D400x 2014-2026

What is the D400x

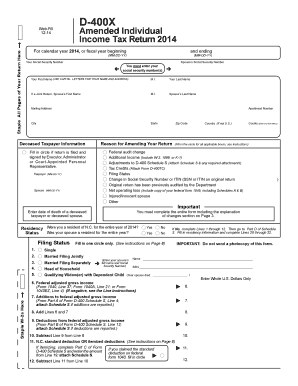

The D400x is a tax form used in North Carolina for individual income tax purposes. Specifically, it is designed for residents who need to report their income and calculate their tax liability. This form can be utilized for various tax years, allowing taxpayers to accurately declare their earnings and claim deductions or credits applicable to their situation. The D400x is particularly important for those who may have experienced changes in their financial circumstances or need to amend previously filed tax returns.

How to use the D400x

Using the D400x involves several steps to ensure accurate completion and submission. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, individuals will need to fill out the form by entering their personal information, income details, and any deductions or credits they wish to claim. Once completed, the form can be submitted either electronically or via mail, depending on the taxpayer's preference and the filing requirements for that tax year.

Steps to complete the D400x

Completing the D400x requires careful attention to detail. Here are the essential steps:

- Gather all relevant income documents, such as W-2s and 1099s.

- Fill out your personal information at the top of the form.

- Report your total income in the designated sections.

- Claim any deductions or credits you are eligible for.

- Calculate your total tax liability based on the information provided.

- Review the completed form for accuracy.

- Submit the form electronically or by mail to the appropriate tax authority.

Legal use of the D400x

The D400x is legally binding when filled out correctly and submitted according to North Carolina tax laws. It is essential that taxpayers ensure all information is accurate and complete to avoid potential penalties or legal issues. The form must be signed and dated by the taxpayer or their authorized representative to validate the submission. Compliance with state regulations regarding eSignatures and electronic submissions is also crucial for the legal acceptance of the form.

Filing Deadlines / Important Dates

Filing deadlines for the D400x typically align with the federal tax deadlines. Generally, the due date for filing individual income tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any specific deadlines for submitting amended returns using the D400x, as these may differ from regular filing dates.

Required Documents

To complete the D400x accurately, taxpayers must have several documents on hand. These typically include:

- W-2 forms from employers.

- 1099 forms for any additional income.

- Receipts for deductible expenses.

- Records of any tax credits claimed.

- Previous tax returns for reference.

Form Submission Methods (Online / Mail / In-Person)

The D400x can be submitted through various methods, providing flexibility for taxpayers. Individuals may choose to file online using approved e-filing software, which often simplifies the process and ensures accuracy. Alternatively, the form can be printed and mailed to the appropriate tax office. In some cases, taxpayers may also have the option to submit the form in person at designated tax offices, depending on local regulations and availability.

Quick guide on how to complete d 400x web fill amended individual income tax return 2014

Complete D400x effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, alter, and eSign your documents swiftly without delays. Manage D400x on any platform using the airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to modify and eSign D400x with ease

- Locate D400x and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious searches for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign D400x and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 400x web fill amended individual income tax return 2014

How to generate an eSignature for the D 400x Web Fill Amended Individual Income Tax Return 2014 online

How to create an electronic signature for the D 400x Web Fill Amended Individual Income Tax Return 2014 in Google Chrome

How to create an eSignature for signing the D 400x Web Fill Amended Individual Income Tax Return 2014 in Gmail

How to create an eSignature for the D 400x Web Fill Amended Individual Income Tax Return 2014 right from your mobile device

How to make an electronic signature for the D 400x Web Fill Amended Individual Income Tax Return 2014 on iOS

How to make an electronic signature for the D 400x Web Fill Amended Individual Income Tax Return 2014 on Android devices

People also ask

-

What is airSlate SignNow and how can it help with my tax file needs?

airSlate SignNow is a document signing platform that allows you to manage your documents efficiently, including your tax file. It simplifies the process of sending, signing, and storing your tax-related documents, ensuring compliance and security. With its user-friendly interface, you can streamline your tax filing process.

-

How does airSlate SignNow ensure the security of my tax file?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption methods and secure data storage to protect your tax file from unauthorized access. Additionally, you can track who views and signs your documents, adding another layer of security.

-

What features does airSlate SignNow offer to manage my tax file efficiently?

airSlate SignNow offers features such as customizable templates, automatic reminders, and integration with popular accounting software. This makes managing your tax file easier and helps ensure that you never miss an important deadline. These features cater specifically to the needs of professionals handling tax documents.

-

Is airSlate SignNow cost-effective for managing multiple tax files?

Absolutely! airSlate SignNow provides a cost-effective solution for managing multiple tax files. With flexible pricing plans, you can choose one that suits your business size and document volume, ensuring you're only paying for what you need. This affordability helps you save money while staying organized.

-

Can I integrate airSlate SignNow with other software for my tax file management?

Yes, airSlate SignNow integrates seamlessly with various popular accounting and tax software, making tax file management a breeze. Integration with tools like QuickBooks or Excel streamlines your workflow, allowing you to access and manage your documents in one place. This connectivity enhances overall efficiency.

-

How does airSlate SignNow improve the speed of processing tax files?

Using airSlate SignNow signNowly accelerates the processing of tax files. The platform allows you to send documents for signature within seconds, reducing the turnaround time compared to traditional methods. Faster processing means you can submit your tax documents on time, avoiding potential penalties.

-

What benefits does airSlate SignNow provide for small businesses handling tax files?

For small businesses, airSlate SignNow offers numerous benefits like affordability, ease of use, and efficient document management. It empowers you to handle your tax files without the need for extensive resources, making it accessible for even the smallest of businesses. This allows you to focus on what’s crucial—growing your business.

Get more for D400x

- Application for your supplementary american express platinum card form

- The american express gold business card application form

- American express business card application form

- New account application new zealand form

- American express corporate card employee application full form

- The british airways american express premium plus card application form

- Rental assistance fdl form

- Buy sell contract template form

Find out other D400x

- Help Me With eSignature PPT for Legal

- eSignature Presentation for Legal Free

- How Can I eSignature PPT for Legal

- eSignature Presentation for Legal Simple

- eSignature Form for Legal Easy

- eSignature Word for Procurement Mobile

- eSignature Form for Legal Safe

- eSignature PDF for Procurement Mobile

- eSignature Document for Procurement Online

- How To eSignature Document for Procurement

- How Do I eSignature Document for Procurement

- eSignature Form for Procurement Computer

- eSignature Form for Procurement Mobile

- eSignature PDF for Procurement Secure

- eSignature Document for Procurement Computer

- eSignature Form for Procurement Now

- How Can I eSignature Document for Procurement

- eSignature Document for Procurement Mobile

- eSignature PDF for Procurement Simple

- eSignature Form for Procurement Fast