Sa 800 Form 2012

What is the SA-800 Form

The SA-800 form is a specific document used primarily for reporting certain financial information to the Internal Revenue Service (IRS). This form is often associated with businesses and organizations that need to disclose specific details about their financial activities. It is crucial for ensuring compliance with federal tax regulations and for maintaining accurate records for auditing purposes.

How to Use the SA-800 Form

Using the SA-800 form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial records and data required for the form. This may include income statements, expense reports, and other financial documents. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once completed, review the form for any errors before submission to avoid potential penalties.

Steps to Complete the SA-800 Form

Completing the SA-800 form requires a systematic approach. Follow these steps:

- Gather necessary financial documents, including income statements and expense records.

- Fill out each section of the form, ensuring accuracy in all reported figures.

- Double-check all entries for any discrepancies or errors.

- Sign and date the form where required.

- Submit the form by the designated deadline to the appropriate IRS office.

Legal Use of the SA-800 Form

The SA-800 form is legally binding when filled out accurately and submitted in accordance with IRS guidelines. It is essential to comply with all relevant tax laws and regulations to avoid penalties. The form must be submitted on time, and all information provided must be truthful and complete to ensure its legality.

Required Documents

To complete the SA-800 form, specific documents are required. These may include:

- Previous tax returns for reference.

- Financial statements, including profit and loss statements.

- Records of all income and expenses related to the reporting period.

- Any supporting documentation that validates the figures reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the SA-800 form are critical to ensure compliance with IRS regulations. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for most taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to stay informed about any changes to these dates to avoid late filing penalties.

Who Issues the Form

The SA-800 form is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary information to fulfill their reporting obligations.

Quick guide on how to complete sa 800 form

Complete Sa 800 Form seamlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents quickly without delays. Handle Sa 800 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Sa 800 Form effortlessly

- Find Sa 800 Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional written signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you prefer to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Sa 800 Form to ensure outstanding communication throughout any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct sa 800 form

Create this form in 5 minutes!

How to create an eSignature for the sa 800 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

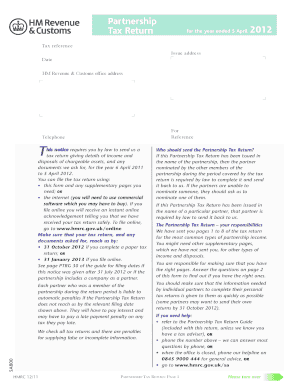

What is the SA800 form and why is it important?

The SA800 form is a partnership tax return used in the UK for reporting the income and expenses of partnerships to HM Revenue and Customs. It is important because it ensures that all partners are compliant with tax obligations, making it essential for the financial health of a business.

-

How does airSlate SignNow help with the SA800 form?

airSlate SignNow simplifies the process of creating, signing, and storing the SA800 form. Our platform allows users to fill out the form electronically, making it easier to manage and collaborate on important tax documents.

-

Is there a cost associated with using airSlate SignNow for the SA800 form?

Yes, while airSlate SignNow offers a free trial, there are subscription plans available for ongoing use. These plans are cost-effective and provide full access to features to streamline the completion of the SA800 form.

-

Can I integrate airSlate SignNow with other software for my SA800 form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and management software. This means you can efficiently manage your SA800 form alongside your other business processes.

-

What features does airSlate SignNow offer for handling the SA800 form?

airSlate SignNow offers features such as electronic signatures, templates, and document sharing, making it perfect for handling the SA800 form. These features enhance collaboration and efficiency, ensuring you can complete your tax return processes smoothly.

-

How secure is airSlate SignNow when dealing with the SA800 form?

airSlate SignNow prioritizes your security with advanced encryption protocols and compliance with data protection regulations. When handling sensitive information like the SA800 form, you can trust that your data is safe and secure.

-

Can I get help if I have questions about the SA800 form on airSlate SignNow?

Yes, airSlate SignNow offers customer support and resources to assist you with the SA800 form. Whether you need help using the platform or have specific questions about the form, our support team is ready to help.

Get more for Sa 800 Form

Find out other Sa 800 Form

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF