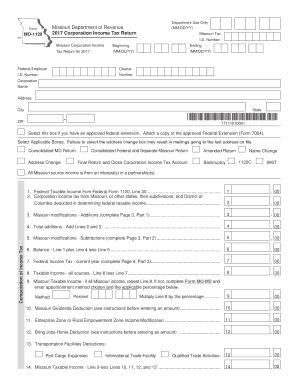

Corporation Income Tax Return 2017

What is the Corporation Income Tax Return

The Corporation Income Tax Return is a tax form used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for calculating the corporation's tax liability to the Internal Revenue Service (IRS). Corporations must file this return annually, regardless of whether they owe any taxes. The most common version of this form is IRS Form 1120, which applies to most C corporations. S corporations use a different form, IRS Form 1120S, to report their income and deductions.

Steps to complete the Corporation Income Tax Return

Completing the Corporation Income Tax Return involves several steps to ensure accurate reporting and compliance with IRS requirements. Here is a general outline of the process:

- Gather financial records: Collect all necessary documents, including income statements, balance sheets, and expense records.

- Determine your filing status: Identify whether your corporation is a C corporation or an S corporation, as this affects the form used.

- Fill out the form: Complete the appropriate sections of the form, detailing income, deductions, and credits.

- Review for accuracy: Double-check all entries for errors or omissions to avoid potential penalties.

- Submit the form: File the completed return with the IRS by the designated deadline.

Required Documents

To accurately complete the Corporation Income Tax Return, several documents are necessary. These include:

- Financial statements: Income statements and balance sheets that reflect the corporation's financial performance.

- Expense records: Documentation of all business expenses incurred during the tax year.

- Previous tax returns: Copies of prior year returns may be needed for reference.

- Supporting schedules: Additional forms or schedules that provide detailed information about specific items reported.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing their income tax returns. Generally, the due date for filing the Corporation Income Tax Return is the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the return is due on April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can also apply for an extension, allowing an additional six months to file, but any taxes owed must still be paid by the original deadline.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Corporation Income Tax Return. These guidelines include instructions on how to fill out each section of the form, eligibility criteria for various deductions and credits, and specific rules for different types of corporations. It is crucial for businesses to follow these guidelines closely to ensure compliance and avoid potential penalties.

Penalties for Non-Compliance

Failing to file the Corporation Income Tax Return on time or submitting inaccurate information can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Additionally, interest accrues on any unpaid taxes, increasing the overall liability. It is essential for corporations to understand these penalties and take proactive measures to comply with filing requirements.

Quick guide on how to complete corporation income tax return

Complete Corporation Income Tax Return effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an excellent environmentally friendly substitute to traditional printed and signed documents, as you can easily locate the appropriate form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, adjust, and eSign your documents quickly without any hold-ups. Handle Corporation Income Tax Return on any device with airSlate SignNow apps for Android or iOS and enhance any document-centric operation today.

The simplest way to adjust and eSign Corporation Income Tax Return seamlessly

- Locate Corporation Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you would like to share your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Edit and eSign Corporation Income Tax Return and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct corporation income tax return

Create this form in 5 minutes!

How to create an eSignature for the corporation income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Corporation Income Tax Return?

A Corporation Income Tax Return is a tax form that corporations must file to report their income, gains, losses, deductions, and credits. This return is essential for determining the corporation's tax liability. Understanding how to accurately complete this return can help businesses avoid penalties and ensure compliance with tax regulations.

-

How can airSlate SignNow help with Corporation Income Tax Returns?

airSlate SignNow streamlines the process of preparing and submitting Corporation Income Tax Returns by allowing users to easily send and eSign necessary documents. Our platform ensures that all forms are securely signed and stored, making it easier to manage tax-related paperwork. This efficiency can save businesses time and reduce the risk of errors.

-

What features does airSlate SignNow offer for Corporation Income Tax Returns?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically designed for Corporation Income Tax Returns. These tools help businesses automate their tax filing process, ensuring that all necessary documents are completed accurately and on time. Additionally, our platform provides a user-friendly interface that simplifies document management.

-

Is airSlate SignNow cost-effective for managing Corporation Income Tax Returns?

Yes, airSlate SignNow is a cost-effective solution for managing Corporation Income Tax Returns. Our pricing plans are designed to fit various business sizes and budgets, allowing companies to choose the best option for their needs. By reducing the time spent on paperwork, businesses can also save on labor costs associated with tax preparation.

-

Can airSlate SignNow integrate with accounting software for Corporation Income Tax Returns?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage Corporation Income Tax Returns. This integration allows for automatic data transfer, reducing the need for manual entry and minimizing errors. By connecting your accounting tools with SignNow, you can streamline your tax preparation process.

-

What are the benefits of using airSlate SignNow for Corporation Income Tax Returns?

Using airSlate SignNow for Corporation Income Tax Returns offers numerous benefits, including enhanced efficiency, improved accuracy, and secure document management. Our platform allows for quick eSigning and easy access to all tax documents in one place. This not only simplifies the filing process but also helps businesses stay organized and compliant.

-

How secure is airSlate SignNow for handling Corporation Income Tax Returns?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Corporation Income Tax Returns. Our platform employs advanced encryption and secure storage solutions to protect your data. Additionally, we comply with industry standards to ensure that your information remains confidential and secure throughout the signing process.

Get more for Corporation Income Tax Return

Find out other Corporation Income Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors