Recipient Created Tax Invoice RCTI Agreement Form

Understanding the Recipient Created Tax Invoice RCTI Agreement

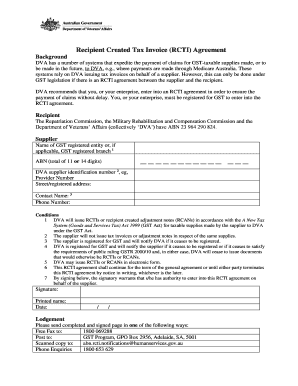

The Recipient Created Tax Invoice (RCTI) Agreement is a crucial document for businesses that allows the recipient of goods or services to issue a tax invoice on behalf of the supplier. This arrangement is particularly useful in industries where the supplier may not be able to issue invoices directly. The RCTI Agreement outlines the responsibilities of both parties, ensuring compliance with tax regulations while facilitating smoother transactions.

In the United States, this agreement must adhere to specific legal requirements, including the inclusion of necessary details such as the supplier's information, the nature of the goods or services provided, and the applicable tax rates. By establishing clear guidelines, the RCTI Agreement helps prevent misunderstandings and ensures that both parties are on the same page regarding invoicing and tax obligations.

Steps to Complete the Recipient Created Tax Invoice RCTI Agreement

Completing the RCTI Agreement involves several key steps to ensure that all necessary information is accurately documented. Here’s a straightforward process to follow:

- Gather necessary information, including the supplier's name, address, and tax identification number.

- Clearly define the terms of the agreement, including the types of goods or services covered.

- Ensure both parties sign the agreement to validate it legally.

- Maintain a copy of the signed agreement for your records, as it may be required for tax purposes.

Following these steps can help streamline the invoicing process and ensure compliance with tax regulations.

Key Elements of the Recipient Created Tax Invoice RCTI Agreement

When drafting an RCTI Agreement, certain key elements must be included to ensure its validity and effectiveness:

- Identification of Parties: Clearly state the names and addresses of both the supplier and the recipient.

- Description of Goods/Services: Provide a detailed description of the goods or services that the agreement covers.

- Tax Information: Include the applicable tax rates and any relevant tax identification numbers.

- Agreement Duration: Specify the time frame during which the agreement is valid.

- Signatures: Ensure that both parties sign the agreement to confirm their acceptance of the terms.

Incorporating these elements helps to create a comprehensive and legally sound RCTI Agreement.

Legal Use of the Recipient Created Tax Invoice RCTI Agreement

The legal use of an RCTI Agreement is governed by tax laws and regulations, which vary by state. It is essential for businesses to understand these legal frameworks to avoid penalties. The agreement must comply with the Internal Revenue Service (IRS) guidelines, ensuring that all invoicing practices are legitimate and transparent.

Businesses should also be aware of the implications of non-compliance, which can result in fines or other legal consequences. Consulting with a tax professional can provide clarity on how to properly implement the RCTI Agreement within the bounds of the law.

Examples of Using the Recipient Created Tax Invoice RCTI Agreement

There are various scenarios in which an RCTI Agreement can be beneficial:

- Freelancers: A freelancer providing services to a company may use an RCTI to issue invoices for their work.

- Wholesale Suppliers: A wholesale supplier may allow retailers to issue RCTIs for products sold, simplifying the invoicing process.

- Construction Projects: In construction, subcontractors may issue RCTIs to general contractors for work completed.

These examples illustrate the flexibility of the RCTI Agreement in various business contexts, helping to streamline invoicing and ensure compliance.

Quick guide on how to complete recipient created tax invoice rcti agreement

Complete Recipient Created Tax Invoice RCTI Agreement effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the appropriate template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Recipient Created Tax Invoice RCTI Agreement on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Recipient Created Tax Invoice RCTI Agreement without hassle

- Find Recipient Created Tax Invoice RCTI Agreement and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional pen-and-ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to deliver your form: via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Recipient Created Tax Invoice RCTI Agreement and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the recipient created tax invoice rcti agreement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a recipient created tax invoice?

A recipient created tax invoice (RCTI) is a type of invoice that allows the recipient of goods or services to create the invoice on behalf of the supplier. This process simplifies billing and ensures compliance with tax regulations. Using airSlate SignNow, businesses can easily manage RCTIs, streamlining their invoicing process.

-

How does airSlate SignNow support recipient created tax invoices?

airSlate SignNow provides a user-friendly platform for creating and managing recipient created tax invoices. With our eSigning capabilities, you can quickly send RCTIs for approval and ensure they are legally binding. This feature enhances efficiency and reduces the time spent on invoicing.

-

Is there a cost associated with using airSlate SignNow for recipient created tax invoices?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features for managing recipient created tax invoices, ensuring you get the best value for your investment. You can choose a plan that fits your budget and requirements.

-

What are the benefits of using airSlate SignNow for recipient created tax invoices?

Using airSlate SignNow for recipient created tax invoices offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance with tax regulations. Our platform allows for quick document turnaround and secure eSigning, making the invoicing process seamless for both parties.

-

Can I integrate airSlate SignNow with other accounting software for recipient created tax invoices?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, allowing you to manage recipient created tax invoices alongside your financial records. This integration helps streamline your workflow and ensures that all your invoicing data is in one place.

-

How secure is the process of creating recipient created tax invoices with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure access protocols to protect your recipient created tax invoices and sensitive information. You can trust that your documents are safe and compliant with industry standards.

-

Can I customize my recipient created tax invoices in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your recipient created tax invoices to reflect your brand and meet your specific needs. You can add your logo, adjust the layout, and include any necessary fields to ensure your invoices are professional and tailored to your business.

Get more for Recipient Created Tax Invoice RCTI Agreement

- Foundation contractor package minnesota form

- Plumbing contractor package minnesota form

- Brick mason contractor package minnesota form

- Roofing contractor package minnesota form

- Electrical contractor package minnesota form

- Sheetrock drywall contractor package minnesota form

- Flooring contractor package minnesota form

- Trim carpentry contractor package minnesota form

Find out other Recipient Created Tax Invoice RCTI Agreement

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy