Terms and Definitions for the Speculation and Vacancy Tax 2023-2026

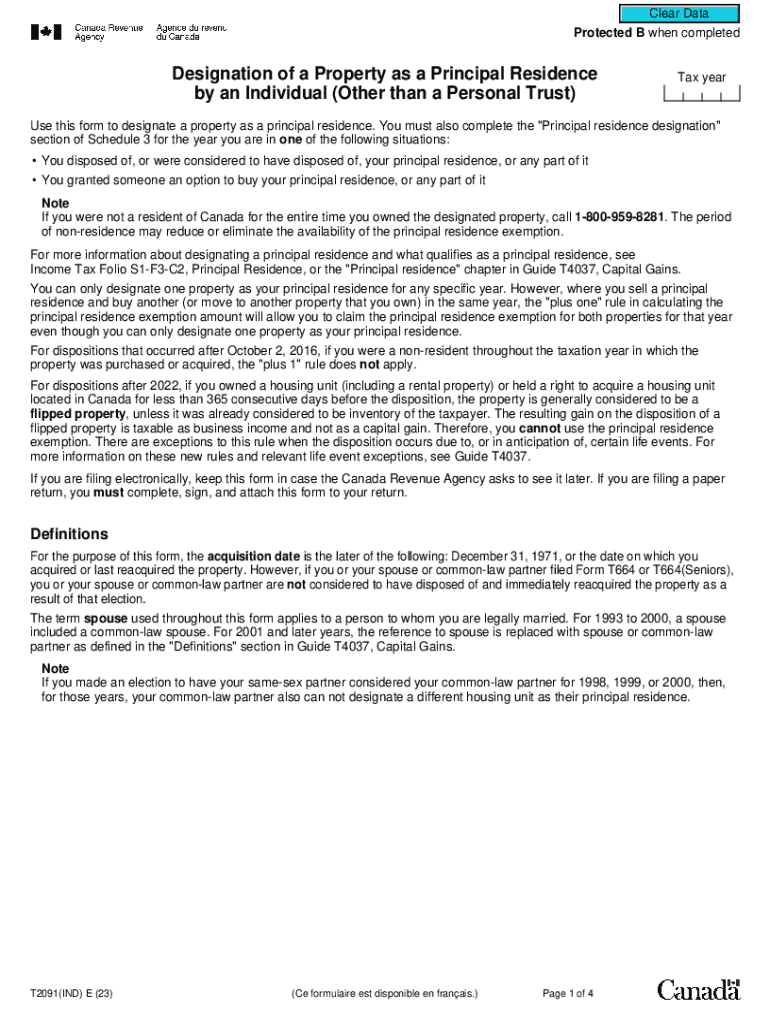

Understanding Form T2091

Form T2091, also known as the T2091 IND form, is used for reporting specific tax obligations related to the Speculation and Vacancy Tax in the United States. This form is essential for individuals and entities who own residential properties and need to declare their tax status. Understanding the purpose of this form is critical for compliance with local tax laws.

Steps to Complete Form T2091

Completing Form T2091 involves several important steps to ensure accuracy and compliance. First, gather all necessary information, including property details and ownership status. Next, accurately fill out each section of the form, providing clear and concise information. Be sure to review the form for any errors or omissions before submission. Finally, submit the form by the designated deadline to avoid penalties.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with Form T2091. Typically, the form must be submitted by a specific date each year, often aligned with tax season. Missing these deadlines can result in penalties, so keeping track of these important dates is essential for compliance.

Legal Use of Form T2091

Form T2091 serves a legal purpose in the context of property ownership and taxation. It is designed to ensure that property owners fulfill their tax obligations related to speculation and vacancy taxes. Proper use of this form helps maintain transparency and accountability within the real estate market.

Eligibility Criteria for Form T2091

Eligibility for filing Form T2091 typically depends on property ownership status and the nature of the property. Generally, individuals or entities that own residential properties that may be subject to speculation and vacancy taxes must complete this form. Understanding the eligibility criteria is vital to determine whether you need to file.

Who Issues Form T2091

Form T2091 is issued by the relevant tax authority in your state or locality. This authority is responsible for overseeing tax compliance and ensuring that property owners report their obligations accurately. Familiarizing yourself with the issuing body can provide additional resources and guidance for completing the form correctly.

Penalties for Non-Compliance

Failure to file Form T2091 or inaccuracies in the submitted information can lead to significant penalties. These penalties may include fines or additional tax liabilities. Understanding the consequences of non-compliance emphasizes the importance of accurate and timely submission of the form.

Quick guide on how to complete terms and definitions for the speculation and vacancy tax

Complete Terms And Definitions For The Speculation And Vacancy Tax effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the right form and safely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without delays. Manage Terms And Definitions For The Speculation And Vacancy Tax on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Terms And Definitions For The Speculation And Vacancy Tax without hassle

- Find Terms And Definitions For The Speculation And Vacancy Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight signNow sections of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you’d like to send your form, via email, SMS, an invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Terms And Definitions For The Speculation And Vacancy Tax to ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct terms and definitions for the speculation and vacancy tax

Create this form in 5 minutes!

How to create an eSignature for the terms and definitions for the speculation and vacancy tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is t2091 and how does it relate to airSlate SignNow?

t2091 refers to a specific feature within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, making it easier to send and sign documents securely. By utilizing t2091, businesses can improve efficiency and reduce turnaround times for important documents.

-

How much does airSlate SignNow cost for using t2091?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains cost-effective for businesses of all sizes. t2091 is included in the standard package, which offers a range of features at an affordable monthly rate. You can explore different pricing tiers on our website to find the best fit for your needs.

-

What are the key features of t2091 in airSlate SignNow?

t2091 includes features such as customizable templates, automated workflows, and secure cloud storage. These functionalities are designed to enhance user experience and ensure that document signing is both efficient and secure. With t2091, users can easily manage their documents from anywhere, at any time.

-

What benefits does t2091 offer for businesses?

By implementing t2091, businesses can signNowly reduce the time spent on document management and signing processes. This feature promotes better collaboration among team members and clients, leading to faster decision-making. Additionally, t2091 helps ensure compliance with legal standards, providing peace of mind for businesses.

-

Can t2091 integrate with other software applications?

Yes, t2091 is designed to seamlessly integrate with various software applications, enhancing its functionality. This includes popular tools like CRM systems, project management software, and cloud storage services. These integrations allow businesses to create a more cohesive workflow and improve overall productivity.

-

Is t2091 suitable for small businesses?

Absolutely! t2091 is particularly beneficial for small businesses looking for an affordable and efficient document management solution. Its user-friendly interface and cost-effective pricing make it accessible for teams of any size. Small businesses can leverage t2091 to streamline their operations without breaking the bank.

-

How secure is the t2091 feature in airSlate SignNow?

The t2091 feature in airSlate SignNow prioritizes security, utilizing advanced encryption methods to protect sensitive documents. Compliance with industry standards ensures that your data remains safe during transmission and storage. Users can trust that their information is secure while using t2091 for eSigning and document management.

Get more for Terms And Definitions For The Speculation And Vacancy Tax

- Rbt training and competence attestation for alternative pathway form

- Porters diamond model auto pdf form

- Interview rubric template form

- Carriers agreement form

- Bnsf application crossing form

- Soccer youth form

- Tolland youth football ampamp cheerleading form

- Employment application form borang permohonan pekerjaan

Find out other Terms And Definitions For The Speculation And Vacancy Tax

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF