Exempt Distribution of Gasoline Product Schedule GT9 Ontario Ca Form

What is the Exempt Distribution Of Gasoline Product Schedule GT9 Ontario ca

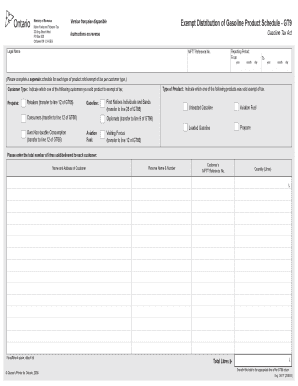

The Exempt Distribution Of Gasoline Product Schedule GT9 is a specific form used in Ontario, Canada, to report exempt distributions of gasoline products. This form is essential for businesses that distribute gasoline and are eligible for exemptions under certain regulations. It helps ensure compliance with provincial tax laws and provides a structured way to document exempt transactions, which can include sales to specific types of customers or for particular purposes.

How to use the Exempt Distribution Of Gasoline Product Schedule GT9 Ontario ca

Using the Exempt Distribution Of Gasoline Product Schedule GT9 involves several key steps. First, businesses must gather all relevant information regarding their gasoline distributions, including details about the products, quantities, and recipients. Next, the form should be accurately filled out, ensuring all sections are completed to reflect the exempt nature of the distributions. Once completed, the form must be submitted to the appropriate provincial authority as part of the compliance process.

Steps to complete the Exempt Distribution Of Gasoline Product Schedule GT9 Ontario ca

Completing the Exempt Distribution Of Gasoline Product Schedule GT9 requires careful attention to detail. Here are the steps to follow:

- Collect all necessary documentation related to the gasoline products distributed.

- Fill in the form with accurate information, including the type of gasoline, quantity, and the nature of the exemption.

- Review the completed form for accuracy to avoid any potential issues.

- Submit the form to the designated provincial authority by the required deadline.

Key elements of the Exempt Distribution Of Gasoline Product Schedule GT9 Ontario ca

The key elements of the Exempt Distribution Of Gasoline Product Schedule GT9 include the identification of the distributor, details of the gasoline products distributed, and the specific exemptions being claimed. Additionally, it requires information about the recipients of the gasoline and the purpose of the distribution. Each section must be filled out comprehensively to ensure compliance with regulatory standards.

Legal use of the Exempt Distribution Of Gasoline Product Schedule GT9 Ontario ca

The legal use of the Exempt Distribution Of Gasoline Product Schedule GT9 is crucial for businesses engaged in the distribution of gasoline. This form serves as a legal document that supports the claim for exemption from certain taxes, ensuring that businesses operate within the framework of the law. Proper use of the form protects businesses from potential legal repercussions and ensures transparency in their operations.

Filing Deadlines / Important Dates

Filing deadlines for the Exempt Distribution Of Gasoline Product Schedule GT9 are typically set by the provincial authorities. It is essential for businesses to be aware of these dates to avoid penalties for late submission. Keeping track of important dates ensures that all necessary documentation is submitted in a timely manner, maintaining compliance with tax regulations.

Quick guide on how to complete exempt distribution of gasoline product schedule gt9 ontario ca

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents swiftly without any delays. Manage [SKS] across any platform using the airSlate SignNow apps for Android or iOS, and streamline any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Exempt Distribution Of Gasoline Product Schedule GT9 Ontario ca

Create this form in 5 minutes!

How to create an eSignature for the exempt distribution of gasoline product schedule gt9 ontario ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the federal gasoline tax credit?

The Fuel Tax Credit is for offsetting the tax that the U.S. government charges on fuels such as gasoline and diesel in specific circumstances. The Internal Revenue Service (IRS) taxes these fuels mainly to fund highway maintenance, imposing the tax when the fuel is purchased.

-

How to get money back from gas receipts?

The Form SCGR-1 and all related schedules must be completed and submitted to our office within three (3) years from the date of gasoline purchase before a refund can be considered. Schedules A and B/C are required with all claims for refund. Schedule D is required for claims utilizing the inventory method.

-

What is the gasoline tax refund program in Ontario?

Ontario Gasoline Tax Refund Program for PTO Operations The Ontario Gasoline Tax Refund Program offers refunds on taxes paid for gasoline used in Power Take Off (PTO) operations, benefiting businesses utilizing auxiliary equipment powered by the same fuel tank as a licensed motor vehicle.

-

Who qualifies for the carbon tax rebate in Ontario?

Eligible adults 18 years or older at the end of 2023. resident in Ontario on December 31, 2023. filed their 2023 Income Tax and Benefit Returns by December 31, 2024 and. not bankrupt or incarcerated in 2024.

-

Who is eligible for the gas refund in Ontario?

Who is eligible. Eligible applicants for the Ontario Gasoline Tax Refund Program for Power Take Off (PTO) operations include businesses and operators in Ontario using clear diesel fuel, gasoline, or propane in licensed motor vehicles for auxiliary equipment operations.

-

How do I claim my California gas tax refund?

Electronic Claim Submission If submitting a claim electronically, please email the Form SCGR-1, along with the applicable Schedules and supporting documentation to "GTRClaims@sco.ca.gov". For larger files, please convert the attachment into a ZIP (compressed) formatted file prior to submitting.

-

What taxes are on gasoline in Ontario?

Gasoline tax rates The tax rates are: 14.7¢ per litre of unleaded gasoline. Effective July 1, 2022, until June 30, 2025, the gasoline tax rate on unleaded gasoline will be reduced from 14.7 cents per litre to 9.0 cents per litre, representing a cut of 5.7 cents per litre.

-

Can you get gas tax exempt?

Procedures to Apply for Gasoline Tax All oil companies require the submission of a business or fleet credit card application. Business credit card applications for personal gas tax exemption must include the residential address of the applicant and must be signed by the applicant.

Get more for Exempt Distribution Of Gasoline Product Schedule GT9 Ontario ca

Find out other Exempt Distribution Of Gasoline Product Schedule GT9 Ontario ca

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment