Tsp 70 2018-2026

What is the TSP 70?

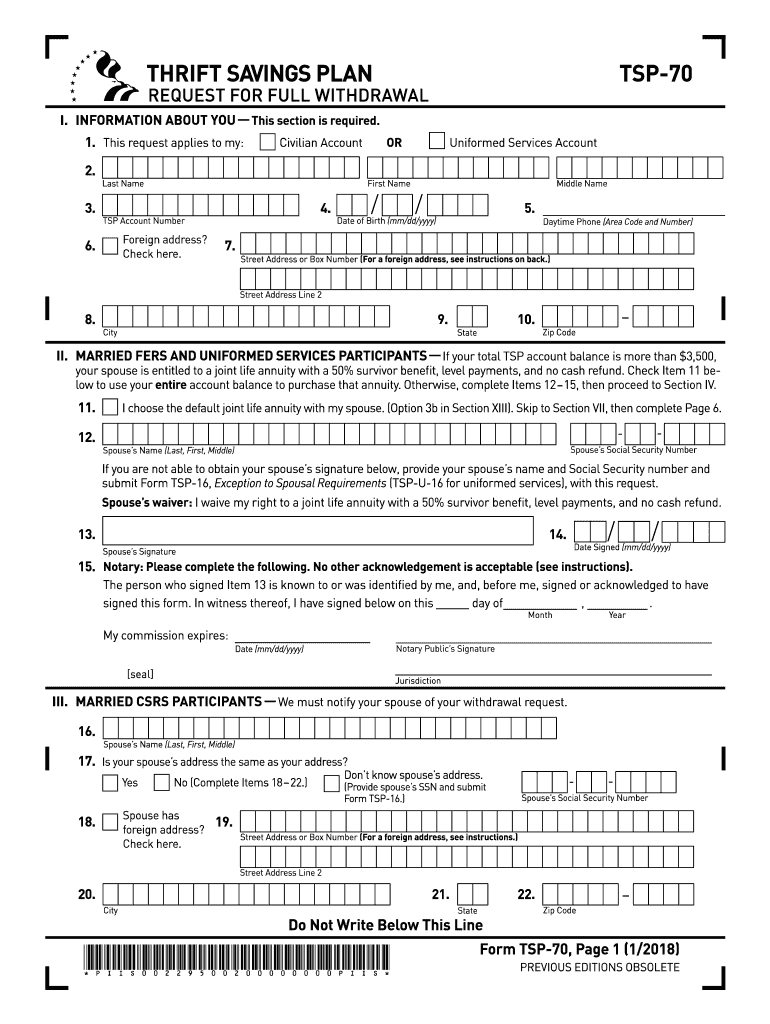

The TSP 70 form, also known as the Thrift Savings Plan Withdrawal Form, is a crucial document for participants looking to withdraw funds from their TSP accounts. This form is specifically designed for those who wish to request a full withdrawal of their retirement savings. The TSP 70 outlines the necessary information required to process the withdrawal request, ensuring that the funds are disbursed correctly and in compliance with federal regulations.

How to Obtain the TSP 70

To obtain the TSP 70 form, participants can visit the official Thrift Savings Plan website or access it through their TSP account. The form is available as a fillable PDF, making it easy to complete online. Additionally, participants can request a printed version of the form by contacting the TSP service office directly. It is essential to ensure that you have the most current version of the form to avoid any processing delays.

Steps to Complete the TSP 70

Completing the TSP 70 form involves several key steps:

- Provide personal information, including your name, address, and Social Security number.

- Select the type of withdrawal you are requesting, whether it is a full withdrawal or a partial withdrawal.

- Indicate how you would like to receive your funds, such as a direct deposit or a check.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to the TSP service office via mail or electronically, if available.

Legal Use of the TSP 70

The TSP 70 form is legally binding once completed and submitted according to the guidelines set forth by the Thrift Savings Plan. To ensure compliance, participants must adhere to the regulations outlined in the TSP's governing documents. This includes understanding the tax implications of withdrawals and ensuring that all required signatures are present. Utilizing a reliable digital platform for e-signatures can enhance the legal validity of the submission.

Required Documents

When submitting the TSP 70 form, participants may need to provide additional documentation to support their withdrawal request. This could include:

- A copy of your government-issued identification.

- Any relevant court orders if applicable, such as divorce decrees.

- Proof of employment termination or retirement, if relevant.

Having these documents ready can expedite the processing of your withdrawal request.

Form Submission Methods

The TSP 70 form can be submitted through various methods to accommodate participants' preferences:

- Online Submission: If you are using a digital platform that supports e-signatures, you may be able to submit the form electronically.

- Mail: Participants can print the completed form and send it to the TSP service office via postal mail.

- In-Person: Some participants may choose to deliver the form in person at designated TSP locations.

Quick guide on how to complete tsp 70 request for full withdrawal

Effortlessly prepare Tsp 70 on any device

Managing documents online has become increasingly popular among companies and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed papers, as you can access the correct format and securely store it online. airSlate SignNow provides you with all the tools you need to create, edit, and electronically sign your documents swiftly without delays. Manage Tsp 70 on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Tsp 70 without hassle

- Locate Tsp 70 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to send your form: via email, text message (SMS), invitation link, or download it to your computer.

No more worries about lost or misplaced files, exhausting document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device of your preference. Modify and electronically sign Tsp 70 to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tsp 70 request for full withdrawal

How to create an eSignature for the Tsp 70 Request For Full Withdrawal in the online mode

How to generate an electronic signature for the Tsp 70 Request For Full Withdrawal in Chrome

How to generate an eSignature for signing the Tsp 70 Request For Full Withdrawal in Gmail

How to create an electronic signature for the Tsp 70 Request For Full Withdrawal from your smart phone

How to make an electronic signature for the Tsp 70 Request For Full Withdrawal on iOS

How to create an eSignature for the Tsp 70 Request For Full Withdrawal on Android devices

People also ask

-

What is Tsp 70 and how does it relate to airSlate SignNow?

Tsp 70 refers to the document signing and management capabilities provided by airSlate SignNow. It is designed to streamline the eSigning process, making it easier for businesses to send, sign, and manage their documents effectively.

-

How much does airSlate SignNow cost for Tsp 70 users?

The pricing for airSlate SignNow varies based on the subscription plan chosen. For users interested in Tsp 70 features, plans are designed to be cost-effective, ensuring that businesses of all sizes can benefit from the electronic signature solutions without breaking the bank.

-

What are the key features of Tsp 70 in airSlate SignNow?

Tsp 70 includes essential features such as customizable templates, real-time tracking, and secure storage. These features empower users to enhance their document workflows, making eSigning simple and efficient.

-

What are the benefits of using Tsp 70 for document management?

Utilizing Tsp 70 with airSlate SignNow offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for document transactions. Businesses can manage their documents seamlessly, leading to improved productivity.

-

Can Tsp 70 integrate with other software solutions?

Yes, Tsp 70 in airSlate SignNow integrates smoothly with various software solutions, including CRM and project management tools. This integration capability allows businesses to enhance their workflows and keep all their systems connected.

-

Is Tsp 70 secure for sensitive documents?

Absolutely, Tsp 70 prioritizes security by utilizing advanced encryption methods and compliance with industry standards. This ensures that all documents signed and stored through airSlate SignNow remain confidential and secure.

-

How can I get started with Tsp 70 on airSlate SignNow?

Getting started with Tsp 70 is straightforward. Simply visit the airSlate SignNow website, sign up for an account, and explore the user-friendly interface to begin sending and signing documents efficiently.

Get more for Tsp 70

- Ayudas e incentivos para empresas portal pyme form

- Paper form ssa 2 application for wifes or husbands

- Form ssa 1 bkfill online printable fillable

- Your social security number and card social security number form

- Maine notice of intent to homeschool not subsequent year form

- Jc 17a order of disposition child in home michigan courts form

- Pc 670 minor guardianship social history form

- As a provider of child care services for the city of new yorks administration for childrens services acs you may elect to form

Find out other Tsp 70

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself