INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi Portale Inps 2015-2026

Understanding the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi

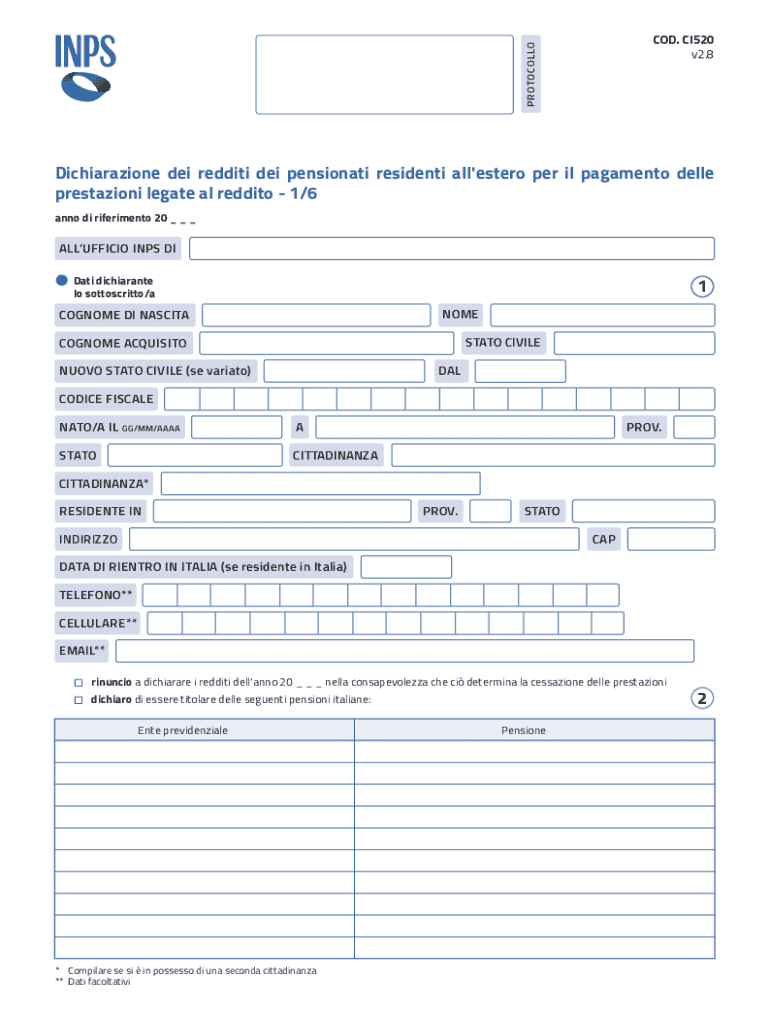

The INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi is a crucial document for Italian citizens residing abroad. This declaration is essential for reporting income earned outside Italy and ensures compliance with Italian tax laws. It serves to inform the Italian Social Security Institute (INPS) about your financial status, which can impact your eligibility for various benefits and pensions. Understanding this form is vital for maintaining your legal standing and ensuring you fulfill your obligations as a taxpayer.

Steps to Complete the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi

Completing the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi involves several key steps:

- Gather necessary documentation, including proof of income, residency, and any applicable tax returns.

- Access the INPS online portal, which provides a user-friendly interface for filling out the form.

- Fill in your personal details, including your Italian tax code, contact information, and residency status.

- Report your income accurately, ensuring all figures are correct and well-documented.

- Review your completed declaration for any errors before submission.

- Submit the form electronically through the INPS portal or print and mail it to the appropriate INPS office.

Required Documents for the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi

When preparing to submit the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi, it is essential to have the following documents ready:

- Proof of income from all sources, such as pay stubs or tax returns.

- Documentation of residency status, including utility bills or lease agreements.

- Your Italian tax code (codice fiscale) for identification purposes.

- Any previous INPS correspondence related to your residency or income.

Legal Use of the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi

The legal implications of the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi are significant. Failing to submit this declaration can lead to penalties, including fines or loss of benefits. It is essential to understand that this document is not just a formality; it is a legal requirement for Italian citizens living abroad. Compliance ensures that individuals maintain their rights to social security benefits and avoid potential legal issues with the Italian government.

Filing Deadlines for the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi

Awareness of filing deadlines is critical for the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi. Typically, the submission period aligns with the annual tax filing season in Italy. It is advisable to check the INPS website or consult with a tax professional to confirm specific dates, as they may vary from year to year. Meeting these deadlines is essential to avoid penalties and ensure compliance with Italian tax regulations.

Examples of Using the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi

Understanding practical scenarios can clarify how the INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi is used. For instance, a retired Italian citizen living in the United States must report any pension income received from Italy. Similarly, an Italian expatriate working abroad needs to declare their foreign earnings to maintain their eligibility for Italian pension benefits. These examples highlight the importance of accurate reporting and compliance with Italian tax laws.

Quick guide on how to complete inps residenti allestero dichiarazione redditi portale inps

Easily Prepare INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi Portale Inps on Any Device

Online document management has become widely accepted by companies and individuals alike. It offers a perfect environmentally-friendly substitute for conventional printed and signed documentation, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any hassles. Manage INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi Portale Inps on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The Easiest Way to Edit and Electronically Sign INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi Portale Inps Effortlessly

- Obtain INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi Portale Inps and then click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight pertinent sections of the documents or redact sensitive data with specialized tools that airSlate SignNow offers for this purpose.

- Generate your electronic signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, an invite link, or downloading it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi Portale Inps to ensure efficient communication at every step of the document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct inps residenti allestero dichiarazione redditi portale inps

Create this form in 5 minutes!

How to create an eSignature for the inps residenti allestero dichiarazione redditi portale inps

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is red est ita cod c1520 and how does it relate to airSlate SignNow?

Red est ita cod c1520 refers to a specific coding standard that can enhance document management processes. With airSlate SignNow, businesses can leverage this coding to streamline their eSigning and document workflows, ensuring compliance and efficiency.

-

How much does airSlate SignNow cost for users interested in red est ita cod c1520?

The pricing for airSlate SignNow varies based on the features and number of users. For those focusing on red est ita cod c1520, we offer tailored plans that provide essential tools for document management at competitive rates.

-

What features does airSlate SignNow offer that support red est ita cod c1520?

AirSlate SignNow includes features such as customizable templates, secure eSigning, and integration capabilities that align with red est ita cod c1520. These features help businesses efficiently manage their documents while adhering to coding standards.

-

Can airSlate SignNow integrate with other software while using red est ita cod c1520?

Yes, airSlate SignNow offers seamless integrations with various software applications. This capability is particularly beneficial for users implementing red est ita cod c1520, as it allows for enhanced workflow automation and data synchronization.

-

What are the benefits of using airSlate SignNow with red est ita cod c1520?

Using airSlate SignNow in conjunction with red est ita cod c1520 provides businesses with improved document accuracy and compliance. It also enhances collaboration among teams, leading to faster turnaround times for document approvals.

-

Is airSlate SignNow user-friendly for those unfamiliar with red est ita cod c1520?

Absolutely! AirSlate SignNow is designed with user experience in mind, making it accessible even for those unfamiliar with red est ita cod c1520. Our intuitive interface and comprehensive support resources ensure a smooth onboarding process.

-

How does airSlate SignNow ensure security when dealing with red est ita cod c1520?

AirSlate SignNow prioritizes security by implementing advanced encryption and compliance measures. When handling documents related to red est ita cod c1520, users can trust that their sensitive information is protected throughout the signing process.

Get more for INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi Portale Inps

- Body systems template form

- Bird beak lab answer key form

- Sfusd transcript form

- Authorization to discloseobtain health information hartford hospital english 571559 hartford hospital consent forms rehab

- Anugya patra form

- Atto di notoriet esempio form

- Pythagorean theorem worksheet five pack math worksheets land form

- Customer move out request form 2 3 xlsx

Find out other INPS RESIDENTI ALL'ESTERO Dichiarazione Redditi Portale Inps

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later