The Basic Rate of Tax on This Gift and All Future Gifts of Sciences Po Form

Understanding the Basic Rate of Tax on This Gift and All Future Gifts of Sciences Po

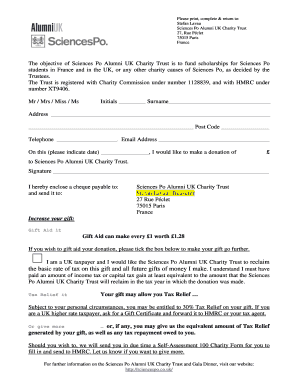

The Basic Rate of Tax on this gift and all future gifts of Sciences Po refers to the tax implications associated with monetary or non-monetary contributions made to the institution. This tax rate is crucial for both the giver and the recipient, as it determines the financial responsibilities involved in the gifting process. Typically, the rate is influenced by federal and state tax laws, which may vary based on the total value of the gift and the relationship between the donor and the recipient.

Steps to Complete the Basic Rate of Tax on This Gift and All Future Gifts of Sciences Po

To properly address the Basic Rate of Tax on this gift, follow these steps:

- Determine the value of the gift: Assess the fair market value of the gift at the time of transfer.

- Identify the relationship: Understand how the relationship between the donor and recipient affects tax rates.

- Consult IRS guidelines: Review the relevant IRS regulations regarding gift taxes to ensure compliance.

- Complete necessary forms: Fill out the appropriate tax forms, such as Form 709, if applicable.

- Submit forms: File the completed forms with the IRS by the designated deadline.

Legal Use of the Basic Rate of Tax on This Gift and All Future Gifts of Sciences Po

The legal use of the Basic Rate of Tax on this gift ensures that both parties comply with tax regulations. Understanding the legal framework surrounding gift taxation is essential to avoid penalties. Gifts exceeding a certain threshold may require the filing of a gift tax return. It is advisable to seek legal counsel or tax advice to navigate these regulations effectively.

IRS Guidelines for the Basic Rate of Tax on This Gift and All Future Gifts of Sciences Po

The IRS provides specific guidelines regarding the taxation of gifts. These include annual exclusion limits, which allow donors to give a certain amount without incurring tax liabilities. For the current tax year, this amount is set at a specific figure, which may change annually. Additionally, donors should be aware of the lifetime gift exemption, which impacts how much can be given over a lifetime without triggering gift taxes.

Required Documents for the Basic Rate of Tax on This Gift and All Future Gifts of Sciences Po

When addressing the Basic Rate of Tax on gifts, certain documents are required to ensure compliance with tax laws. These may include:

- Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return.

- Valuation documentation: Evidence of the gift's fair market value.

- Relationship documentation: Proof of the relationship between the donor and recipient, if necessary.

Examples of Using the Basic Rate of Tax on This Gift and All Future Gifts of Sciences Po

Examples of how the Basic Rate of Tax applies can clarify its impact. For instance, if a donor gives a cash gift of $15,000 to a friend, they may not need to file a gift tax return due to the annual exclusion limit. Conversely, if a donor gifts a property valued at $500,000, they must file Form 709 and may need to consider the lifetime gift exemption. Understanding these scenarios helps donors make informed decisions regarding their gifts.

Quick guide on how to complete the basic rate of tax on this gift and all future gifts of sciences po

Complete [SKS] effortlessly on any device

Online document management has become widely adopted by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and without complications. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The easiest way to modify and eSign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight key sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Create this form in 5 minutes or less

Related searches to The Basic Rate Of Tax On This Gift And All Future Gifts Of Sciences Po

Create this form in 5 minutes!

How to create an eSignature for the the basic rate of tax on this gift and all future gifts of sciences po

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the basic rate of tax on gifts related to Sciences Po?

The basic rate of tax on this gift and all future gifts of Sciences Po varies based on the value of the gift and the relationship between the giver and the recipient. It's important to consult the latest tax regulations or a tax professional to understand how these rates apply to your specific situation.

-

How does airSlate SignNow help with managing gift documentation?

airSlate SignNow provides a streamlined solution for sending and eSigning documents related to gifts, including those associated with Sciences Po. This ensures that all necessary paperwork is completed efficiently, helping you stay compliant with tax regulations, including the basic rate of tax on this gift and all future gifts of Sciences Po.

-

Are there any fees associated with using airSlate SignNow for gift documentation?

Yes, airSlate SignNow offers various pricing plans that cater to different needs. While there may be fees associated with certain features, the platform is designed to be cost-effective, especially when managing important documents like those related to the basic rate of tax on this gift and all future gifts of Sciences Po.

-

What features does airSlate SignNow offer for eSigning documents?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools make it easy to manage documents related to the basic rate of tax on this gift and all future gifts of Sciences Po, ensuring a smooth and efficient process.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications, enhancing its functionality. This allows you to manage documents related to the basic rate of tax on this gift and all future gifts of Sciences Po alongside your existing tools, streamlining your workflow.

-

Is airSlate SignNow secure for handling sensitive gift documentation?

Absolutely, airSlate SignNow prioritizes security with features like encryption and secure cloud storage. This ensures that all documents, including those concerning the basic rate of tax on this gift and all future gifts of Sciences Po, are protected against unauthorized access.

-

How can I get started with airSlate SignNow for my gift documentation needs?

Getting started with airSlate SignNow is simple. You can sign up for a free trial to explore its features and see how it can assist you with documents related to the basic rate of tax on this gift and all future gifts of Sciences Po before committing to a paid plan.

Get more for The Basic Rate Of Tax On This Gift And All Future Gifts Of Sciences Po

Find out other The Basic Rate Of Tax On This Gift And All Future Gifts Of Sciences Po

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy