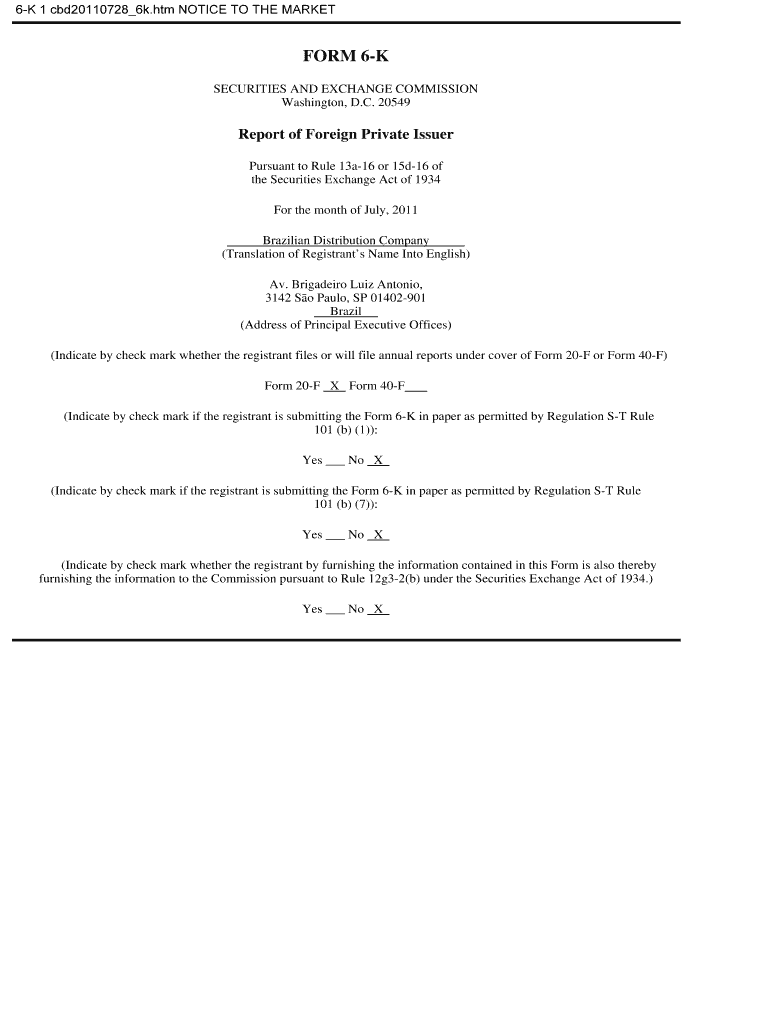

6 K 1 Cbd201107286k Form

What is the 6 K 1 Cbd201107286k

The 6 K 1 Cbd201107286k is a specific tax form used primarily for reporting income, deductions, and credits for certain types of partnerships and corporations. It serves as an informational return that provides the IRS with details about the income distributed to partners or shareholders. This form is essential for ensuring compliance with tax regulations and accurately reporting financial activities related to business entities.

How to use the 6 K 1 Cbd201107286k

Using the 6 K 1 Cbd201107286k involves filling out the form with accurate financial information regarding income, deductions, and credits allocated to each partner or shareholder. It is important to ensure that the details are consistent with the entity's overall tax return. Once completed, this form should be distributed to all partners or shareholders, who will then use it to report their share of income on their individual tax returns.

Steps to complete the 6 K 1 Cbd201107286k

Completing the 6 K 1 Cbd201107286k requires several key steps:

- Gather all financial documents related to the partnership or corporation's income and expenses.

- Fill in the entity's identifying information, including name, address, and tax identification number.

- Report the total income, deductions, and credits for each partner or shareholder.

- Ensure that all calculations are accurate and consistent with the entity's overall tax return.

- Distribute copies of the completed form to all partners or shareholders.

Legal use of the 6 K 1 Cbd201107286k

The legal use of the 6 K 1 Cbd201107286k is crucial for compliance with IRS regulations. This form must be filed accurately and timely to avoid penalties. Each partner or shareholder must report the information provided on the form when filing their personal tax returns. Failure to use this form correctly can lead to issues with tax compliance and potential audits.

Filing Deadlines / Important Dates

Filing deadlines for the 6 K 1 Cbd201107286k typically align with the tax return deadlines for partnerships and corporations. Generally, partnerships must file their returns by the fifteenth day of the third month following the end of their tax year. It is essential to keep track of these deadlines to ensure timely submission and avoid penalties.

Who Issues the Form

The 6 K 1 Cbd201107286k is issued by partnerships and certain corporations, specifically those that are required to report income, deductions, and credits to their partners or shareholders. This form acts as a means of communication between the entity and the IRS, detailing the financial activities that must be reported by individual partners or shareholders.

Quick guide on how to complete 6 k 1 cbd201107286k

Prepare [SKS] effortlessly on any device

Digital document management has gained increased popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can locate the correct template and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance your document-centric procedures today.

The easiest method to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal legitimacy as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 6 K 1 Cbd201107286k

Create this form in 5 minutes!

How to create an eSignature for the 6 k 1 cbd201107286k

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 6 K 1 Cbd201107286k?

6 K 1 Cbd201107286k refers to a specific product or service offered by airSlate SignNow that enhances document management and eSigning capabilities. It is designed to streamline workflows and improve efficiency for businesses of all sizes. Understanding its features can help you leverage its full potential.

-

How does 6 K 1 Cbd201107286k benefit my business?

The 6 K 1 Cbd201107286k solution provides numerous benefits, including faster document turnaround times and improved compliance. By utilizing this tool, businesses can reduce paper usage and enhance collaboration among team members. This ultimately leads to increased productivity and cost savings.

-

What are the pricing options for 6 K 1 Cbd201107286k?

Pricing for 6 K 1 Cbd201107286k varies based on the features and number of users required. airSlate SignNow offers flexible plans to accommodate different business needs, ensuring that you only pay for what you use. For detailed pricing information, visit our website or contact our sales team.

-

Can I integrate 6 K 1 Cbd201107286k with other software?

Yes, 6 K 1 Cbd201107286k seamlessly integrates with various software applications, including CRM and project management tools. This integration allows for a more cohesive workflow, enabling you to manage documents and signatures without switching between platforms. Check our integration page for a full list of compatible applications.

-

Is 6 K 1 Cbd201107286k secure for sensitive documents?

Absolutely! 6 K 1 Cbd201107286k employs advanced security measures, including encryption and secure access controls, to protect your sensitive documents. Our commitment to security ensures that your data remains confidential and compliant with industry standards. You can trust airSlate SignNow with your most important documents.

-

How user-friendly is the 6 K 1 Cbd201107286k platform?

The 6 K 1 Cbd201107286k platform is designed with user experience in mind, making it easy for anyone to navigate and utilize its features. With an intuitive interface, users can quickly learn how to send and eSign documents without extensive training. This ease of use contributes to faster adoption within your organization.

-

What types of documents can I manage with 6 K 1 Cbd201107286k?

You can manage a wide variety of documents with 6 K 1 Cbd201107286k, including contracts, agreements, and forms. The platform supports multiple file formats, allowing you to upload and send documents effortlessly. This versatility makes it suitable for various industries and use cases.

Get more for 6 K 1 Cbd201107286k

Find out other 6 K 1 Cbd201107286k

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed