PT 020B Application for Exemption Schedule B Property Tax Division Propertytax Utah Form

What is the PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah

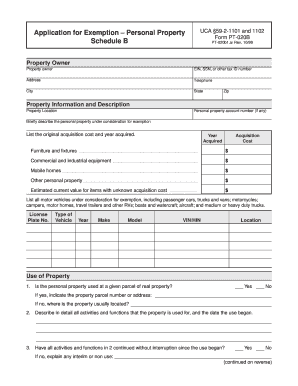

The PT 020B Application For Exemption Schedule B is a form utilized by property owners in Utah to apply for property tax exemptions. This application is specifically designed for certain categories of properties that may qualify for tax relief under state law. The form helps streamline the process of determining eligibility for exemptions, which can significantly reduce the tax burden for qualifying individuals or entities.

Steps to complete the PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah

Completing the PT 020B Application involves several key steps to ensure accurate submission. First, gather all necessary documentation that supports your claim for exemption. This may include proof of ownership, financial statements, or other relevant information. Next, fill out the application form carefully, ensuring that all sections are completed accurately. Pay special attention to the eligibility criteria listed on the form. After filling out the application, review it for any errors before submission. Finally, submit the form through the designated method, whether online, by mail, or in person, as specified by the local property tax division.

Eligibility Criteria

To qualify for the exemptions outlined in the PT 020B Application, applicants must meet specific eligibility criteria established by Utah state law. Generally, these criteria include ownership of the property, the intended use of the property, and compliance with any additional requirements set forth by the local property tax authority. It is essential for applicants to review these criteria thoroughly to ensure they meet all necessary qualifications before applying.

Required Documents

When submitting the PT 020B Application, applicants must provide several supporting documents to validate their claim for exemption. Commonly required documents include proof of property ownership, tax identification numbers, and any financial documents that demonstrate the property's use or purpose. It is advisable to check with the local property tax division for a complete list of required documents to avoid delays in processing the application.

Form Submission Methods (Online / Mail / In-Person)

The PT 020B Application can be submitted through various methods, depending on the preferences of the applicant and the guidelines set by the local property tax division. Options typically include online submission through a designated portal, mailing the completed form to the appropriate office, or delivering it in person. Each method has its own set of instructions, so it is important to follow the guidelines provided by the local authority to ensure successful submission.

Application Process & Approval Time

The application process for the PT 020B Application involves several stages, including initial review, verification of submitted documents, and final approval. Once the application is submitted, the local property tax division will assess the eligibility based on the provided information. The approval time can vary, typically ranging from a few weeks to several months, depending on the volume of applications received and the complexity of each case. Applicants are encouraged to check the status of their application periodically during this waiting period.

Quick guide on how to complete pt 020b application for exemption schedule b property tax division propertytax utah

Complete PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah on any platform with the airSlate SignNow Android or iOS applications and simplify any document-focused task today.

How to edit and eSign PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah with ease

- Obtain PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from your chosen device. Edit and eSign PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah and ensure smooth communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pt 020b application for exemption schedule b property tax division propertytax utah

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah?

The PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah is a form used by property owners in Utah to apply for property tax exemptions. This application helps eligible individuals reduce their property tax burden by providing necessary documentation to the Property Tax Division.

-

How can airSlate SignNow assist with the PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah?

airSlate SignNow simplifies the process of completing and submitting the PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah. Our platform allows users to easily fill out the form, eSign it, and send it directly to the appropriate authorities, ensuring a smooth submission process.

-

What are the pricing options for using airSlate SignNow for the PT 020B Application?

airSlate SignNow offers various pricing plans to accommodate different needs, starting with a free trial. Our plans are designed to be cost-effective, allowing users to manage their PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah submissions without breaking the bank.

-

What features does airSlate SignNow provide for the PT 020B Application?

With airSlate SignNow, users can access features such as customizable templates, secure eSigning, and document tracking. These features enhance the efficiency of completing the PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah, making the process faster and more reliable.

-

Are there any benefits to using airSlate SignNow for property tax applications?

Using airSlate SignNow for your PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah offers numerous benefits, including time savings and improved accuracy. Our platform reduces the risk of errors and ensures that your application is submitted correctly and on time.

-

Can I integrate airSlate SignNow with other software for my property tax needs?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow. This means you can easily connect your existing tools with the PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah process for enhanced efficiency.

-

Is airSlate SignNow secure for submitting the PT 020B Application?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah is protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the submission process.

Get more for PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah

Find out other PT 020B Application For Exemption Schedule B Property Tax Division Propertytax Utah

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF