Application or Revocation of the Authorization to File Separate 2022-2026

Understanding the Application or Revocation of the Authorization to File Separate

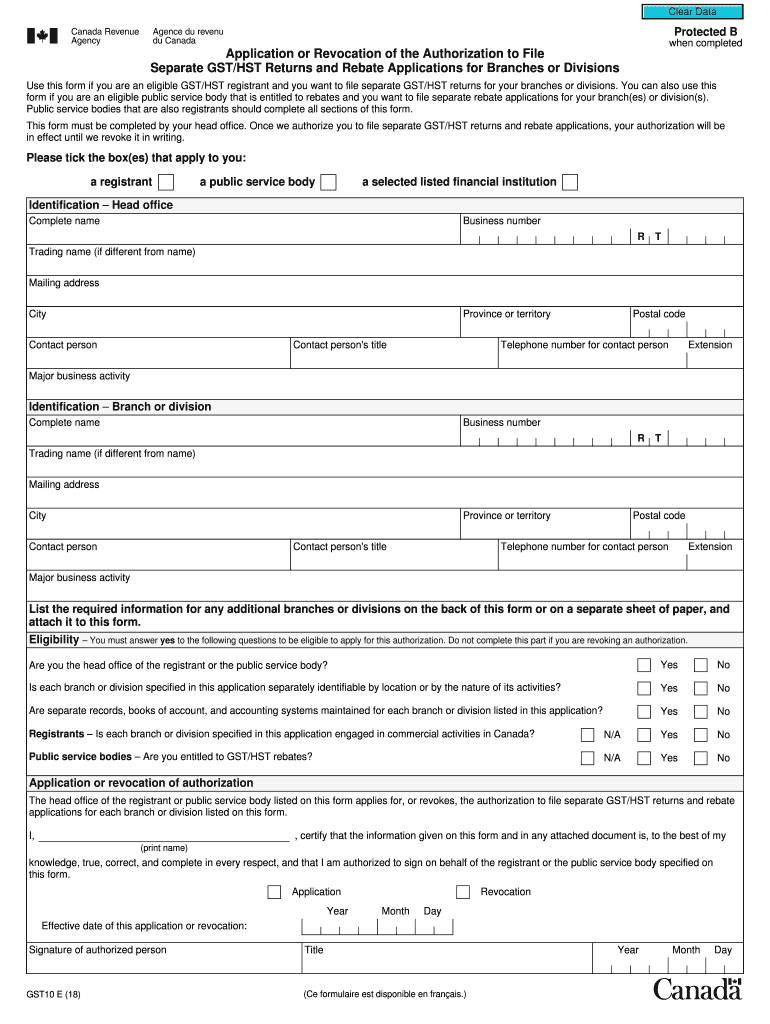

The Application or Revocation of the Authorization to File Separate, often referred to as the gst10 election, is a vital form for taxpayers who wish to change their filing status. This form allows individuals to either apply for or revoke their authorization to file their taxes separately from their spouse. Understanding the implications of this decision is crucial, as it can affect tax rates, deductions, and overall tax liability.

When filing this form, taxpayers must consider their marital status, income levels, and potential tax benefits associated with filing jointly versus separately. It is advisable to consult with a tax professional to assess which option is most beneficial based on individual circumstances.

Steps to Complete the Application or Revocation of the Authorization to File Separate

Completing the gst10 election involves several key steps to ensure accuracy and compliance. Here is a straightforward process to follow:

- Gather necessary information, including Social Security numbers, income details, and any relevant tax documents.

- Obtain the gst10 form from the appropriate tax authority or agency.

- Fill out the form, ensuring all sections are completed accurately. Pay special attention to the authorization section.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person, depending on local regulations.

Legal Use of the Application or Revocation of the Authorization to File Separate

The legal framework surrounding the gst10 election is essential for taxpayers to understand. This form must be filed in accordance with IRS regulations and state laws. Filing the form correctly can help taxpayers avoid penalties and ensure compliance with tax obligations.

It is important to note that submitting this form does not guarantee approval. The IRS may review the application and request additional information. Taxpayers should retain copies of all submitted documents for their records.

Filing Deadlines and Important Dates

Timely submission of the gst10 election is critical. Taxpayers should be aware of the deadlines associated with this form to avoid late fees or penalties. Generally, the application must be submitted before the tax filing deadline for the year in which the election is intended to take effect.

For the most accurate information regarding specific deadlines, it is advisable to consult the IRS website or a tax professional, as these dates can vary annually and may be influenced by changes in tax law.

Required Documents for the Application or Revocation of the Authorization to File Separate

When preparing to file the gst10 election, several documents are typically required. These may include:

- Completed gst10 form.

- Proof of identity, such as a driver's license or Social Security card.

- Income documentation, including W-2s or 1099 forms.

- Any previous tax returns that may support the application.

Having these documents ready can streamline the filing process and help ensure that all necessary information is provided.

IRS Guidelines for the Application or Revocation of the Authorization to File Separate

The IRS provides specific guidelines regarding the gst10 election that taxpayers must follow. These guidelines outline eligibility criteria, filing procedures, and potential consequences of filing incorrectly.

Taxpayers should familiarize themselves with these guidelines to ensure compliance. It is also beneficial to stay updated on any changes to IRS regulations that may impact the filing of this form. Consulting IRS publications or a tax professional can provide additional clarity on these requirements.

Quick guide on how to complete application or revocation of the authorization to file separate

Effortlessly Prepare Application Or Revocation Of The Authorization To File Separate on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed forms, allowing you to access the required documents and securely store them online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Application Or Revocation Of The Authorization To File Separate on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Effortless Modification and Electronic Signing of Application Or Revocation Of The Authorization To File Separate

- Locate Application Or Revocation Of The Authorization To File Separate and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or black out sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious document searches, or errors that require new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Application Or Revocation Of The Authorization To File Separate while ensuring exceptional communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application or revocation of the authorization to file separate

Create this form in 5 minutes!

How to create an eSignature for the application or revocation of the authorization to file separate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the gst10 election and how does it relate to airSlate SignNow?

The gst10 election is a tax election that allows businesses to manage their GST obligations more effectively. With airSlate SignNow, you can easily eSign documents related to the gst10 election, ensuring compliance and streamlining your workflow.

-

How can airSlate SignNow help with the gst10 election process?

airSlate SignNow simplifies the gst10 election process by providing a platform for electronic signatures and document management. This allows businesses to quickly prepare, send, and sign necessary documents, reducing delays and improving efficiency.

-

What are the pricing options for using airSlate SignNow for gst10 election documents?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those related to the gst10 election. You can choose from monthly or annual subscriptions, ensuring you get the best value for your document signing requirements.

-

Are there any specific features in airSlate SignNow that support the gst10 election?

Yes, airSlate SignNow includes features such as customizable templates and automated workflows that are particularly useful for managing gst10 election documents. These features help streamline the signing process and ensure that all necessary information is captured accurately.

-

Can I integrate airSlate SignNow with other tools for managing gst10 election documents?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to manage your gst10 election documents seamlessly. Whether you use accounting software or project management tools, you can connect them with airSlate SignNow for enhanced productivity.

-

What benefits does airSlate SignNow provide for businesses dealing with the gst10 election?

Using airSlate SignNow for the gst10 election offers numerous benefits, including time savings, improved accuracy, and enhanced compliance. The platform's user-friendly interface makes it easy for teams to collaborate on documents, ensuring that all signatures are collected promptly.

-

Is airSlate SignNow secure for handling sensitive gst10 election documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive gst10 election documents. The platform employs advanced encryption and authentication measures to protect your data throughout the signing process.

Get more for Application Or Revocation Of The Authorization To File Separate

Find out other Application Or Revocation Of The Authorization To File Separate

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement