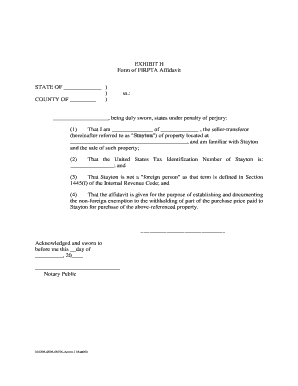

Firpta Form

What is the FIRPTA Form

The FIRPTA form, officially known as the Foreign Investment in Real Property Tax Act form, is a tax document required by the Internal Revenue Service (IRS) for foreign investors selling U.S. real estate. This form ensures that the U.S. government collects taxes on gains realized from the sale of property by non-resident aliens. It is essential for both buyers and sellers to understand this form, as it plays a vital role in the tax implications of real estate transactions involving foreign parties.

How to Use the FIRPTA Form

Using the FIRPTA form involves several steps to ensure compliance with IRS regulations. First, the seller must complete the form accurately, providing details about the property, the sale price, and the seller's tax identification number. Next, the buyer must withhold a percentage of the sale price, typically fifteen percent, to cover potential tax liabilities. This withheld amount is then reported and submitted to the IRS along with the FIRPTA form. Proper use of this form helps avoid penalties and ensures that tax obligations are met.

Steps to Complete the FIRPTA Form

Completing the FIRPTA form requires careful attention to detail. Here are the key steps:

- Gather necessary information, including the seller's details, property description, and sale price.

- Fill out the FIRPTA form, ensuring all fields are completed accurately.

- Calculate the withholding amount based on the sale price.

- Submit the completed form to the IRS, along with the payment for the withheld taxes.

- Provide a copy of the form to the buyer for their records.

Required Documents

To complete the FIRPTA form, certain documents are necessary. These include:

- Proof of identity for the seller, such as a passport or government-issued ID.

- Documentation of the property being sold, including the title deed.

- Financial records that indicate the sale price and any related expenses.

- Tax identification number for the seller, which may be an Individual Taxpayer Identification Number (ITIN) or a Social Security Number (SSN).

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the FIRPTA form. These guidelines detail the requirements for withholding, the necessary calculations, and the deadlines for submission. Adhering to these guidelines is crucial to avoid penalties and ensure compliance. The IRS also outlines the conditions under which exemptions may apply, allowing certain foreign sellers to avoid withholding if they meet specific criteria.

Penalties for Non-Compliance

Failure to comply with FIRPTA regulations can result in significant penalties. If the buyer does not withhold the required amount or the seller fails to file the FIRPTA form, both parties may face fines and interest on unpaid taxes. Additionally, the IRS may impose a penalty equal to the amount that should have been withheld, which underscores the importance of understanding and adhering to FIRPTA requirements.

Quick guide on how to complete firpta form 47209331

Complete Firpta Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate template and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents rapidly without delays. Manage Firpta Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The simplest method to edit and eSign Firpta Form without any hassle

- Locate Firpta Form and click on Get Form to commence.

- Utilize the tools we provide to finalize your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Select your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or disorganized files, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Firpta Form and guarantee exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the firpta form 47209331

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a FIRPTA form and why is it important?

The FIRPTA form is a crucial document required for foreign investors selling U.S. real estate. It ensures that the appropriate taxes are withheld from the sale proceeds. Understanding the FIRPTA form is essential for compliance and to avoid potential penalties.

-

How can airSlate SignNow help with FIRPTA form processing?

airSlate SignNow streamlines the process of completing and signing the FIRPTA form electronically. Our platform allows users to fill out, eSign, and send the FIRPTA form securely, saving time and reducing paperwork. This efficiency is particularly beneficial for real estate transactions.

-

Is there a cost associated with using airSlate SignNow for FIRPTA forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that simplify the FIRPTA form process, including eSigning and document management. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for FIRPTA form management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for FIRPTA forms. These tools enhance the user experience and ensure that all necessary steps are completed efficiently. Additionally, our platform supports document storage for easy access.

-

Can I integrate airSlate SignNow with other software for FIRPTA forms?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage FIRPTA forms alongside your existing tools. This flexibility allows for seamless workflows and enhances productivity in handling real estate transactions.

-

What are the benefits of using airSlate SignNow for FIRPTA forms?

Using airSlate SignNow for FIRPTA forms provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. Our platform simplifies the signing process, ensuring that all parties can complete the FIRPTA form quickly and accurately. This leads to faster transactions and improved customer satisfaction.

-

Is airSlate SignNow compliant with legal requirements for FIRPTA forms?

Yes, airSlate SignNow is designed to comply with legal requirements for electronic signatures and document management, including FIRPTA forms. Our platform adheres to industry standards to ensure that your documents are legally binding and secure. This compliance gives users peace of mind when handling sensitive transactions.

Get more for Firpta Form

- In the supreme court of the state of oregon respondent on form

- In the superior court of the state of lewis county wa form

- Plaintiffpetitioner defendantrespondent form

- People of the state of california defendantrespondent form

- Request for waiver of prepaid costs md rule 1 325 form

- Order to show cause and appear courtsstatewyus form

- Request for waiver of prepaid costs for assembling the form

- State of wyoming courtsstatewyus form

Find out other Firpta Form

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template