Changes to California Business Entity Filings WikiForm

What is the Changes To California Business Entity Filings WikiForm

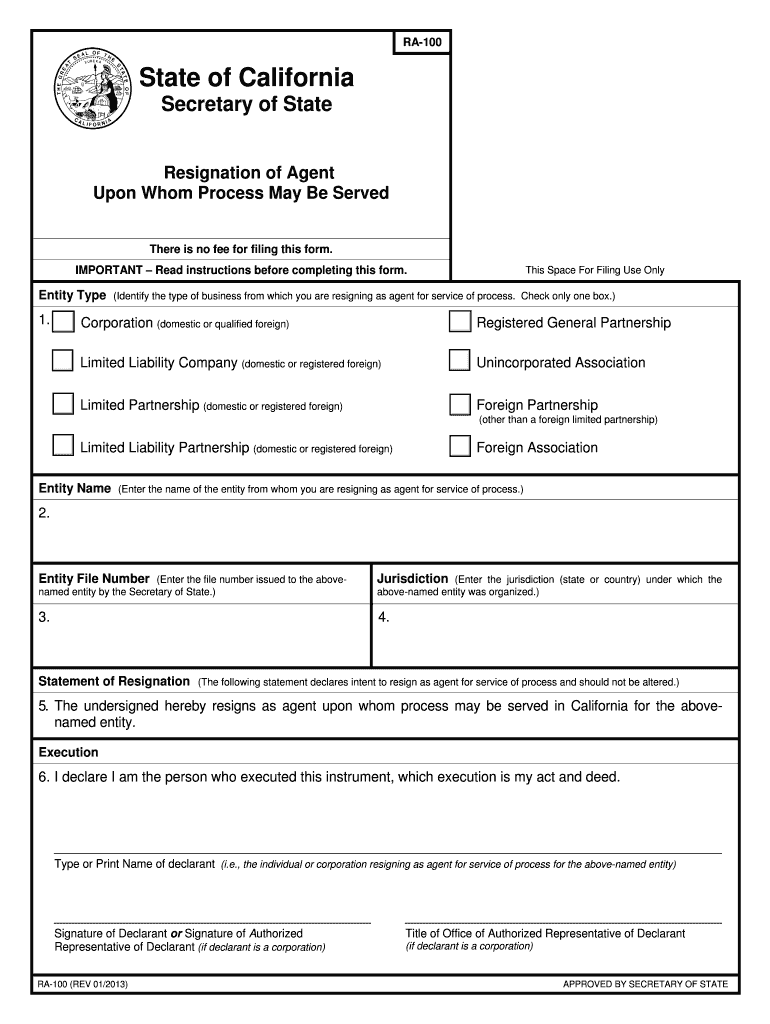

The Changes To California Business Entity Filings WikiForm is a legal document used by businesses in California to update their entity information with the Secretary of State. This form is essential for maintaining compliance with state regulations and ensuring that all business records are accurate and up to date. It applies to various business entity types, including Limited Liability Companies (LLCs), corporations, and partnerships. By submitting this form, businesses can officially report changes such as a change of address, change of officers, or changes in ownership structure.

Steps to complete the Changes To California Business Entity Filings WikiForm

Completing the Changes To California Business Entity Filings WikiForm involves several straightforward steps:

- Gather necessary information: Collect all relevant details about your business, including the entity name, identification number, and specific changes you wish to report.

- Access the form: Obtain the official Changes To California Business Entity Filings WikiForm from the California Secretary of State's website or authorized sources.

- Fill out the form: Carefully complete each section of the form, ensuring that all information is accurate and clearly presented.

- Review for accuracy: Double-check the completed form for any errors or omissions before submission.

- Submit the form: Choose your preferred submission method—online, by mail, or in-person—and follow the instructions for filing.

Required Documents

When completing the Changes To California Business Entity Filings WikiForm, certain documents may be required to support your submission. These typically include:

- Your business entity's current formation documents.

- Any previous amendments or filings that relate to the changes being reported.

- Identification or verification documents for individuals involved in the changes, such as officers or directors.

Having these documents ready can facilitate a smoother filing process and ensure compliance with state requirements.

Filing Deadlines / Important Dates

It is crucial to be aware of any relevant deadlines when submitting the Changes To California Business Entity Filings WikiForm. Typically, businesses must file this form within a specific timeframe after a change occurs. Key dates to consider include:

- The date of the change, which triggers the filing requirement.

- Annual reporting deadlines, which may coincide with the need to update business information.

- Any specific deadlines set by the California Secretary of State for particular types of changes.

Staying informed about these dates helps avoid potential penalties or compliance issues.

Legal use of the Changes To California Business Entity Filings WikiForm

The Changes To California Business Entity Filings WikiForm serves a legal purpose by ensuring that a business's public records accurately reflect its current status. Filing this form is not just a procedural step; it is a legal requirement under California law. Failure to file the form can result in penalties, including fines or administrative dissolution of the business entity. Therefore, it is essential for business owners to understand the legal implications of maintaining accurate filings and to ensure timely submissions.

Examples of using the Changes To California Business Entity Filings WikiForm

There are several scenarios in which a business may need to use the Changes To California Business Entity Filings WikiForm:

- A business relocates to a new address and needs to update its registered address with the state.

- Changes in management occur, such as the appointment or resignation of an officer or director.

- A partnership undergoes a change in ownership structure, requiring updates to the entity's registration.

In each case, timely submission of the form ensures that the business remains compliant with state regulations and that stakeholders have access to accurate information.

Quick guide on how to complete changes to california business entity filings wikiform

Effortlessly Prepare [SKS] on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any delay. Manage [SKS] seamlessly on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Modify and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or mislaid documents, frustrating form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Changes To California Business Entity Filings WikiForm

Create this form in 5 minutes!

How to create an eSignature for the changes to california business entity filings wikiform

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Changes To California Business Entity Filings WikiForm?

The Changes To California Business Entity Filings WikiForm refers to the updated regulations and requirements for filing business entity documents in California. These changes can affect various aspects of business operations, including compliance and reporting. It's essential for business owners to stay informed about these updates to ensure they meet all legal obligations.

-

How can airSlate SignNow assist with Changes To California Business Entity Filings WikiForm?

airSlate SignNow provides a streamlined platform for managing and eSigning documents related to Changes To California Business Entity Filings WikiForm. Our solution simplifies the process, allowing businesses to quickly prepare, send, and sign necessary documents. This efficiency helps ensure compliance with the latest filing requirements.

-

What features does airSlate SignNow offer for managing business filings?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning capabilities. These tools are designed to help businesses efficiently manage Changes To California Business Entity Filings WikiForm. Additionally, our platform ensures that all documents are securely stored and easily accessible.

-

Is airSlate SignNow cost-effective for small businesses dealing with Changes To California Business Entity Filings WikiForm?

Yes, airSlate SignNow is a cost-effective solution for small businesses navigating Changes To California Business Entity Filings WikiForm. Our pricing plans are designed to accommodate various budgets, ensuring that even small enterprises can access essential document management tools. This affordability helps businesses save time and resources.

-

Can airSlate SignNow integrate with other software for business filings?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your ability to manage Changes To California Business Entity Filings WikiForm. Whether you use accounting software or project management tools, our platform can connect to streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management provides numerous benefits, including increased efficiency, enhanced security, and improved compliance with Changes To California Business Entity Filings WikiForm. Our platform allows for quick document preparation and signing, reducing turnaround times and minimizing errors. This ultimately leads to a more productive business environment.

-

How does airSlate SignNow ensure the security of my business documents?

airSlate SignNow prioritizes the security of your business documents, especially when dealing with Changes To California Business Entity Filings WikiForm. We employ advanced encryption methods and secure cloud storage to protect your sensitive information. Additionally, our platform complies with industry standards to ensure your data remains safe.

Get more for Changes To California Business Entity Filings WikiForm

- Rbs account closure form

- Notebook case file form

- United states refugee admissions program usrap pdf 199 kb uscis form

- Noc for sale paf officers fazaia housing scheme form

- Ficha de cadastro para professor nome nacionalidade antigo univille form

- Cop form pdf

- Checklist of self management skills form

- Arabic exemption aub form

Find out other Changes To California Business Entity Filings WikiForm

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online