01NKFWithdrawal Application Form PDF 2021-2026

What is the Nambawan Super Savings and Loans Withdrawal Application Form?

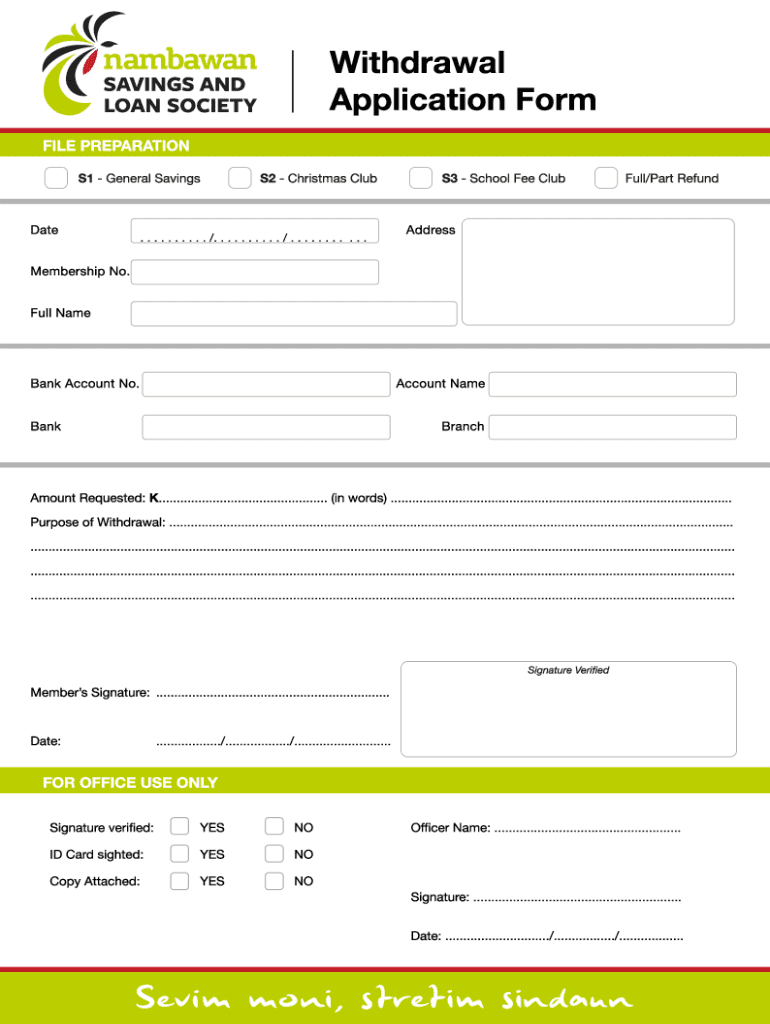

The Nambawan Super Savings and Loans Withdrawal Application Form, commonly referred to as the 01NKFWithdrawal application form, is a crucial document for members of the Nambawan Super savings and loans scheme. This form is specifically designed for individuals seeking to withdraw funds from their savings or loan accounts. It ensures that all necessary information is collected to process the withdrawal request efficiently and in compliance with the governing regulations.

How to Use the Nambawan Super Savings and Loans Withdrawal Application Form

Using the Nambawan Super Savings and Loans Withdrawal Application Form involves several straightforward steps. First, download the form in PDF format from the official Nambawan Super website. After downloading, fill out the required fields, including personal details, account information, and the amount you wish to withdraw. Ensure that all information is accurate to avoid delays in processing. Once completed, submit the form as per the instructions provided, either online or through physical submission.

Steps to Complete the Nambawan Super Savings and Loans Withdrawal Application Form

Completing the Nambawan Super Savings and Loans Withdrawal Application Form requires careful attention to detail. Follow these steps:

- Download the form from the official source.

- Provide your full name and membership number at the top of the form.

- Specify the type of withdrawal you are requesting.

