Schedule 2 SpousePartner Information Applicants Who

What is the Schedule 2 Spouse/Partner Information Applicants Who

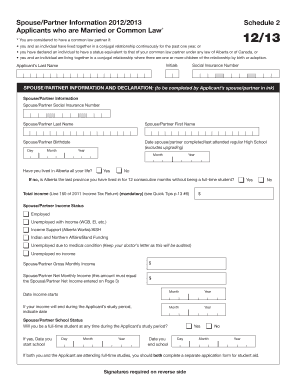

The Schedule 2 Spouse/Partner Information Applicants Who is a specific form used primarily in tax filings to gather essential information about a taxpayer's spouse or partner. This form is crucial for accurately reporting income, deductions, and credits that may be influenced by a spouse or partner's financial status. It helps the IRS assess the combined financial situation of married couples or partners, ensuring that all relevant information is considered during the tax assessment process.

How to use the Schedule 2 Spouse/Partner Information Applicants Who

To effectively use the Schedule 2 Spouse/Partner Information Applicants Who, begin by obtaining the form from the IRS website or through tax preparation software. Fill in the required fields with accurate details about your spouse or partner, including their name, Social Security number, and income information. Ensure that all information is current and correct to avoid potential issues with your tax return. Once completed, attach this form to your main tax return to provide the IRS with a comprehensive view of your financial situation.

Steps to complete the Schedule 2 Spouse/Partner Information Applicants Who

Completing the Schedule 2 Spouse/Partner Information Applicants Who involves several straightforward steps:

- Obtain the form from the IRS website or tax software.

- Enter your spouse or partner's full name as it appears on their Social Security card.

- Provide their Social Security number accurately.

- List their income sources, including wages, interest, and any other earnings.

- Double-check all entries for accuracy and completeness.

- Attach the completed form to your tax return before submission.

Required Documents

When filling out the Schedule 2 Spouse/Partner Information Applicants Who, certain documents may be necessary to ensure accuracy. These include:

- Your spouse or partner's Social Security card or number.

- Documentation of income sources, such as W-2 forms or 1099 forms.

- Any relevant tax documents that reflect deductions or credits applicable to your spouse or partner.

Eligibility Criteria

Eligibility to use the Schedule 2 Spouse/Partner Information Applicants Who generally applies to individuals who are married or in a legally recognized partnership. Both parties must provide their financial information to ensure a complete and accurate tax return. It's important to note that if you are filing separately, you may still need to include this information depending on your specific tax situation.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule 2 Spouse/Partner Information Applicants Who. It is essential to follow these guidelines to avoid errors that could lead to delays or penalties. Key points include:

- Ensure all information is accurate and matches the records held by the IRS.

- Submit the form along with your primary tax return.

- Keep copies of all submitted documents for your records.

Quick guide on how to complete schedule 2 spousepartner information applicants who

Complete [SKS] effortlessly on any device

Online document administration has become increasingly favored by organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize vital sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule 2 SpousePartner Information Applicants Who

Create this form in 5 minutes!

How to create an eSignature for the schedule 2 spousepartner information applicants who

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Schedule 2 SpousePartner Information Applicants Who?

Schedule 2 SpousePartner Information Applicants Who is designed to collect essential information about spouses or partners of applicants. This information is crucial for processing applications accurately and efficiently, ensuring that all relevant details are considered.

-

How can airSlate SignNow help with Schedule 2 SpousePartner Information Applicants Who?

airSlate SignNow streamlines the process of collecting Schedule 2 SpousePartner Information Applicants Who by allowing users to create, send, and eSign documents easily. This ensures that all necessary information is gathered quickly and securely, reducing the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow for Schedule 2 SpousePartner Information Applicants Who?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for small businesses and larger enterprises. Each plan provides access to features that simplify the management of Schedule 2 SpousePartner Information Applicants Who, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing Schedule 2 SpousePartner Information Applicants Who?

With airSlate SignNow, users can take advantage of features such as customizable templates, automated workflows, and secure eSigning. These tools make it easier to manage Schedule 2 SpousePartner Information Applicants Who efficiently, ensuring that all necessary information is captured and processed.

-

Are there any integrations available for airSlate SignNow related to Schedule 2 SpousePartner Information Applicants Who?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing the management of Schedule 2 SpousePartner Information Applicants Who. These integrations allow for better data flow and collaboration, making it easier to handle all aspects of the application process.

-

What benefits does airSlate SignNow provide for Schedule 2 SpousePartner Information Applicants Who?

Using airSlate SignNow for Schedule 2 SpousePartner Information Applicants Who offers numerous benefits, including increased efficiency, reduced errors, and enhanced security. By digitizing the process, businesses can save time and resources while ensuring compliance with necessary regulations.

-

Is airSlate SignNow user-friendly for managing Schedule 2 SpousePartner Information Applicants Who?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage Schedule 2 SpousePartner Information Applicants Who. The intuitive interface allows users to navigate the platform effortlessly, even if they have limited technical skills.

Get more for Schedule 2 SpousePartner Information Applicants Who

Find out other Schedule 2 SpousePartner Information Applicants Who

- Help Me With eSignature Texas Construction Contract Template

- eSignature Illinois Architectural Proposal Template Simple

- Can I eSignature Indiana Home Improvement Contract

- How Do I eSignature Maryland Home Improvement Contract

- eSignature Missouri Business Insurance Quotation Form Mobile

- eSignature Iowa Car Insurance Quotation Form Online

- eSignature Missouri Car Insurance Quotation Form Online

- eSignature New Jersey Car Insurance Quotation Form Now

- eSignature Hawaii Life-Insurance Quote Form Easy

- How To eSignature Delaware Certeficate of Insurance Request

- eSignature New York Fundraising Registration Form Simple

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking