Ssa 222 2018

Quick guide on how to complete ssa 222

Manage Ssa 222 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely save it online. airSlate SignNow provides all the essential tools to produce, revise, and electronically sign your documents quickly without delays. Handle Ssa 222 on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

How to adjust and electronically sign Ssa 222 with ease

- Find Ssa 222 and click on Get Form to begin.

- Use the tools available to complete your form.

- Mark relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes only seconds and has the same legal validity as a conventional wet signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ssa 222 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ssa 222

Create this form in 5 minutes!

How to create an eSignature for the ssa 222

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is SSA survivor lump sum?

A surviving spouse or child may receive a special lump-sum death payment of $255 if they meet certain requirements. Social Security's Lump Sum Death Payment (LSDP) is federally funded and managed by the U.S. Social Security Administration (SSA).

-

What is SSA Title 2 benefits?

Title II provides for payment of disability benefits to disabled individuals who are "insured" under the Act by virtue of their contributions to the Social Security trust fund through the Social Security tax on their earnings, as well as to certain disabled dependents of insured individuals.

-

What is Section 222 of the Social Security Act?

Section 222(b) of the Act deals with deductions where an individual who is entitled either to disability insurance benefits, or to child's insurance benefits for a month in which he is age 18 or older, refuses to accept vocational rehabilitation services.

-

What is the SSA 222 form?

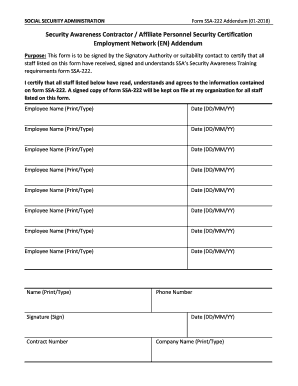

Purpose: This form is to be signed by the Signatory Authority or Suitability Contact to signNow that all staff listed on this form have received, signed, and understand SSA's Security Awareness Certification requirements in Form SSA-222.

-

What is title II monthly income?

Social Security Disability Insurance (SSDI) is a federal program that provides cash payments to individuals who are under age 65, have earned sufficient “work credits” by paying Federal Insurance Contributions Act (FICA) taxes, and meet the definition of “disabled.” An estimated 11 million people receive SSDI with an ...

-

What does title 2 mean for Social Security benefits?

Title II provides for payment of disability benefits to disabled individuals who are "insured" under the Act by virtue of their contributions to the Social Security trust fund through the Social Security tax on their earnings, as well as to certain disabled dependents of insured individuals.

-

Are Title II benefits taxable?

If you receive a Title II Disability Benefit (SSDI, CDB or DWB), you may have to pay taxes on your benefits, depending on the amount you receive. No one pays taxes on more than 85% of their Social Security benefits based on current IRS rules.

-

Who is eligible for double Social Security benefits?

Dually entitled beneficiaries qualify for benefits based on their own work record and a spouse or survivor benefit based on their spouse's work record. Generally, the higher of the two benefits is paid.

Get more for Ssa 222

Find out other Ssa 222

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation