Gst10 2012

What is the Gst10

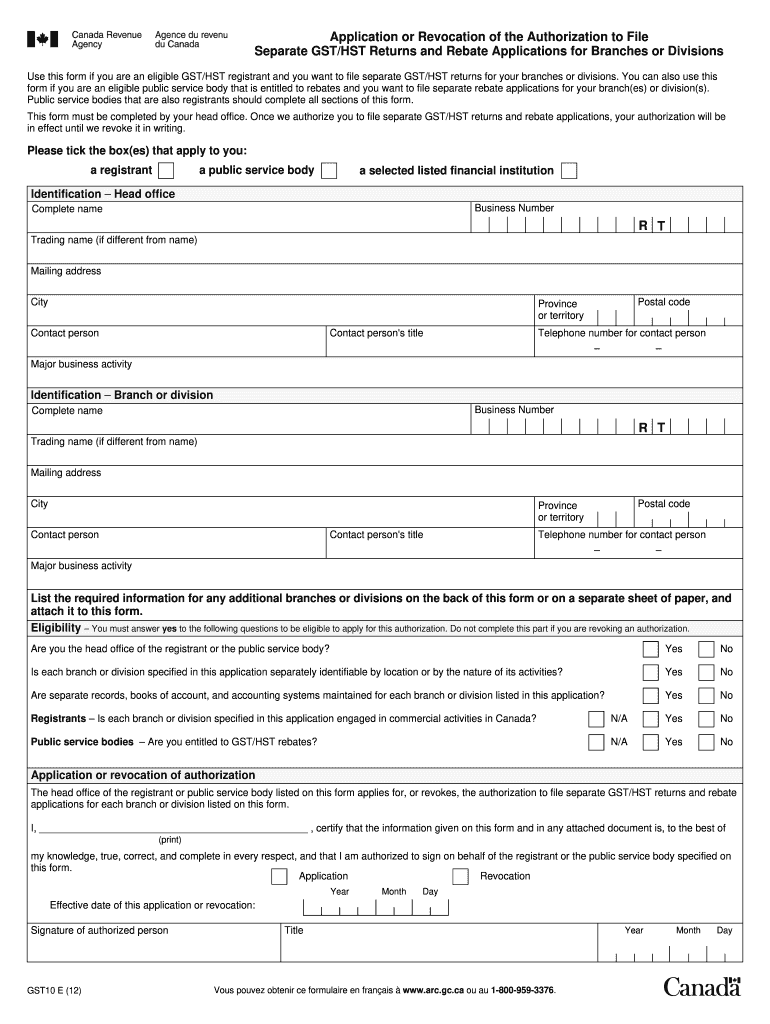

The Gst10 form is a crucial document used in specific tax and legal contexts within the United States. This form serves to report certain financial transactions and is often required by various governmental entities. Understanding the Gst10 is essential for individuals and businesses to ensure compliance with tax regulations and to avoid potential penalties. It is important to note that the Gst10 form may have specific requirements depending on the nature of the transaction being reported.

How to use the Gst10

Using the Gst10 form involves several steps to ensure accurate completion and submission. First, gather all necessary information related to the transactions that need to be reported. This may include details such as transaction amounts, dates, and parties involved. Next, fill out the form carefully, ensuring that all sections are completed accurately. After completing the form, review it for any errors before submitting it to the appropriate authority. Utilizing digital tools can streamline this process, making it easier to fill out and eSign the Gst10 form securely.

Steps to complete the Gst10

Completing the Gst10 form requires attention to detail. Here are the essential steps:

- Gather all relevant financial documentation.

- Access the Gst10 form through the appropriate source.

- Fill in your personal or business information as required.

- Provide details of the transactions being reported.

- Review the completed form for accuracy.

- Submit the form electronically or via mail, depending on the requirements.

Legal use of the Gst10

The Gst10 form must be used in accordance with applicable laws and regulations. This includes ensuring that the information provided is truthful and complete. Legal use of the form also involves understanding the specific contexts in which it is required, as misuse or inaccuracies can lead to penalties. Compliance with federal and state guidelines is essential to maintain the integrity of the reporting process.

Filing Deadlines / Important Dates

Filing deadlines for the Gst10 form can vary based on the nature of the transactions being reported. It is crucial to be aware of these deadlines to avoid late submissions, which may incur penalties. Typically, these dates are established by the IRS or relevant state authorities. Keeping track of these important dates ensures timely compliance and helps in maintaining good standing with tax obligations.

Who Issues the Form

The Gst10 form is typically issued by state tax authorities or specific federal agencies, depending on the context of its use. Understanding who issues the form can help in determining the correct procedures for obtaining and submitting it. Each issuing authority may have its own guidelines and requirements, so it is important to refer to the appropriate agency for accurate information.

Quick guide on how to complete gst10

Easily Prepare Gst10 on Any Device

Digital document management has gained traction among companies and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate format and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Gst10 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Modify and Electronically Sign Gst10 Effortlessly

- Obtain Gst10 and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive details using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious document hunting, or mistakes that require new copies being printed. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and electronically sign Gst10 and ensure excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct gst10

Create this form in 5 minutes!

How to create an eSignature for the gst10

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the gst10 election and how does it work?

The gst10 election is a tax election that allows businesses to simplify their tax reporting requirements. By opting for this election, companies can regulate their GST obligations with ease. Understanding the gst10 election helps ensure compliance and optimized tax management.

-

How does airSlate SignNow support the gst10 election process?

airSlate SignNow provides a seamless platform for sending and eSigning documents related to the gst10 election. With our user-friendly interface, users can quickly prepare and sign essential tax documents, reducing paperwork and enhancing productivity. This makes managing the gst10 election efficient and straightforward.

-

What are the pricing options for airSlate SignNow when handling gst10 election documents?

airSlate SignNow offers flexible pricing plans tailored for businesses involved in the gst10 election. Our competitive pricing ensures that companies of all sizes can access the tools they need to manage their GST obligations effectively. Choose a plan that suits your needs and start streamlining your gst10 election processes.

-

What features does airSlate SignNow provide for the gst10 election?

With airSlate SignNow, businesses benefit from features such as advanced eSigning capabilities, customizable templates, and secure document storage specifically for gst10 election documents. Our platform ensures that you can manage your GST obligations efficiently. These features help facilitate a smooth gst10 election process.

-

What are the benefits of using airSlate SignNow for my gst10 election needs?

Using airSlate SignNow for your gst10 election needs simplifies document management and enhances operational efficiency. Our platform reduces the time needed for document preparation and signing, allowing you to focus on what matters most. Enjoy the peace of mind that comes from using a reliable solution for your gst10 election.

-

Does airSlate SignNow integrate with other accounting software for the gst10 election?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms frequently used in handling gst10 election processes. This integration allows for synchronized workflows, making it easier to manage financial data and GST obligations. With airSlate SignNow, you can streamline your gst10 election documentation process.

-

Is airSlate SignNow secure for handling sensitive gst10 election documents?

Absolutely, airSlate SignNow prioritizes security, especially when dealing with sensitive gst10 election documents. Our platform uses advanced encryption techniques to protect your data both in transit and at rest. You can confidently manage your gst10 election paperwork knowing that your documents are secure.

Get more for Gst10

- Confirmation of residential address template form

- Quarterly inspection report state nj form

- Hud 9834 form

- Ac 20 27g experimental aircraft association eaa form

- Temporary water shut off notice form

- Parent provider child care contract child development council form

- Works sheet form

- Disclosure statement tamara g suttle licensed professional form

Find out other Gst10

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free