Please Note a Clearance Certificate or Letter Indicates that No Tax Liability is Known to the Tax Administration Division at the Form

Understanding the Clearance Certificate

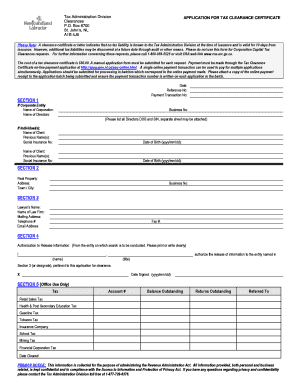

A clearance certificate or letter serves as an official document indicating that, at the time of issuance, the Tax Administration Division has no record of tax liability for the individual or business. This certificate is crucial for various transactions, such as securing loans, selling property, or applying for certain licenses. It confirms that the taxpayer is in good standing with tax obligations, providing peace of mind to both the taxpayer and the entities they engage with.

Obtaining a Clearance Certificate

To obtain a clearance certificate, taxpayers typically need to submit a request to the appropriate tax authority. This process may involve filling out specific forms, providing identification, and sometimes paying a fee. It is essential to ensure that all tax returns are filed and any outstanding taxes are paid before applying for the certificate. The application can often be submitted online, by mail, or in person, depending on state regulations.

Key Elements of the Clearance Certificate

A clearance certificate will generally include the following key elements:

- Taxpayer Information: This includes the name, address, and taxpayer identification number of the individual or business.

- Issuing Authority: The certificate will specify the tax authority that issued the document.

- Validity Period: The certificate is valid for ten days from the date of issuance, after which it may need to be renewed.

- Statement of No Liability: A clear statement indicating that no tax liability is known at the time of issuance.

Legal Uses of the Clearance Certificate

The clearance certificate is often required in various legal and business contexts. For instance, it may be necessary when transferring property ownership, applying for business licenses, or during audits. Having this document can facilitate smoother transactions and help avoid potential legal complications related to unpaid taxes.

Steps to Complete the Clearance Certificate Application

Completing the application for a clearance certificate typically involves the following steps:

- Gather all necessary documentation, including tax returns and identification.

- Complete the required application form accurately.

- Submit the application to the appropriate tax authority, either online, by mail, or in person.

- Pay any applicable fees associated with the application.

- Await confirmation and issuance of the clearance certificate.

State-Specific Rules for Clearance Certificates

It is important to note that the rules and procedures for obtaining a clearance certificate can vary by state. Each state may have its own requirements regarding documentation, fees, and processing times. Taxpayers should consult their state’s tax authority for detailed information specific to their location.

Quick guide on how to complete please note a clearance certificate or letter indicates that no tax liability is known to the tax administration division at

Complete [SKS] effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and digitally sign your documents swiftly without hindrances. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and digitally sign [SKS] with ease

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important parts of your documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your amendments.

- Select your preferred method to send your form via email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate the worry of lost or mislaid files, cumbersome form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and digitally sign [SKS] and ensure exceptional communication at any point during your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Please Note A Clearance Certificate Or Letter Indicates That No Tax Liability Is Known To The Tax Administration Division At The

Create this form in 5 minutes!

How to create an eSignature for the please note a clearance certificate or letter indicates that no tax liability is known to the tax administration division at

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Clearance Certificate or Letter?

A Clearance Certificate or Letter is an official document that confirms that no tax liability is known to the Tax Administration Division at the time of issuance. Please note a Clearance Certificate or Letter indicates that it is valid for 10 days from the date of issuance, providing a temporary assurance of tax compliance.

-

How can airSlate SignNow help me obtain a Clearance Certificate?

With airSlate SignNow, you can easily manage and eSign documents required for obtaining a Clearance Certificate. Our platform streamlines the process, ensuring that you can submit your requests efficiently while keeping track of all necessary documentation. Please note a Clearance Certificate or Letter indicates that no tax liability is known to the Tax Administration Division at the time of issuance.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to suit different business needs, from basic to advanced features. Each plan is designed to provide cost-effective solutions for document management and eSigning. Please note a Clearance Certificate or Letter indicates that no tax liability is known to the Tax Administration Division at the time of issuance and is valid for 10 days from.

-

What features does airSlate SignNow offer?

airSlate SignNow provides a range of features including document templates, eSignature capabilities, and secure cloud storage. These tools help businesses streamline their document workflows and ensure compliance. Please note a Clearance Certificate or Letter indicates that no tax liability is known to the Tax Administration Division at the time of issuance.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive, Salesforce, and more. This allows you to enhance your workflow and manage documents seamlessly across platforms. Please note a Clearance Certificate or Letter indicates that no tax liability is known to the Tax Administration Division at the time of issuance and is valid for 10 days from.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow can signNowly improve your business's efficiency by reducing the time spent on document management and eSigning. The platform is user-friendly and cost-effective, making it accessible for businesses of all sizes. Please note a Clearance Certificate or Letter indicates that no tax liability is known to the Tax Administration Division at the time of issuance.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your sensitive documents and data. Our platform ensures that all transactions are encrypted and compliant with industry standards. Please note a Clearance Certificate or Letter indicates that no tax liability is known to the Tax Administration Division at the time of issuance and is valid for 10 days from.

Get more for Please Note A Clearance Certificate Or Letter Indicates That No Tax Liability Is Known To The Tax Administration Division At The

Find out other Please Note A Clearance Certificate Or Letter Indicates That No Tax Liability Is Known To The Tax Administration Division At The

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself

- eSignature California Commercial Lease Agreement Template Easy

- eSignature Florida Commercial Lease Agreement Template Easy