan you choose. We offer flexible pricing options that cater to businesses of all sizes, ensuring you find a plan that meets your needs.

-

What features does the ctw4p solution offer?

The ctw4p solution allows users to easily create, send, and track documents for eSigning. It includes features like customizable templates, secure cloud storage, and team collaboration tools, making document management simpler and more efficient.

-

What are the benefits of using airSlate SignNow's ctw4p for my business?

By using airSlate SignNow's ctw4p, businesses can reduce paperwork, save time, and enhance security in document transactions. This solution helps to streamline workflows, improve compliance, and increase customer satisfaction by facilitating faster signing processes.

-

Can I integrate airSlate SignNow with other software using ctw4p?

Yes, airSlate SignNow's ctw4p supports integrations with a variety of software applications. This allows your business to connect and automate workflows seamlessly, enhancing overall efficiency and making document management easier.

-

Is it easy to use airSlate SignNow's ctw4p for my team?

Absolutely! airSlate SignNow's ctw4p is designed to be user-friendly, making it easy for teams to adopt and use without extensive training. Its intuitive interface ensures that you can quickly get started with eSigning and document management.

-

How does airSlate SignNow ensure the security of documents signed using ctw4p?

airSlate SignNow takes document security seriously. The ctw4p solution uses advanced encryption and complies with industry standards to ensure that your documents are safe, giving you peace of mind as you conduct business.

Get more for Ct W3

- Post standard application gallatin county montana gallatin mt form

- Doterra contact number form

- Ssol columbia form

- Acupuncture intake form

- Counterproposal colorado real estate commission approved form

- Contract to buy and sell real estate residential colorado real estate commission approved form

- Agreement to amend extend contract form

- Pattern interrogatories under rule 33 form 20 crcp bradford

Find out other Ct W3

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free