- Fill in your bank account details for fund transfer.

- Indicate the amount you wish to withdraw.

- Sign and date the form to validate your request.

Legal Use of the Nambawan Super Savings and Loans Withdrawal Application Form

The Nambawan Super Savings and Loans Withdrawal Application Form must be used in accordance with the legal guidelines set forth by the Nambawan Super scheme. This includes ensuring that the member is eligible to make a withdrawal based on their account status and that all information provided is truthful and complete. Misuse of the form or submission of false information can lead to penalties or denial of the withdrawal request.

Required Documents for the Nambawan Super Savings and Loans Withdrawal Application Form

When submitting the Nambawan Super Savings and Loans Withdrawal Application Form, certain documents may be required to support your request. Typically, these documents include:

- A valid form of identification, such as a driver's license or passport.

- Proof of membership with Nambawan Super.

- Any additional documentation requested by Nambawan Super to verify your withdrawal request.

Form Submission Methods

The Nambawan Super Savings and Loans Withdrawal Application Form can be submitted through various methods to accommodate member preferences. Members may choose to submit the completed form online via the Nambawan Super portal, or they can opt for physical submission at designated Nambawan Super offices. Ensure that you follow the specific instructions provided for each submission method to ensure timely processing.

Quick guide on how to complete 01nkfwithdrawal application form pdf

Complete 01NKFWithdrawal application form pdf effortlessly on any device

Online document administration has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the proper form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage 01NKFWithdrawal application form pdf on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign 01NKFWithdrawal application form pdf seamlessly

- Locate 01NKFWithdrawal application form pdf and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the information carefully and then click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and eSign 01NKFWithdrawal application form pdf to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 01nkfwithdrawal application form pdf

Create this form in 5 minutes!

How to create an eSignature for the 01nkfwithdrawal application form pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nambawan super savings and loans forms pdf download?

The nambawan super savings and loans forms pdf download refers to the downloadable PDF forms provided by Nambawan Super for savings and loan applications. These forms are essential for members looking to manage their savings or apply for loans efficiently.

-

How can I access the nambawan super savings and loans forms pdf download?

You can easily access the nambawan super savings and loans forms pdf download by visiting the official Nambawan Super website. There, you will find a dedicated section for downloads where you can find the necessary forms.

-

Are there any fees associated with the nambawan super savings and loans forms pdf download?

No, downloading the nambawan super savings and loans forms pdf is free of charge. Members can download the forms without any fees, making it a cost-effective solution for managing their savings and loans.

-

What features do the nambawan super savings and loans forms offer?

The nambawan super savings and loans forms provide a structured format for submitting applications, ensuring all necessary information is captured. This helps streamline the process for both members and the Nambawan Super team.

-

Can I fill out the nambawan super savings and loans forms pdf online?

Yes, you can fill out the nambawan super savings and loans forms pdf online using PDF editing software. This allows for a convenient way to complete your forms before downloading and submitting them.

-

What are the benefits of using the nambawan super savings and loans forms?

Using the nambawan super savings and loans forms simplifies the application process, ensuring that all required details are included. This reduces the chances of delays and helps members access their savings or loans more quickly.

-

Is there a deadline for submitting the nambawan super savings and loans forms?

Yes, there may be specific deadlines for submitting the nambawan super savings and loans forms depending on the type of application. It is advisable to check the Nambawan Super website for the latest information on submission timelines.

Get more for 01NKFWithdrawal application form pdf

- Oregon unsecured installment payment promissory note for fixed rate oregon form

- Oregon note form

- Oregon installments fixed rate promissory note secured by personal property oregon form

- Oregon installments fixed rate promissory note secured by commercial real estate oregon form

- Notice of option for recording oregon form

- Oregon documents form

- General durable power of attorney for property and finances or financial effective upon disability oregon form

- Essential legal life documents for baby boomers oregon form

Find out other 01NKFWithdrawal application form pdf

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors