Crucial Dates for the UK Tax Year a Comprehensive Guide 2024-2026

Understanding the SA800 Partnership Tax Return

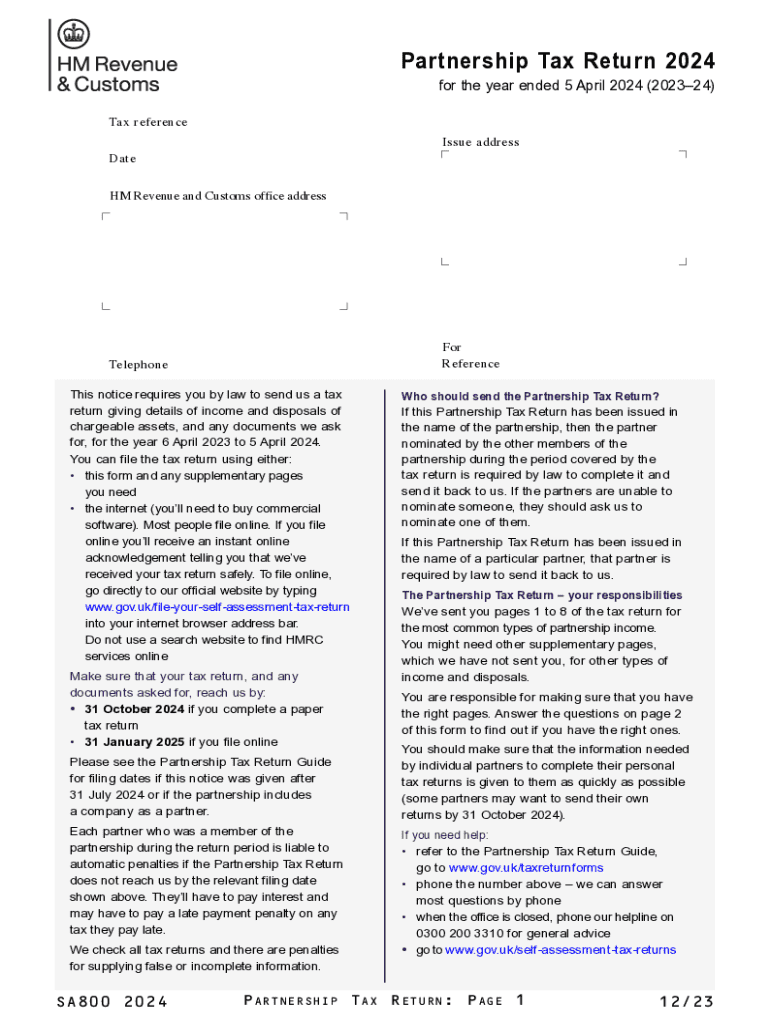

The SA800 partnership tax return is a crucial document for partnerships in the UK, used to report the income, gains, and losses of the partnership to HM Revenue and Customs (HMRC). This form is essential for ensuring that each partner's share of profits is accurately reported for tax purposes. The SA800 form must be completed annually, and it includes information about the partnership's financial activities over the tax year.

Key Components of the SA800 Form

The SA800 form consists of several sections that require detailed information. Key components include:

- Partnership details: This section captures the name, address, and registration number of the partnership.

- Income and expenses: Here, partnerships report their total income and allowable expenses, which are crucial for calculating taxable profits.

- Partner information: Each partner's share of profits and losses must be detailed, ensuring accurate tax reporting for individuals.

- Tax calculations: This section outlines how the partnership's profits are taxed and the distribution of tax liabilities among partners.

Filing Deadlines for the SA800 Form

Timely submission of the SA800 form is critical to avoid penalties. The deadline for filing the SA800 partnership tax return is usually set for January 31 following the end of the tax year. For example, for the tax year ending April 5, 2024, the return must be submitted by January 31, 2025. Extensions may be available under certain circumstances, but it is essential to check with HMRC for specific guidelines.

Submission Methods for the SA800 Form

The SA800 form can be submitted through various methods, providing flexibility for partnerships. Options include:

- Online submission: Partnerships can file their SA800 forms electronically through HMRC's online services, which is often faster and more efficient.

- Paper submission: If preferred, partnerships can complete a paper version of the SA800 form and send it by post to HMRC.

- In-person submission: While less common, partnerships may also submit forms in person at designated HMRC offices, though this may require an appointment.

Penalties for Late Submission

Failing to submit the SA800 form by the deadline can result in significant penalties. HMRC imposes fines for late filings, which can escalate the longer the return is overdue. Initial penalties may start at £100 for late submissions, with additional fines applied for continued delays. It is crucial for partnerships to prioritize timely filing to avoid these financial repercussions.

Eligibility Criteria for Filing the SA800

Not all businesses need to file an SA800 form. Eligibility typically includes partnerships that generate income and have a legal partnership agreement. This includes general partnerships, limited partnerships, and limited liability partnerships (LLPs). Sole traders and companies are not required to file the SA800; instead, they have different tax obligations.

Examples of Partnership Scenarios

Understanding how the SA800 applies to various partnership scenarios can help ensure compliance. Some common examples include:

- General partnerships: All partners share profits and losses equally unless specified otherwise in the partnership agreement.

- Limited partnerships: These consist of general partners who manage the business and limited partners who contribute capital but have limited liability.

- Limited liability partnerships (LLPs): Partners in an LLP have limited personal liability, which can affect how profits are distributed and reported.

Quick guide on how to complete crucial dates for the uk tax year a comprehensive guide

Complete Crucial Dates For The UK Tax Year A Comprehensive Guide effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Crucial Dates For The UK Tax Year A Comprehensive Guide on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to edit and eSign Crucial Dates For The UK Tax Year A Comprehensive Guide with ease

- Locate Crucial Dates For The UK Tax Year A Comprehensive Guide and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to missing or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Crucial Dates For The UK Tax Year A Comprehensive Guide and guarantee excellent communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct crucial dates for the uk tax year a comprehensive guide

Create this form in 5 minutes!

How to create an eSignature for the crucial dates for the uk tax year a comprehensive guide

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SA800 partnership tax return?

The SA800 partnership tax return is a tax form used by partnerships in the UK to report their income, expenses, and profits to HM Revenue and Customs. It is essential for ensuring that all partners fulfill their tax obligations accurately. Using airSlate SignNow can simplify the process of preparing and submitting your SA800 partnership tax return.

-

How can airSlate SignNow help with my SA800 partnership tax return?

airSlate SignNow provides an easy-to-use platform for managing and eSigning documents related to your SA800 partnership tax return. With its intuitive interface, you can streamline the preparation and submission process, ensuring that all necessary documents are completed and signed efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small partnerships handling SA800 partnership tax returns. Each plan includes features that enhance document management and eSigning capabilities, making it a cost-effective solution for your tax return needs.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your SA800 partnership tax return. These integrations allow for smooth data transfer and document handling, ensuring that your tax return process is efficient and organized.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are particularly beneficial for managing your SA800 partnership tax return. These tools help ensure that all partners can collaborate effectively and that documents are handled securely.

-

Is airSlate SignNow secure for handling sensitive tax information?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive information related to the SA800 partnership tax return. You can trust that your documents are safe while using our platform.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your SA800 partnership tax return on the go. This flexibility ensures that you can review, sign, and send documents anytime, anywhere, making tax management more convenient.

Get more for Crucial Dates For The UK Tax Year A Comprehensive Guide

- Service report template form

- Gateway b2 workbook answers form

- Modelo alta a terceros gobierno de canarias pdf form

- Service learning time sheet servicelearning cps k12 il form

- Clinical guide to the use of vitamin c pdf form

- Concussion symptom score sheet pdf form

- 461 5 army form

- Fillable online hbp request to withdraw funds from an form

Find out other Crucial Dates For The UK Tax Year A Comprehensive Guide

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF

- How Can I eSign North Carolina Life Sciences PDF

- How Can I eSign Louisiana Legal Presentation

- How To eSign Louisiana Legal Presentation

- Can I eSign Minnesota Legal Document

- How Do I eSign Hawaii Non-Profit PDF

- How To eSign Hawaii Non-Profit Word

- How Do I eSign Hawaii Non-Profit Presentation

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form