Form FT 941 1 Tax Ny

What is the Form FT 941 1 Tax Ny

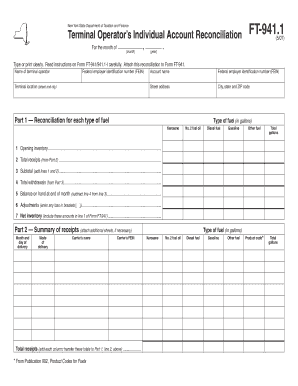

The Form FT 941 1 Tax Ny is a tax document used by businesses operating in New York to report and remit specific taxes. This form is essential for ensuring compliance with state tax regulations. It is primarily designed for employers to report payroll taxes, including income tax withholding and contributions to unemployment insurance. Understanding the purpose and requirements of this form is crucial for accurate tax reporting.

How to use the Form FT 941 1 Tax Ny

Using the Form FT 941 1 Tax Ny involves several steps to ensure proper completion and submission. First, gather all necessary financial records, including payroll data and tax withholding information. Next, accurately fill out the form with the required details, such as the total wages paid and the amount of taxes withheld. After completing the form, review it for accuracy before submitting it to the appropriate state agency. This ensures compliance and avoids potential penalties.

Steps to complete the Form FT 941 1 Tax Ny

Completing the Form FT 941 1 Tax Ny requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant payroll records for the reporting period.

- Enter the total wages paid to employees during the period.

- Calculate and input the total amount of state income tax withheld.

- Provide details regarding unemployment insurance contributions.

- Review the form for any errors or omissions.

- Submit the completed form to the designated state agency by the filing deadline.

Legal use of the Form FT 941 1 Tax Ny

The legal use of the Form FT 941 1 Tax Ny is governed by New York state tax laws. This form must be filed accurately and on time to avoid legal repercussions. Failure to submit the form or providing incorrect information can lead to penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand their legal obligations regarding this form to maintain compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Form FT 941 1 Tax Ny are crucial for maintaining compliance. Typically, this form must be submitted quarterly, with specific due dates for each quarter. Businesses should be aware of these deadlines to avoid late fees and penalties. It is advisable to mark these dates on a calendar and set reminders to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The Form FT 941 1 Tax Ny can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses prefer to submit the form electronically through the state’s tax portal.

- Mail: The form can be printed and mailed to the appropriate state tax office.

- In-Person: Some businesses may choose to deliver the form in person at designated tax offices.

Quick guide on how to complete form ft 941 1 tax ny

Effortlessly Prepare Form FT 941 1 Tax Ny on Any Device

The management of online documents has gained traction among businesses and individuals. It represents an ideal eco-friendly option to conventional printed and signed documents, allowing you to obtain the correct form and securely store it digitally. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without complications. Manage Form FT 941 1 Tax Ny on any device using the airSlate SignNow applications for Android or iOS and enhance any document-centered process today.

How to Modify and Electronically Sign Form FT 941 1 Tax Ny with Ease

- Find Form FT 941 1 Tax Ny and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, the hassle of searching for forms, or mistakes that require new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form FT 941 1 Tax Ny to ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ft 941 1 tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form FT 941 1 Tax Ny, and why is it important?

Form FT 941 1 Tax Ny is a tax form specifically for businesses operating in New York. It is crucial for ensuring compliance with state tax regulations, helping businesses accurately report their tax obligations. Using airSlate SignNow to manage this form streamlines the eSigning process, making it easier for businesses to stay organized and compliant.

-

How can airSlate SignNow assist with the completion of Form FT 941 1 Tax Ny?

airSlate SignNow provides tools that simplify the process of filling out and eSigning Form FT 941 1 Tax Ny. Users can easily upload their forms, fill them out electronically, and send them for signatures within minutes. This not only saves time but also enhances accuracy and minimizes errors in tax submissions.

-

What features does airSlate SignNow offer for managing Form FT 941 1 Tax Ny?

With airSlate SignNow, users gain access to features like document collaboration, customizable templates, and secure cloud storage. These tools are especially beneficial for managing Form FT 941 1 Tax Ny, as they allow for seamless contributions from multiple stakeholders and keep all versions of the document accessible and organized.

-

Is airSlate SignNow affordable for small businesses needing to file Form FT 941 1 Tax Ny?

Absolutely! airSlate SignNow offers competitive pricing plans designed to meet the needs of small businesses. By investing in this cost-effective solution, small businesses can efficiently manage their Form FT 941 1 Tax Ny filings without worrying about extravagant costs, making it an excellent budget-friendly option.

-

Can I integrate airSlate SignNow with other tools for handling Form FT 941 1 Tax Ny?

Yes, airSlate SignNow allows for seamless integrations with various business tools and software. This means you can connect it with your accounting software or CRM to streamline your workflows related to Form FT 941 1 Tax Ny. Integrating these systems enhances productivity and ensures a smooth process from document preparation to filing.

-

What benefits does using airSlate SignNow provide for documenting Form FT 941 1 Tax Ny?

Using airSlate SignNow for documenting Form FT 941 1 Tax Ny brings signNow benefits, including improved efficiency, enhanced security, and simplified tracking. The platform ensures that your documents are securely signed and stored, making them readily accessible when needed. This ultimately facilitates compliance and a hassle-free filing process.

-

How secure is airSlate SignNow when handling Form FT 941 1 Tax Ny?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like Form FT 941 1 Tax Ny. The platform employs advanced encryption protocols and secure storage solutions to ensure that all documents remain confidential and protected from unauthorized access. This guarantees peace of mind for users regarding their tax filings.

Get more for Form FT 941 1 Tax Ny

- Comparison shopping for a credit card take charge today form

- Credit application northwest pipe fittings northwestpipe form

- Da form 5519 r 403230228

- Sba form 994f small business administration sba

- Printform g2 rpclearrev 060123check he

- Partnership replacement tax forms

- Georgia consol 484360564 form

- Irs introduces a domestic filing exception to schedules k form

Find out other Form FT 941 1 Tax Ny

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure