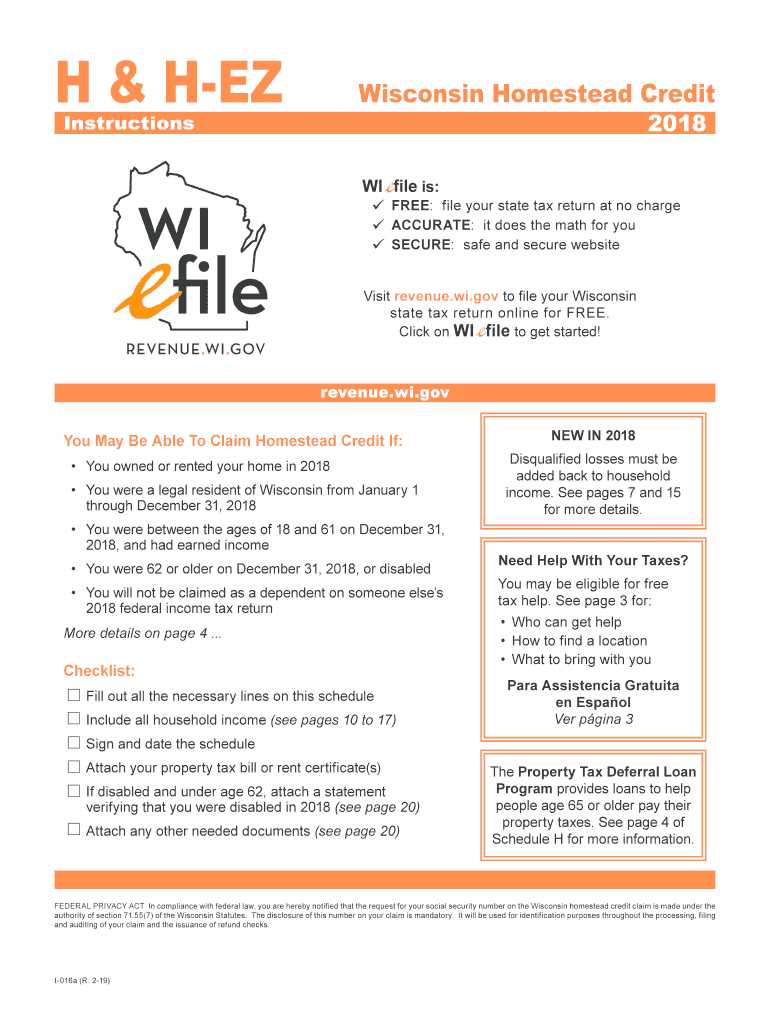

Homestead Form

What is the Homestead

The Homestead refers to a property tax exemption available to eligible homeowners in Wisconsin. This exemption is designed to reduce the amount of property taxes owed, thereby making homeownership more affordable. The Homestead credit is particularly beneficial for low-income residents, seniors, and individuals with disabilities, as it provides financial relief by offsetting property tax liabilities.

Eligibility Criteria

To qualify for the Homestead credit in Wisconsin, applicants must meet specific criteria. Generally, you must be a legal resident of Wisconsin, occupy the property as your primary residence, and meet income limits set by the state. Additionally, you cannot own more than one property or have a net worth exceeding the allowable limits. It is essential to review the eligibility requirements thoroughly to ensure compliance.

Steps to Complete the Homestead

Filling out the 2018 Wisconsin Homestead credit form involves several steps. First, gather all necessary documentation, including proof of income and property ownership. Next, complete the form accurately, providing information about your household income, property details, and any other required data. After filling out the form, review it for accuracy before submitting it to the appropriate state agency. Ensure that you keep a copy for your records.

Filing Deadlines / Important Dates

Timely submission of the Homestead credit application is crucial to receive the benefits. In Wisconsin, the deadline for filing the 2018 Homestead credit form is typically set for the end of the tax year. It is advisable to check the specific filing dates each year as they may vary. Missing the deadline could result in the loss of potential tax credits, so it is essential to stay informed.

Required Documents

When applying for the Homestead credit, several documents are necessary to support your application. These may include proof of income, property tax bills, and any relevant identification. Having these documents ready will streamline the application process and help ensure that your submission is complete and accurate.

Legal Use of the Homestead

The Homestead credit is governed by specific legal guidelines that dictate its use and eligibility. It is essential to understand these regulations to ensure compliance and avoid potential penalties. The credit is intended for residential properties only and cannot be applied to commercial properties or second homes. Familiarizing yourself with the legal aspects of the Homestead can help you navigate the application process effectively.

Quick guide on how to complete 2018 form wi i 016a fill online printable fillable blank

Prepare Homestead effortlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It offers a seamless eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your files swiftly without hindrances. Manage Homestead on any gadget using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign Homestead with ease

- Locate Homestead and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or black out sensitive information with tools specifically designed for that task by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information carefully and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Edit and eSign Homestead and maintain excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 form wi i 016a fill online printable fillable blank

How to generate an electronic signature for the 2018 Form Wi I 016a Fill Online Printable Fillable Blank in the online mode

How to create an eSignature for the 2018 Form Wi I 016a Fill Online Printable Fillable Blank in Google Chrome

How to make an electronic signature for signing the 2018 Form Wi I 016a Fill Online Printable Fillable Blank in Gmail

How to make an electronic signature for the 2018 Form Wi I 016a Fill Online Printable Fillable Blank straight from your mobile device

How to make an eSignature for the 2018 Form Wi I 016a Fill Online Printable Fillable Blank on iOS

How to create an eSignature for the 2018 Form Wi I 016a Fill Online Printable Fillable Blank on Android

People also ask

-

What is airSlate SignNow and how does it relate to 2018 wi?

airSlate SignNow is a digital signature platform that allows businesses to send and eSign documents easily. It directly relates to the 2018 wi initiative, providing an efficient solution to streamline your document workflows, ensuring compliance and security.

-

What pricing plans does airSlate SignNow offer for 2018 wi users?

airSlate SignNow provides various pricing plans tailored for different needs, including affordable options for individual users and robust plans for teams. These plans are designed to offer flexibility, making it accessible for businesses looking to enhance their 2018 wi capabilities.

-

What key features does airSlate SignNow provide for optimizing 2018 wi processes?

airSlate SignNow includes features such as customizable workflows, templates, and advanced security measures. These capabilities help businesses enhance their document management and eSigning processes, crucial for adhering to the 2018 wi standards.

-

How can airSlate SignNow benefit businesses implementing 2018 wi solutions?

By using airSlate SignNow, businesses can improve their efficiency in document handling, which is essential for the success of any 2018 wi initiative. The platform's user-friendly interface and automation features facilitate quicker responses and better client engagement.

-

Does airSlate SignNow integrate with other tools relevant to 2018 wi?

Yes, airSlate SignNow offers seamless integrations with popular software like Salesforce, Google Workspace, and Microsoft 365. This flexibility helps businesses create a cohesive workflow that supports their 2018 wi objectives.

-

Is airSlate SignNow compliant with regulations pertinent to 2018 wi?

Absolutely! airSlate SignNow is built with compliance in mind, adhering to major regulations such as eIDAS and ESIGN. This compliance ensures that businesses can confidently utilize eSigning in their 2018 wi processes without legal concerns.

-

What customer support options are available for users implementing 2018 wi with airSlate SignNow?

airSlate SignNow provides comprehensive customer support through various channels including live chat, email, and an extensive help center. Users focusing on their 2018 wi initiatives can rely on this support for any inquiries or troubleshooting.

Get more for Homestead

- Tax preparation contract template 787756039 form

- Teach artist contract template form

- Taxi driver contract template form

- Teach assistant contract template form

- Teach contract template form

- Teacher contract template 787756045 form

- Teacher student contract template form

- Team contract template 787756049 form

Find out other Homestead

- Sign New York Banking Moving Checklist Free

- Sign New Mexico Banking Cease And Desist Letter Now

- Sign North Carolina Banking Notice To Quit Free

- Sign Banking PPT Ohio Fast

- Sign Banking Presentation Oregon Fast

- Sign Banking Document Pennsylvania Fast

- How To Sign Oregon Banking Last Will And Testament

- How To Sign Oregon Banking Profit And Loss Statement

- Sign Pennsylvania Banking Contract Easy

- Sign Pennsylvania Banking RFP Fast

- How Do I Sign Oklahoma Banking Warranty Deed

- Sign Oregon Banking Limited Power Of Attorney Easy

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online