AmendmentRepayment Form for Deposit

What is the AmendmentRepayment Form For Deposit

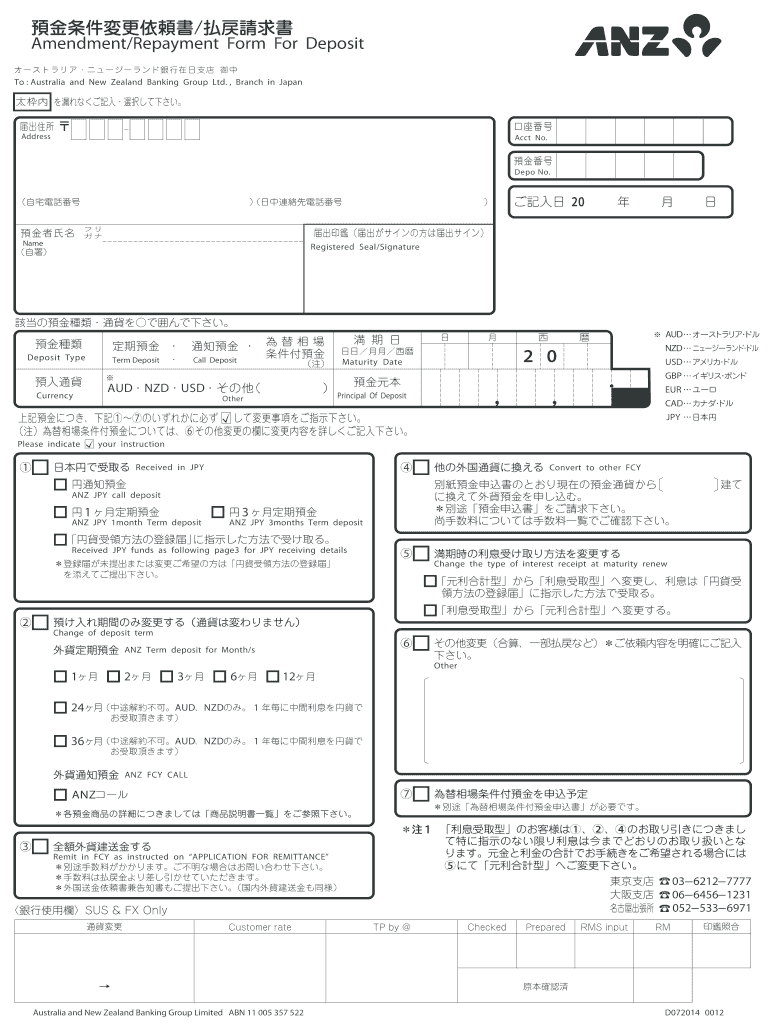

The AmendmentRepayment Form For Deposit is a specialized document used primarily for modifying or correcting deposit-related transactions. This form serves as a formal request to amend previous deposit records, ensuring that any discrepancies are addressed and accurately reflected in financial statements. It is essential for individuals and businesses to maintain precise records, particularly for compliance with financial regulations.

How to use the AmendmentRepayment Form For Deposit

Using the AmendmentRepayment Form For Deposit involves several straightforward steps. First, gather all relevant information regarding the original deposit that requires amendment. This may include transaction dates, amounts, and any associated reference numbers. Next, fill out the form with the corrected details, ensuring that all fields are completed accurately. Finally, submit the form according to the specified submission methods, which may vary based on the issuing authority or financial institution.

Steps to complete the AmendmentRepayment Form For Deposit

Completing the AmendmentRepayment Form For Deposit requires careful attention to detail. Follow these steps:

- Review the original deposit documentation to identify the necessary amendments.

- Obtain the AmendmentRepayment Form For Deposit from the appropriate source.

- Fill in your personal or business information at the top of the form.

- Clearly indicate the corrections needed, including the original and amended amounts.

- Provide any supporting documentation that validates your request.

- Sign and date the form to certify its accuracy.

- Submit the completed form as instructed, either online, by mail, or in person.

Legal use of the AmendmentRepayment Form For Deposit

The AmendmentRepayment Form For Deposit is legally binding once completed and submitted. It is crucial to ensure that all information provided is truthful and accurate, as any misrepresentation can lead to legal consequences. This form is typically governed by financial regulations that require accurate reporting of deposit activities, making it essential for compliance with both state and federal laws.

Key elements of the AmendmentRepayment Form For Deposit

Several key elements are essential to include in the AmendmentRepayment Form For Deposit:

- Personal or Business Information: Include the name, address, and contact details of the individual or entity submitting the form.

- Original Deposit Details: Provide information about the original deposit, including date, amount, and reference number.

- Amended Information: Clearly state the corrected amounts and any changes to the transaction details.

- Supporting Documentation: Attach any relevant documents that support the amendment request.

- Signature: Ensure the form is signed and dated to validate the request.

Form Submission Methods

The AmendmentRepayment Form For Deposit can typically be submitted through various methods, depending on the requirements of the issuing authority:

- Online Submission: Many institutions allow for digital submission through their secure portals.

- Mail: The form can often be printed and mailed to the designated address.

- In-Person: Some may prefer to deliver the form directly to a local office for immediate processing.

Quick guide on how to complete amendmentrepayment form for deposit

Complete [SKS] effortlessly on any device

Online document administration has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign [SKS] effortlessly

- Retrieve [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with specialized tools that airSlate SignNow offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to distribute your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign [SKS] to ensure superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to AmendmentRepayment Form For Deposit

Create this form in 5 minutes!

How to create an eSignature for the amendmentrepayment form for deposit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AmendmentRepayment Form For Deposit?

The AmendmentRepayment Form For Deposit is a customizable document that allows businesses to modify repayment terms for deposits. This form ensures clarity and compliance in financial transactions, making it easier for both parties to understand their obligations.

-

How can I create an AmendmentRepayment Form For Deposit using airSlate SignNow?

Creating an AmendmentRepayment Form For Deposit with airSlate SignNow is simple. You can use our intuitive drag-and-drop editor to customize the form according to your needs, adding fields for signatures, dates, and other essential information.

-

Is there a cost associated with using the AmendmentRepayment Form For Deposit?

Yes, there is a cost associated with using the AmendmentRepayment Form For Deposit through airSlate SignNow. However, our pricing plans are designed to be cost-effective, ensuring that businesses of all sizes can access our eSigning solutions without breaking the bank.

-

What are the benefits of using the AmendmentRepayment Form For Deposit?

The AmendmentRepayment Form For Deposit streamlines the process of modifying repayment agreements, saving time and reducing errors. It enhances transparency between parties and provides a legally binding record of the amended terms.

-

Can I integrate the AmendmentRepayment Form For Deposit with other software?

Absolutely! airSlate SignNow allows seamless integration with various software applications, enabling you to incorporate the AmendmentRepayment Form For Deposit into your existing workflows. This integration enhances efficiency and ensures that all your documents are easily accessible.

-

How secure is the AmendmentRepayment Form For Deposit when using airSlate SignNow?

Security is a top priority at airSlate SignNow. The AmendmentRepayment Form For Deposit is protected with advanced encryption and secure access controls, ensuring that your sensitive information remains confidential and safe from unauthorized access.

-

Can I track the status of my AmendmentRepayment Form For Deposit?

Yes, airSlate SignNow provides real-time tracking for your AmendmentRepayment Form For Deposit. You can easily monitor when the document is viewed, signed, and completed, giving you peace of mind and keeping you informed throughout the process.

Get more for AmendmentRepayment Form For Deposit

Find out other AmendmentRepayment Form For Deposit

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF