Tn 417 2015-2026

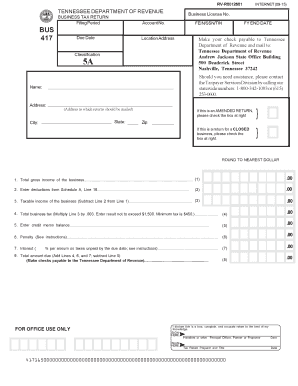

What is the TN 417?

The TN 417 return, also known as the Tennessee 417 tax form, is a document used by businesses in Tennessee to report their franchise and excise taxes. This form is essential for compliance with state tax regulations and is required for various business entities, including corporations and limited liability companies. The TN 417 return provides the state with necessary financial information, ensuring that businesses fulfill their tax obligations accurately and timely.

Steps to Complete the TN 417

Completing the TN 417 return involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements and balance sheets. Next, calculate your taxable income by adjusting your gross receipts and deducting allowable expenses. After determining your tax liability, fill out the TN 417 form with the calculated figures. Finally, review the form for accuracy before submitting it to the appropriate state tax authority.

Form Submission Methods

The TN 417 return can be submitted through various methods. Businesses have the option to file the form online using the Tennessee Department of Revenue's e-filing system, which offers a streamlined process for electronic submissions. Alternatively, businesses may choose to print the form and submit it via mail or deliver it in person to their local tax office. Each submission method has its own processing times and requirements, so it is important to choose the one that best fits your business needs.

Filing Deadlines / Important Dates

Filing deadlines for the TN 417 return are crucial for businesses to avoid penalties. Typically, the return is due on the fifteenth day of the fourth month following the close of the business's fiscal year. For most businesses operating on a calendar year, this means the form is due by April 15. It is essential to stay informed about any changes to deadlines or additional requirements that may arise each tax year.

Legal Use of the TN 417

The TN 417 return must be completed and submitted in accordance with Tennessee state tax laws to be considered legally binding. This includes ensuring that all information reported is accurate and that the form is signed by an authorized representative of the business. Failure to comply with legal requirements can result in penalties, including fines and interest on unpaid taxes. Utilizing a reliable eSignature solution can enhance the legal validity of the submitted form.

Key Elements of the TN 417

Understanding the key elements of the TN 417 return is essential for accurate completion. Important components include the business entity's name, address, and federal employer identification number (EIN). Additionally, the form requires detailed financial information, such as total revenue, deductions, and the resulting tax liability. Each section must be filled out carefully to ensure compliance with state regulations.

Quick guide on how to complete county business tax return classification 5a bus417 state of tn

Effortlessly prepare Tn 417 on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Tn 417 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign Tn 417 with ease

- Find Tn 417 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal authority as a conventional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to share your form, whether by email, SMS, invite link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, and errors requiring new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Tn 417 and ensure excellent communication throughout your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the county business tax return classification 5a bus417 state of tn

How to create an eSignature for the County Business Tax Return Classification 5a Bus417 State Of Tn in the online mode

How to generate an electronic signature for your County Business Tax Return Classification 5a Bus417 State Of Tn in Chrome

How to make an eSignature for signing the County Business Tax Return Classification 5a Bus417 State Of Tn in Gmail

How to generate an electronic signature for the County Business Tax Return Classification 5a Bus417 State Of Tn right from your smart phone

How to create an eSignature for the County Business Tax Return Classification 5a Bus417 State Of Tn on iOS

How to generate an electronic signature for the County Business Tax Return Classification 5a Bus417 State Of Tn on Android OS

People also ask

-

What is the tn 417 return and how do I use it?

The tn 417 return is a specific tax form used for reporting certain income and deductions in Tennessee. Using airSlate SignNow can simplify the signing and submission process, ensuring you meet deadlines without hassle.

-

How much does it cost to eSign my tn 417 return with airSlate SignNow?

airSlate SignNow offers a cost-effective solution for eSigning your tn 417 return, with various pricing plans to fit your needs. You can select a plan based on the frequency of your document signing activities, ensuring value for your investment.

-

What features does airSlate SignNow offer for managing the tn 417 return?

airSlate SignNow provides a user-friendly platform for sending, eSigning, and storing your tn 417 return securely. Key features include customizable templates, automated reminders, and a seamless mobile experience, making it easy to manage your documents on the go.

-

Is airSlate SignNow compliant with state regulations for tax documents like the tn 417 return?

Yes, airSlate SignNow complies with all necessary state regulations, ensuring that your tn 417 return is signed and stored securely. This compliance helps you maintain the integrity and legality of your tax documentation.

-

Can I integrate airSlate SignNow with other applications for managing my tn 417 return?

Absolutely! airSlate SignNow allows seamless integration with various applications, enhancing your workflow when handling the tn 417 return. Whether you're using accounting software or cloud storage solutions, integration ensures a streamlined document management process.

-

How does airSlate SignNow help in speeding up the submission of my tn 417 return?

With airSlate SignNow, you can quickly eSign and submit your tn 417 return without printing or scanning. The platform's instant delivery feature ensures that your document signNowes the appropriate department promptly, minimizing delays.

-

What benefits does airSlate SignNow provide for businesses filing the tn 417 return?

For businesses filing the tn 417 return, airSlate SignNow offers enhanced efficiency and reduced errors. By using electronic signatures, businesses can improve turnaround times and maintain better records, ultimately leading to cost savings.

Get more for Tn 417

- Philippines fake id templates philippines fake id templates filmigo video maker is a powerful video editing tool to make form

- Paper checker instant plagiarism checker tool citation machine form

- The universal life church get ordained for online form

- Health care commission registration form

- Republic of the philippines social security system form

- Small estate affidavit illinois secretary of state form

- Verdienstbescheinigung des arbeitgebers kiz 5 verdienstbescheinigung des arbeitgebers zur vorlage bei der familienkasse fr form

- Waikato tainui remaining claims mandate strategy form

Find out other Tn 417

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer